G20 – a meeting at the highest level

G20 – a meeting at the highest level

The G20 Summit in Hamburg on 7 and 8 July 2017 will be a meeting at the highest level. Its participants will include the world’s major economic players, the two countries with the largest populations in the world, the world’s biggest island country and the most important international institutions on the planet. But who are these participants of the G20 Summit in Hamburg? Twitter.com/RegSprecher

G20 Womens Entrepreneurship

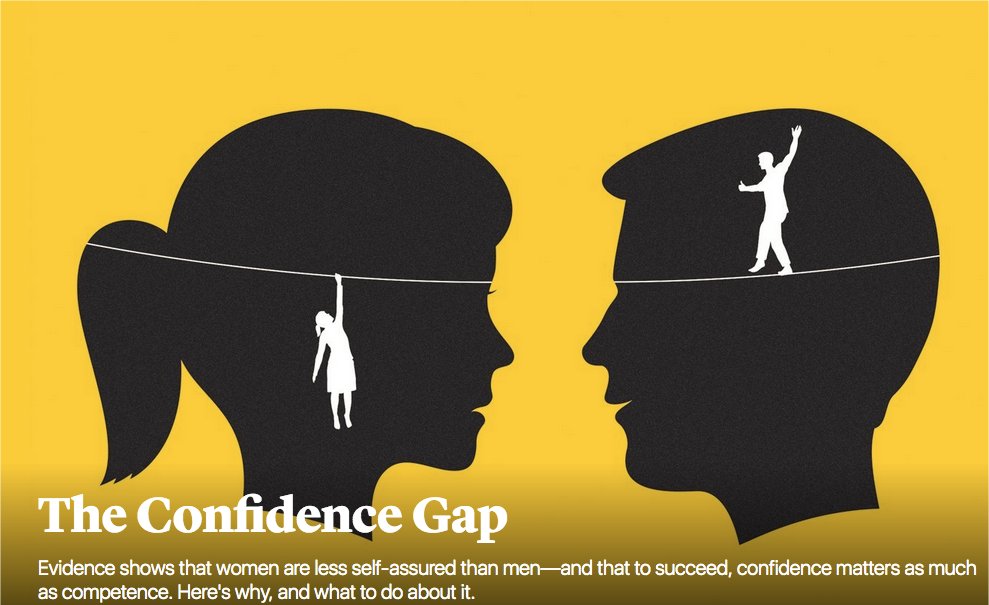

The G20 also seeks to improve women’s economic empowerment. The G20 thus agreed on the goal of improving labour force participation among women and reducing the gap that still exists in this respect between men and women by 25% by 2025. Germany’s G20 Presidency will build on that and focus on improving the quality of women’s employment. The German G20 Presidency will also work to remove the existing barriers which prevent women from gaining access to information and communications technology in developing countries and to improve education and employment prospects in the field of ICT.

-

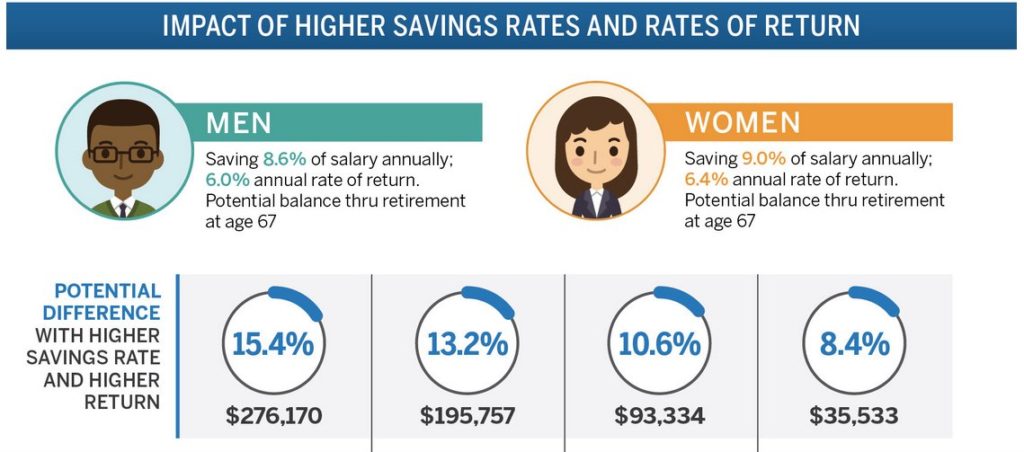

Financial inclusion

Promoting female entrepreneurship and access to finance for womenThe G20 has not yet fully acknowledged the potential of entrepreneurship as another driver of growth. Female entrepreneurship as well as women’s access to finance, including full legal capacity for all women, should therefore be promoted by improving access to credit and investor networks, training, information services and technical support.Women20 urges the G20 to:

-

- Abolish laws and standards that inhibit women’s full legal capacity

- Ensure women’s access to financial and productive assets as well as to markets

- Launch specific programmes to support female entrepreneurs, helping them not only to overcome start-up barriers, but also to grow and sustain their businesses, including via trade

- Increase the share of public procurement sourced to companies that meet specified gender criteria

- Update the Global Partnership for Financial Inclusion (GPFI), with a particular focus on access to finance and bank facilities for women

Suppression of Corruption on G20 Agenda

With a view to combating international terrorism, the G20 states have decided among other things to dry up channels of terrorist financing by means of closer cooperation and improved exchange of information. Since 2009, the prevention and suppression of corruption has also been on the G20 agenda. The G20 has since been working consistently to expand its existing body of principles. Under the German Presidency, the focus is on measures to improve public sector integrity and the common search for ways to fight corruption in particularly susceptible areas. G20-Anti Corruption

-