Two days after the Credit Swiss plea agreement, the Swiss Federal Council issued a statement making it clear what it thinks “the new global standard for the automatic exchange of information in tax matters” should look like.

The Swiss Federal Council is basically following the opinion of the Swiss Bankers Association (SBA) which was published on November 29, 2013.

Switzerland wants to portray itself in the domestic

and international media as a clean, well-regulated and transparent financial centre that has broken with the historic haven for thieves and abusers.

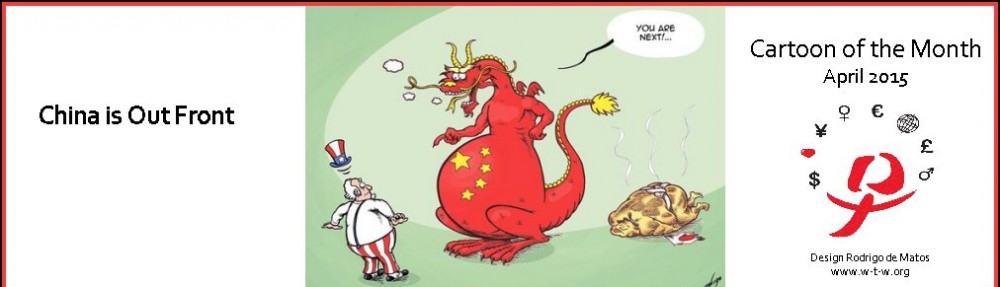

However the Swiss Federal Council statement tells a different story. The Swiss statement is yet more evidence of what has been called a “circle the wagons” strategy, when under pressure from a world that’s moving forward, give ground only inch by inch, if at all, hold on to secrecy where possible – and particularly exploit the weaknesses of weaker and more vulnerable countries.

Multilateral negotiations with intransigent countries like Switzerland and Singapore are always more fruitful than bilateral. The Swiss government therefore plans to stick to a bilateral approach to AIE and engage in “cherry picking”

Switzerland wants to make sure it has maximum leverage over vulnerable developing countries and tries to exclude developing countries from AIE for as long as possible.

The Swiss government is not expecting any external resistance to this strategy of cherry picking. Neither the OECD nor the G20 have made a clear statement in favour of a multilateral approach to AIE. Nor have they asked for the inclusion of developing countries in such a multilateral approach. Nor have LIC/LDC (Low income countries/Low developed countries) governments made it clear that they wish to be included.

It can be expected that Switzerland, likely with the silent support of other rich nations, show what all this is really about: countries with which there are close economic and political ties will cooperate to not hurt each other economically, but that less fortunate countries of the world won’t benefit from this international drive against large-scale tax evasion.

In joining the OECD ministerial agreement, Switzerland and Singapore are suggesting that both countries would put an end to banking secrecy. In reality both countries are trying hard to cement the status quo which benefits their economies as well as international organized crime and money launderers.

Federal Council Press Release