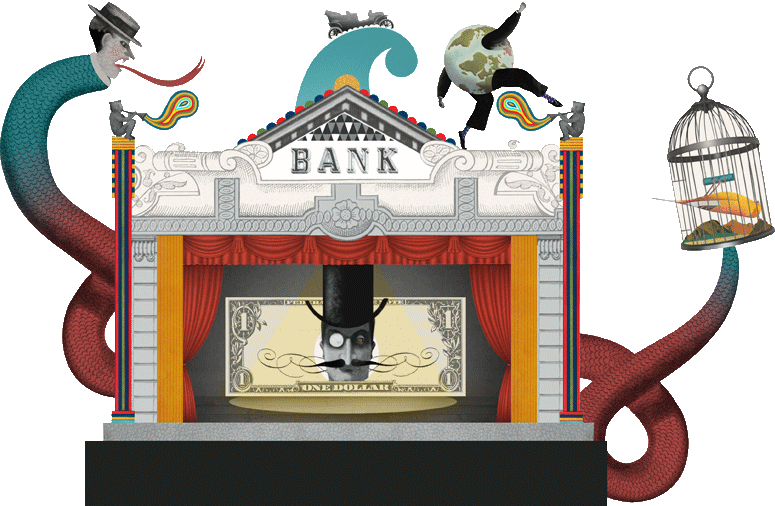

The Finance Sector provides a crucial backbone to the European Economy and -like many other sectors- its increasing dependency on ICT Infrastructures, Providers and their Supply Chain. The importance of ICT Security and Resilience supporting the Finance Sector grew considerably and the objective of protecting automated Inter-Banking transactions and more generally all types of Communications is altogether more critical and complex at the same time.

A stable Financial System in Europe is however the underlying foundation for Economic stability; and the reliance on IT is now life critical for the entire Sector.

Technical Cooperation between the key actors of the Finance Sector at pan-European level becomes an urgent need as the sector faces stronger and larger scale challenges. The following effects of the current silo approach for the protection of the Banks and Finance Institutions presents many inconveniences, such as:

-

-

-

the Implementation of a multitude of security and technical standards, difficult to maintain;

-

the Loss of Interoperability;

-

Imposibility to implement Safe Harbouring, Mutual Aid Assistance;

-

Hosting of more System types, less secure;

-

General Vulnerability to Cyber Attacks.

-

NIS support to Financial Resilience

Twitter : @enisa_eu -

Financial crises | The Economist