Liam Damm comments from New Zealand: The Swiss currency bombshell – coming out of the blue on Friday morning – rattled currency markets and sent shockwaves through the banking system. The Swiss, stereotypically at least, are renowned for a love of order. Friday’s move was anything but.

We’re still struggling to digest the oil shock. Then there’s the effect of the US recovery, the Chinese slowdown, Russia’s currency crisis, the Greek debt standoff, and Europe’s plans to print money. As disparate as these issues are, there is a common theme.

At the core is the spectre of deflation – a phenomenon that the Western world has not seen on a grand scale since the Great Depression. Switzerland, already dealing with its own deflation issues, has been spooked into unpegging its franc from the euro by Europe’s deflation woes.

Maintaining the peg – which was introduced in 2011 as a response to the GFC – required the Swiss central bank to buy foreign currency.

Even Switzerland’s large reserves would have been stretched by further falls in the euro. The Swiss official cash rate was also slashed – it is now minus 0.75 per cent (yes, you have to pay the bank to take your money). The oil slump which has greatly heightened the world deflation risk also played its part in the Swiss currency move.

The oil-related meltdown of the Russian ruble sent wealth from the region looking for a safe haven – the Swiss franc. That put further pressure on the Swiss central bank, increasing the cost of maintaining the artificial peg.

The Reserve Bank in New Zealand, like all central banks around the world, will add this to models that must remain constantly under review. Our bank is unlikely to move rates – in any direction – for some time.

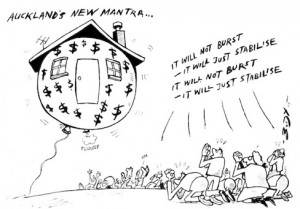

Inflation is very low and likely to fall outside the Reserve Banks target 1-3 per ce But New Zealand has the Christchurch re-build, population growth and a housing boom in Auckland to maintain inflationary pressure.

Our recovery began early and that buys us some time. Continued GDP growth in a low inflation environment is a pretty sweet spot.

New Zealand – as it was in the GFC ultimately – could well be buffered from the worst of this. But we won’t avoid the chill if Europe stagnates, if the US recovery is delayed again and if China keeps slowing.

The pressure on our Reserve Bank to maintain a stimulatory cash rate and ensure the economy doesn’t lose momentum is growing.

One final question lingers in all of this. Why is deflation so bad? As prices fall, consumers have more spending power. What is not to like?

The trouble is that without new wealth creation the upside is unsustainable.

As prices fall margins are squeezed, production falls, businesses contract. Jobs are lost and new jobs not created. Wages fall and a negative spiral takes hold.

It is not a wild freefall like the market meltdown of the GFC. Economies will not collapse overnight.

We can look to Japan for a plausible example of what the world might face – stagnation, low growth and regular dips into recession.

Without growth and momentum, opportunity is removed from the economy. And opportunity is one of capitalism’s most powerful drivers.