Kevin Cirilli writes: Carly Fiorina’s political future depends on whether she can defend her record as CEO of Hewlett-Packard.

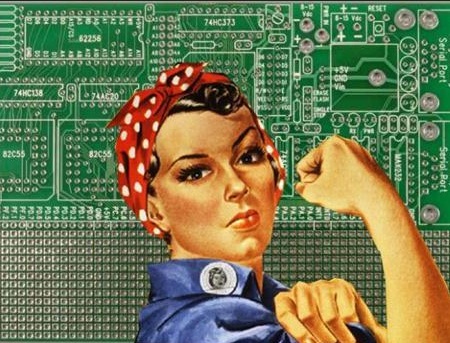

Fiorina said members of her own board leaked confidential information to the media to undermine her decisions, though she stopped short of alleging outright sexism. She was the first female CEO of a Fortune 20 company.

“Men understand other men’s need for respect, but they don’t always understand women’s need for respect,” Fiorina said. “The situation that transpired in the boardroom was all about certain board members wanting to protect their position when they felt threatened, because their behavior was against the code of conduct, and they knew that I as a leader would not tolerate that conduct.”

When asked again if she thought underlying sexism contributed to her firing, she said, “There’s no question that women in positions of authority are scrutinized differently, criticized differently and characterized different.”

Following her departure, she said HP officials monitored her phone calls to see if she had been the one leaking the negative information.

“Set aside the legality for a moment — that is a terrible practice for a board to engage in, and it’s evidence of their dysfunction,” she said.

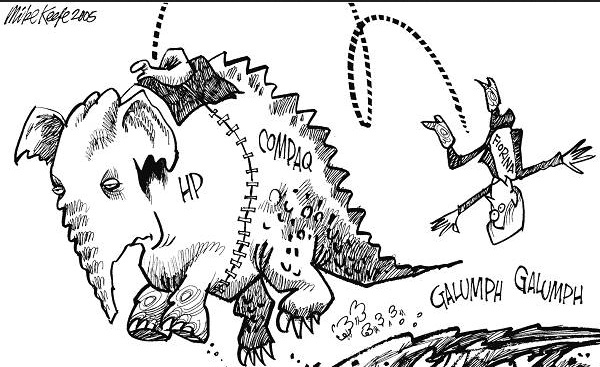

Both critics and supporters portray her as a determined leader. She was ousted, detractors say, partly because of declining stock price and a controversial merger with Compaq that butted heads with HP’s founders’ vision for the future.

Still, she said President George W. Bush called to offer her a job in his administration the day after she was fired, though she declined to say which one.

Another phone call she received was from the late Apple CEO Steve Jobs. She said he urged her to take her time and not do anything for at least six months. She said Jobs told her HP would “regret” firing her one day.

Fiorina is hardly a presidential front-runner. But as the only likely female Republican presidential candidate, she has an important place in the field.

She is often mentioned as a potential vice presidential pick to the eventual Republican nominee. And her supporters praise her fiery speeches that frequently take on Hillary Clinton, the Democratic front-runner.

But her business record has resurfaced as she’s stepped back into the media limelight. Earlier this month, MSNBC’s “Morning Joe” co-host Mika Brzezinski confronted Fiorina about her business record during a contentious appearance. Fiorina said she made tough choices that were best for the company.