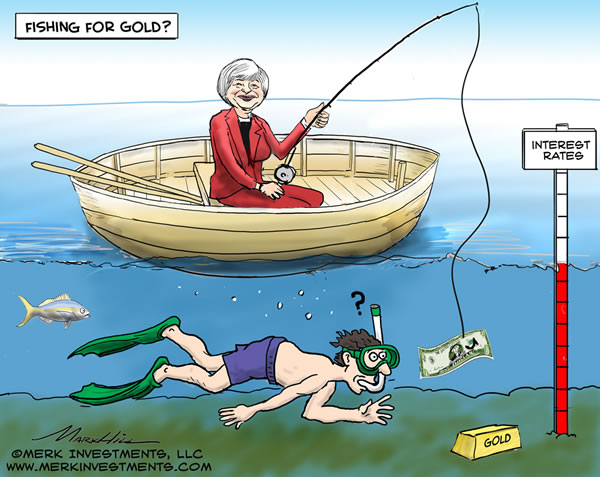

The Rocky Road to Globalization:

The Federal Reserve meeting in Maui hints interest rate rise later this year.

The Fed said economic growth continued to meet its expectations, and it indicated officials did not need to see much more progress before raising rates. The statement said officials wanted to see “some further improvement in the labor market,” suggesting the finish line is closer than at the Fed’s last meeting in June, when the central bank said it sought “further improvement.”

The decision to keep rates near zero for at least a few more weeks was unanimous, supported by all 10 voting members of the Federal Open Market Committee. But a number of those officials have said that they do not intend to wait much longer. While growth remains disappointing by historical standards, the Fed said the economy continued to expand at a “moderate” pace, which was driving “solid job gains and declining unemployment.”

The statement also was notable for the absence of bad news. Although there was no mention of global problems, the Fed has to consider the impact of the strong dollar world wide.

The Fed has kept its benchmark interest rate near zero since December 2008, the centerpiece of its stimulus campaign to revive economic growth and increase employment since the recession. Officials have repeatedly extended that campaign as the economy disappointed their expectations, but in recent months, they have given clear signs they are becoming more worried about waiting too long to start raising interest rates than acting too soon.

Economic growth has increased after a rough winter, and employment expanded by an average of 208,000 jobs per month during the first half of the year. The unemployment rate fell to 5.3 percent.

Fed officials have said repeatedly that they plan to start raising rates this year as long as the economy keeps chugging along.

“If the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds target,” Janet L. Yellen, the Fed’s chairwoman.

Surveys of economic forecasters show that most expect the Fed to start raising interest rates at its next meeting, in mid-September. Measures of market expectations point to a December liftoff, however.

Inflation remains sluggish. Prices rose just 0.2 percent over the 12 months ending in May, according to the Fed’s preferred measure, a Commerce Department index of personal consumption expenditures. It was the 37th consecutive month that inflation has remained below the Fed’s declared target of 2 percent annual growth.

Ms. Yellen and other Fed officials, however, say they are increasingly confident that continued growth will push up prices to a more desirable level.

Global economic slowdown complicates the rate rise.