MORE – Modelling and mapping the risk of Serious and Organised Crime infiltration in legitimate businesses across European territories and sectors.

MORE aimed to analyse, model and map the risk factors of serious and organised crime (SOC) infiltration in legitimate European businesses. It focused on risk factors at two levels:

• Macro level, i.e., across countries,regions and business sectors;

• Micro level, i.e., at the firm level, in terms of ownership and accounting red flags.

MORE built on two previous studies also co-funded by the EU Commission:

• The OCP project, which analysed the economy of organised crime in 7 EU MSs (Finland, France, Ireland, Italy, the Netherlands, Spain and the UK) from a macro perspective;

• The ARIEL project, which analysed the script of OC infiltration in businesses in 5 EU MSs (Italy, the Netherlands,

Slovenia, Sweden and the UK) from a micro perspective.

The MORE project combined the two perspectives and extended the analysis to the whole EU 28. To do so, it adopted a mixed qualitative and quantitative method — which is the only possible way to address a complex issue such as SOC infiltration in

businesses. And in the process, it performed:

• The collection of data, cases and evidence from a wide variety of sources (judicial documents, police reports, institutional reports and media news), relying also on a widespread network of national contact points.

• An in-depth crime-script analysis of 24 case studies of SOC infiltration (equivalent to more than 500 companies

in all EU MS);

• A macro analysis of statistics on selected risk factors across regions, countries and business sectors;

• A micro analysis of ownership and accounting data from a sample of more than 1,000 firms confiscated from OC.

MORE is only a first exploratory step towards a systematic monitoring of the problem of SOC infiltration in businesses across the EU MSs, but it shows that such monitoring would be essential to mitigate and prevent SOC in Europe….MORE_FinalReport

Official website

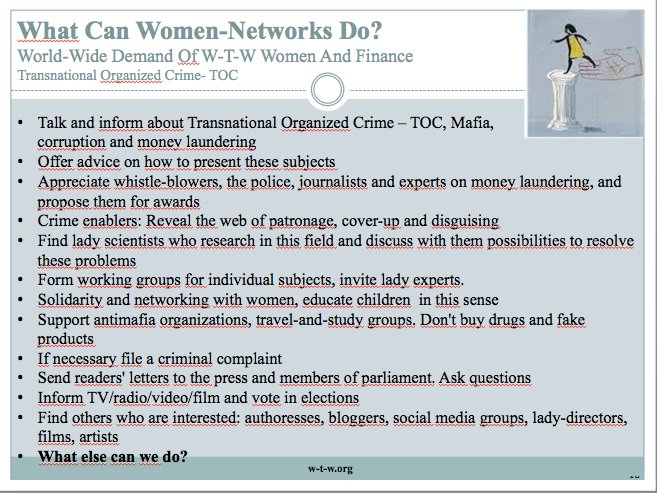

any other threats that can compromise the integrity of the international financial system. A robust and resilient anti-money laundering and combating of terrorism financing (AML/CFT) regime is the first step towards being able to implement effective legal, regulatory and operational measures.

any other threats that can compromise the integrity of the international financial system. A robust and resilient anti-money laundering and combating of terrorism financing (AML/CFT) regime is the first step towards being able to implement effective legal, regulatory and operational measures.