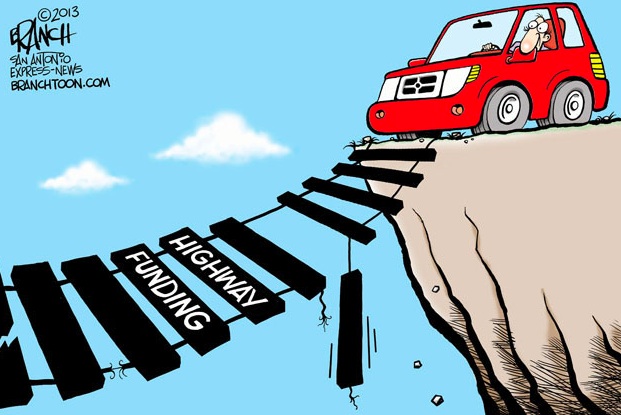

Peter Schroeder writes: The banking industry is scrambling to kill a provision in the Senate highway-funding bill that would reap billions of dollars in revenue by cutting a century-old system that has reaped annual awards for banks.

Industry lobbyists say they were blindsided by the inclusion of the provision, which would help policymakers cover the bill’s cost by cutting the regular dividend the Federal Reserve pays to its member banks.

One lobbyist went so far as to reread the Federal Reserve Act of 1913 after getting wind of the proposal to determine what was at stake.

In a Congress where lawmakers are always hunting for politically palatable ways to raise revenue or cut costs to cover the expenses of additional legislation, the Fed provision was a novel, and rich, one. The proposal is estimated to raise $17 billion over the next decade, and is by far the richest “pay for” included in the bill.

Lobbyists said they were not aware of any previous time when lawmakers had attached the language to a piece of legislation, which would scrap a perk banks have come to expect for over a century.

When banks join the Federal Reserve system, they are required to buy stock in the central bank equal to 6 percent of their assets. However, that stock does not gain value and cannot be traded or sold, so to entice banks to participate, the Fed pays out a 6 percent dividend payment.

The Senate proposal says it would slash that “overly generous” payout to 1.5 percent for all banks with more than $1 billion in assets. While the summary language outlining the proposal said that change would only impact “large banks,” industry advocates argued that banks most would identify as small community shops could easily have assets in excess of that amount.

Banks are working to mobilize against the provision, even as lawmakers are pushing to pass a highway bill before program funding expires at the end of the month.

Senate Banking Committee Chairman Richard Shelby invited Fed Chairwoman Janet Yellen to opine on it when she appeared before his panel earlier this month.

She told lawmakers that if the dividend payment is reduced, some banks may not want to buy into the Fed.

“This is a change that likely would be a significant concern to the many small banks that receive the dividend,” she said.

While banking advocates make the policy argument, they also acknowledge they are facing a hard political reality — $17 billion is hard for members to pass up to help cover costs in a must-pass bill.

“It’s difficult to have a policy discussion when people are looking for a pay for,” said Ballentine. “That’s the issue we’ve been running into.”

The Senate bill is facing an uphill climb towards enactment, as House leaders from both parties have pushed the Senate to instead take up its short-term extension of highway funding and continue working on a longer-term proposal.