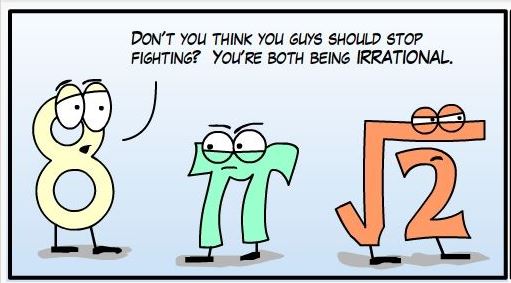

Barry Ritholtz writes: Behavioral economics is grounded in the idea that homo economicus (economic man) fails to account for real-world human behavior. The behaviorists argue that people are not rational; they don’t act narrowly in their own self-interest as profit maximizers. Instead, they are biased and emotional and often fail to make rational judgments about money.

In other words, the traditional starting point of economics is actually false. As a model, it helps conceptualize commerce, but in the real world it can be and often is wrong. This is where the behaviorists come in to show how peoples’ irrationality affects their decision-making. Specifically:

— We get too emotional about the possibility of making lots of money;

— We get too depressed about the risk of losing money;

— Our cognitive processes fool us constantly into believing things that are untrue;

— We have poor impulse control, an inability to think long term and lack patience.

Nowhere does behavioral economics promise to make you as a human being less irrational. At best, its goal is to inform you of your own irrational tendencies.

• Vanguard’s assets under management have at least tripled to more than $3 trillion since the end of the financial crisis. About two-thirds of those assets are in broad, inexpensive passive indices;

• Exchange-traded funds let investors gain broad exposure to almost any asset class in a single purchase at very low cost;

• Asset allocation can now be had for little cost or free via all manner of automated software-based advisers.

Rather than brainwashing investors, behavioral economics has helped create a set of investing alternatives that meet their financial benchmarks and cost very little. That you may have chosen to ignore these alternatives and plunge into the latest fund of funds or private-equity offering isn’t a failure of behavioral economics; it is your own failure to apply what we now know about investing.

The basic premise of economics is that transactional commerce — the production, distribution and consumption of goods and services — is a key way to understand society. What behavioral economics has done is point out the false assumptions and erroneous conclusions inherent in the dismal science of economics.

Your wetware developed to keep you alive on the savannah, not to make risk-reward decisions in the capital markets. A secret brainwashing machine is unnecessary. You are not wired for investing. You never were. That is a feature, not a bug. But our brains have allowed our species to survive long enough to develop expensive, unnecessary financial products.

It is your job to figure that out. Behavioral economics can help.