In October 2016, Andreas Frank*, an expert on money laundering, visited the Bahamas to take a look behind the scenes of the offshore world. Mr Frank was kind enough to share his field report with us, which you can scroll through below and download here.

Some introductory words on the report by Mr Frank:

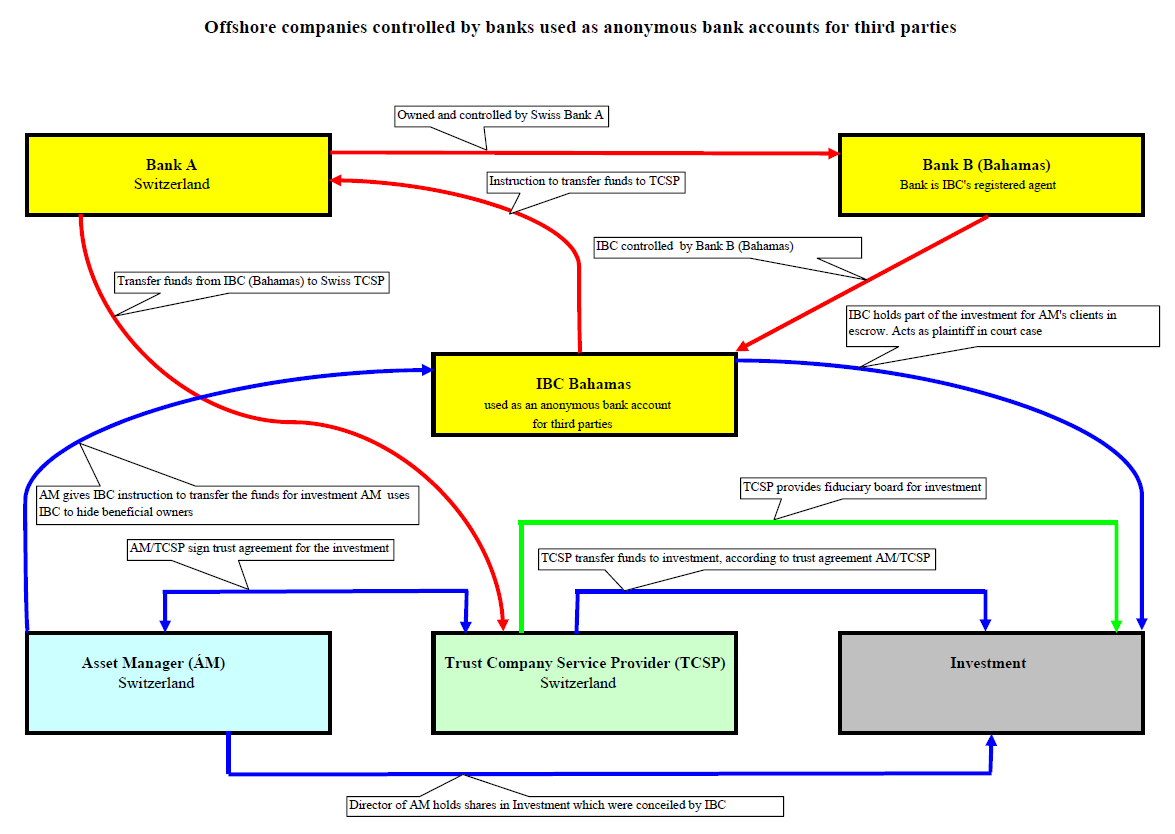

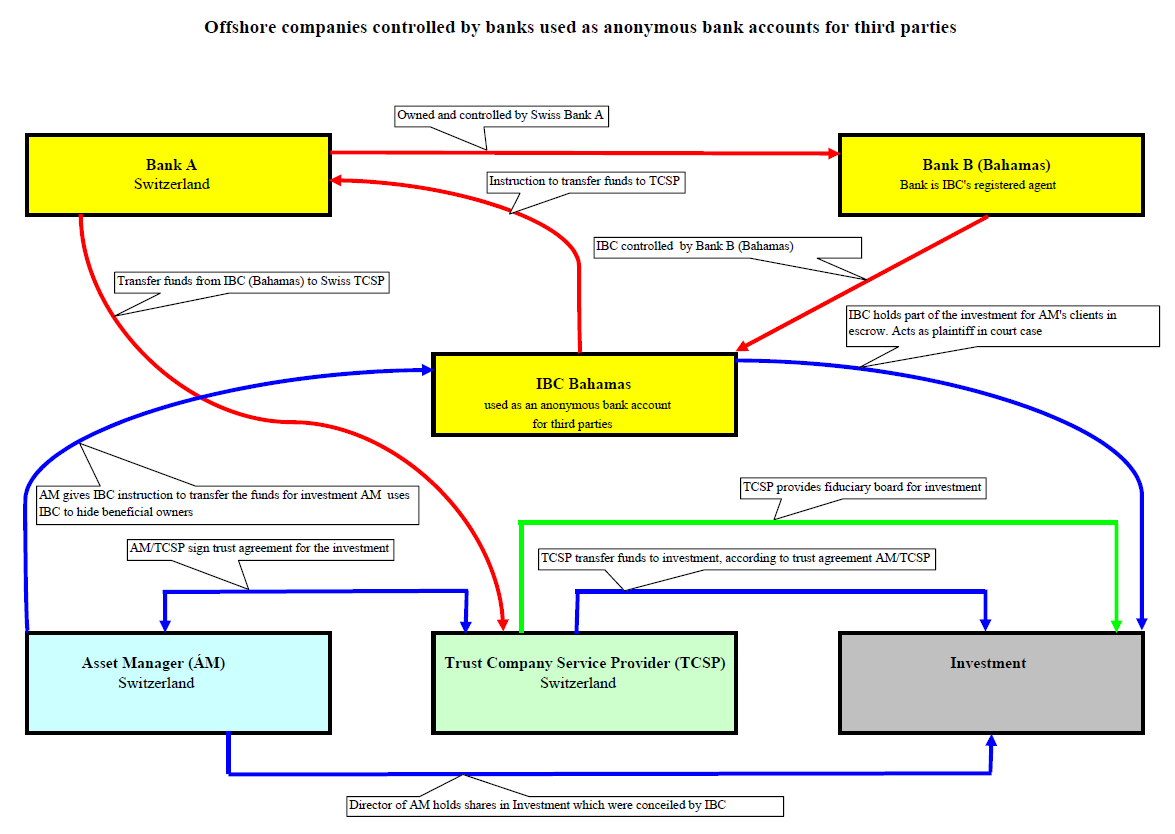

“When it comes to offshore companies, the novel aspect we see here is that banks created these companies with the purpose of letting third parties use them to disguise financial transactions. The point here is that these banks do not simply facilitate tax evasion and money laundering – they actively initiate, promote and support the criminal activities of their clients.

In our case here a bank in the Bahamas established an International Business Company (IBC). The ICB’s directors were directors of a Swiss bank in Geneva, which in turn was the mother of the bank in the Bahamas.

An IBC has no employees, offices, telephones, or e-mail. An IBC has no bookkeeping nor is it required to produce an annual report, nor is it being audited. An ICB does not have to pay any taxes. With a nominal capital of below $ 50 000 only an annual government fee of $ 350 has to be paid. An IBC is not subject to any minimum capital requirements. $ 100, as in the case of Ms Kroes, suffices.

The IBC we are concerned with here, controlled by a Swiss bank, was ordered by a third party, a Swiss wealth manager from Geneva, to transfer several million euros to a Swiss fiduciary. Following the order, the Swiss bank transferred the requested amount to the account of the fiduciary. From there, the fiduciary had the money transferred, via a German bank, to a company in Cologne, Germany.” New insights into the offshore world

*Andreas Frank: Former banker with Goldman Sachs and HSBC,with in-depth knowledge of the financial sector. Internationally recognized independent expert in the field of Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) Currently serving as an advisor to the Bundestag and the Council of Europe.

2017-02-Report-Government-of-The-Bahamas

See also: Frauen und Kinder leiden unter Korruption/ Woher stammt das Geld?