The Attorney General of New York State remarked: “I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy. And I think that is a function of the fact that some of these institutions have become too large. Again, I’m not talking about HSBC; this is just a more general comment. I think it has an inhibiting influence—impact on our ability to bring resolutions that I think would be more appropriate.

What were the banks doing? Mortgage lenders would go out into neighborhoods, and during this boom period, they were giving mortgages to anybody and everybody with a pulse, essentially. They were especially low-income neighborhoods. They were offering these very advantageous loans to people, whether they could afford the houses or not. They were buying huge masses of these loans. They were called like “liar’s loans,” or stated income where no one even checked whether the person had the income to actually pay it off.

Investigative journalist Matt Taibbi writes: Tthese settlements, they always come up with a big number, but the number is always actually—when you actually look at the accounting, it turns out to be smaller than they announce. In the case of the Chase settlement, the number they announced was $13 billion. But there’s a couple of really important factors here. One is that $7 billion of that—it’s $7 billion, right?—was tax-deductible, which means that all of us, American citizens, anybody who pays taxes, actually picked up the check for about $2.4 billion worth of the settlement. So we paid part of that settlement, which is crazy. I mean, the ordinary person, if we get a speeding ticket, we can’t deduct that when we go to pay our taxes. But these people cratered the world economy, and they get to write a tax deduction for it.

Bankers who condcut business this way are careful not to do anything illegal, although their activities are often immoral, unethical and wrong.

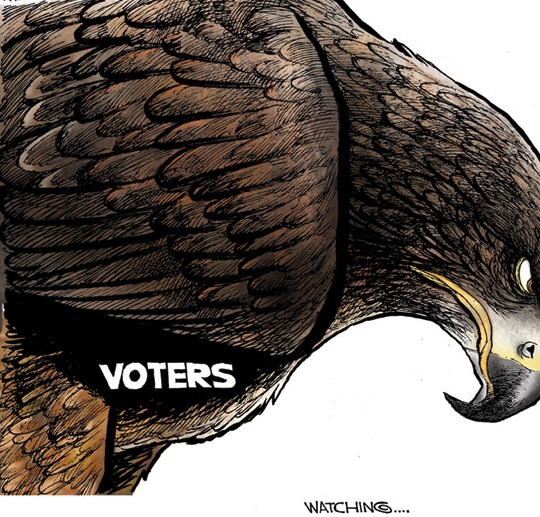

In most developed countries there are laws on the books which prevent bankers from conducting fradulent business. These laws are often not enforced. If we are goiing to clean up corrupt business practices of banks, we must enforce the laws on the books. Banks have to be treated as a special form of business. They deal in other people’s money and be watched like hawks by public officals and citizens alike.