The first step will be to try to get a measure of just how much bad debt there is through a close examination of the assets. On October 23rd the European Central Bank gave some details of how it will do this in an “asset- quality review” and what standards it will expect banks to meet. These revealed something of the fierce arguments that have taken place recently within the ECB and the compromises it has had to swallow. The ECB needs to be tough on banks to restore confidence—yet not too tough. If it reveals capital shortfalls so large that filling them would destroy the public finances of struggling countries then it may undermine confidence rather than restore it. The Economist Reports

W-T-W.org

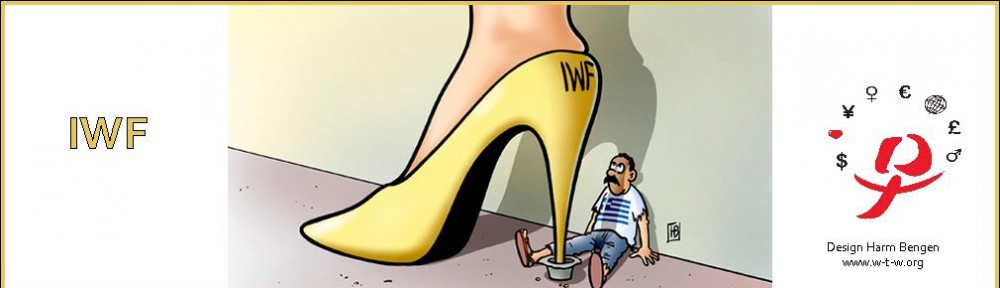

Women and Finance