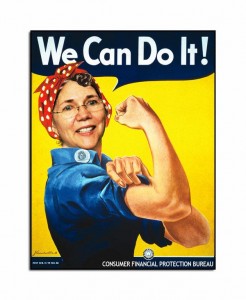

As a Senator and expert on banking, Elizabeth Warren has provided an indispensable oversight to government and banking activities. It is not surprise to find her at the forefront of the massive spending proposed to combat the corona virus in the US.

Before Elizabeth Warren was a senator from Massachusetts and a Democratic presidential candidate, she ran the Congressional Oversight Panel that was in charge of overseeing the $700 billion Troubled Asset Relief Program (TARP) bailout that Congress approved after Wall Street crashed in 2008. In that capacity, Warren, then a Harvard law professor, kept a close watch on where the money was going and crafted public reports that disclosed that the Treasury Department had overpaid $78 billion for assets it bought from failed banks and that large chunks of the money were not being used well.

Last month, Congress passed a $2 trillion coronavirus bailout and assistance bill, and it contains a $500 billion fund from which the Trump administration, at its sole discretion, can dole out money to big corporations in distress. What’s the best way to monitor this flow of billions? Warren, no surprise, has some ideas.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, Warren notes, has four overall parts: sending money to hospitals and other health care facilities, expanding unemployment benefits, providing assistance to small businesses, and establishing what she agrees is a $500 billion “slush fund” for large corporations. There is also money in the bill for education, food security, and state and local government responses to the crisis. Donald Trump and his administration may use this money to “reward their political friends and punish their political enemies.” Warren points out, “I spent a lot of time in the negotiations [over the bill]…to try to get at least some curbs on how the money is spent and some oversight. Republicans basically said this is going to be the price of getting money to our medical providers, getting money to people who are unemployed, getting money to small business: ‘You guys are going to have to go along…with this slush fund for giant corporations.’”

The oversight provisions in the measure do include a special inspector general for pandemic recovery, who will track all loans and expenditures made from the $500 billion fund, and a congressional oversight commission, similar to the one Warren ran years ago, which will monitor this spending and evaluate its impact. But Warren points out the commission will only be as strong as its members, who have yet to be appointed:

When Warren was the cop on the bailout beat, she generally had the support of a Democratic Congress and the Obama administration. That won’t be the case this time around. Trump has already said he has the right to block the new special IG from sharing information with Congress and the public. And the CARES Act contains no provisions that allow any outside review of expenditures or loans before Treasury Secretary Steven Mnuchin okays them. Whatever he (or Trump) decides, goes.

In this environment—with a president hostile to transparency and accountability—what can be done to cast sunlight onto Mnuchin handing out $500 billion in taxpayer dollars to big companies?

Warren recommends: 1. Be consistent in talking about this every single day. We can’t let this just drop off the radar screen. Remind people the slush fund exists. 2. Dig into individual pieces and tease out whatever information we can. 3. Shout about any bad examples that turn up. Point out this is taxpayer money, money that could have been used for personal protective equipment or health care professionals…money that could have been used to help small business and to help people who are unemployed.

With no clawbacks allowed the only recourse is to jump on every piece of information that comes out because that influences the next decision that gets made. The only restraint is “public opinion.

Warren’s tips essentially boil down to this: pay attention, pay attention, pay attention Use crowdsourcing oversight.

W-T-W.org welcomes any comments and suggestions to create crowdsourcing oversight.