As Barakat Akinsiku writes: As Nigerians prepare for a presidential election amid a Boko Haran a nsurgency, the question remains: What about the economy? With falling oil prices, a depreciating foreign reserve and a plunge in the value of the naira, Nigeria econoimic future is uncertain. Whoever emerges victorious from the polls on March 28 will have his work cut out for him.

With 174 million people, Nigeria has one of the worst poverty levels in the world, At least 61% of the population survive on less than a dollar a day, and this was during a period of economic boom when crude oil averaged about $120 a barrel, far beyond the country’s budget benchmark.

While the gains of the oil boom were reportedly stashed in Nigeria’s foreign reserve and Excess Crude Account, most of the funds have since been frittered away. Electricity is almost non-existent, with a measly 4,500 megawatts generated for the population; refined crude is still being imported in a nation that is a major exporter of crude oil. Unemployment is at an all-time high, and virtually nothing works. Nigeria is about to feel the full brunt of a recession.

Other countries have experienced economic challenges like Nigeria’s. As one of the seven emirates making up the UAE, Dubai has been through its own economic boom and bust. It is now a world destination for tourism, a center of commerce and a model for major oil exporters seeking to diversify their economy.

Like Nigeria, Dubai wasn’t always so savvy in economic principles. In the 1900s, the main stay of the Dubai economy was pearl trading and pearl diving. However, following the emergence of artificial pearls from Japan in the late 1920s and the Great Depression of 1929, Dubai’s economy took a downward spiral.

A parallel can be drawn here with the current situation in Nigeria. Not only has the country lost a major customer for its crude oil in the United States, but Nigeria also has to face stiff competition and price wars from the Arabian Peninsula in the battle for market share. While the robust economies of the Gulf Cooperation Council allow them to offer discounts to Asian buyers even in the face of dwindling oil prices, such tactics do not come easily for Nigeria. As it stands, Nigeria faces problems financing its 2015 budget, while the naira is losing value.

Just like pearl divers in Dubai learned to cast their nets for fish rather than jump in for pearls, Nigeria would be wise to seek other sources of revenue while the oil market gains some form of stability.

What makes the emirate worthy of emulation is that despite being in a region bedeviled with crises and an arid landscape, Dubai has gone from being a desert to a world-class state, dazzling and ambitious in development.

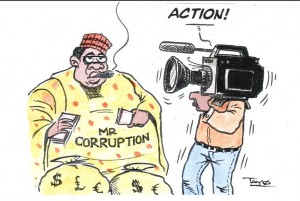

Nigeria’s biggest problem is corruption. Nigerians have remained poor while oil wealth is concentrated in the hands of a few.

The absence of constant electricity has been a major impeding factor to an industrial revolution in Nigeria, and successive governments seem to have no idea how to change the trend. When oil was discovered in 1966, Dubai’s leaders chose to quickly use the receipts from oil rent to finance mass infrastructure, building large ports and 5-star hotels that would one day make the emirate a major trading hub and tourist destination.

So, as harsh economic realities beckon, it is time for Nigeria to overhaul its corrupt institutions, revamp its educational system, invest in critical infrastructure and perhaps revisit the cocoa plantations and groundnut pyramids the country was once known for.