Mario Draghi writes: There is a common misconception that the euro area is a monetary union without a political union. But this reflects a deep misunderstanding of what monetary union means. Monetary union is possible only because of the substantial integration already achieved among European Union countries – and sharing a single currency deepens that integration.

If European monetary union has proved more resilient than many thought, it is only because those who doubted it misjudged this political dimension. They underestimated the ties among its members, how much they had collectively invested, and their willingness to come together to solve common problems when it mattered most.

Yet it is also clear that our monetary union is still incomplete. This was the diagnosis offered two years ago by the so-called “Four Presidents” (the European council president in close collaboration with the presidents of the European Commission, the European Central Bank, and the Eurogroup). And, though important progress has been made in some areas, unfinished business remains in others.

But what does it mean to “complete” a monetary union? Most important, it means having conditions in place that make countries more stable and prosperous than they would be if they were not members. They have to be better off inside than they would be outside.

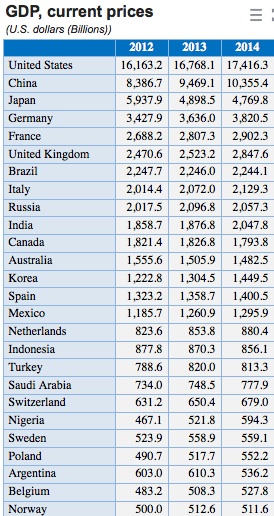

In other political unions, cohesion is maintained through a strong common identity, but often also through permanent fiscal transfers between richer and poorer regions that even out incomes ex post. In the euro area, such one-way transfers between countries are not foreseen (transfers do exist as part of the EU’s cohesion policy, but are limited in size and are primarily designed to support the “catching-up” process in lower income countries or regions). This means that we need a different approach to ensure that each country is permanently better off inside the euro area.

This implies two main things. First, we have to create the conditions for all countries to thrive independently. All members need to be able to exploit comparative advantages within the Single Market, attract capital, and generate jobs. And they need to have enough flexibility to respond quickly to short-term shocks. This comes down to structural reforms that spur competition, reduce unnecessary red tape, and make labor markets more adaptable.

Until now, whether or not to carry out such reforms has largely been a national prerogative. But in a union such as ours they are a clear common interest. Euro area countries depend on one another for growth. And, more fundamentally, if a lack of structural reforms leads to permanent divergence within the monetary union, this raises the specter of exit – from which all members ultimately suffer.

In the euro area, stability and prosperity anywhere depend on countries thriving everywhere. So there is a strong case for sharing more sovereignty in this area – for building a genuine economic union. This means more than beefing up existing procedures. It means governing together: shifting from coordination to common decision-making, and from rules to institutions.

The second implication of the absence of fiscal transfers is that countries need to invest more in other mechanisms to share the cost of shocks. Even with more flexible economies, internal adjustment will always be slower than it would be if countries had their own exchange rate. Risk-sharing is thus essential to prevent recessions from leaving permanent scars and reinforcing economic divergence.

A key part of the solution is to improve private risk-sharing by deepening financial integration. Indeed, the less public risk-sharing we want, the more private risk-sharing we need. A banking union for the euro area should be catalytic in encouraging deeper integration of the banking sector. But risk-sharing is also about deepening capital markets, especially for equity, which is why we also need to advance quickly with a capital markets union.

Still, we have to acknowledge the vital role of fiscal policies in a monetary union. A single monetary policy focused on price stability in the euro area cannot react to shocks that affect only one country or region. So, to avoid prolonged local slumps, it is critical that national fiscal policies can perform their stabilization role.

To allow national fiscal stabilizers to work, governments must be able to borrow at an affordable cost in times of economic stress. A strong fiscal framework is indispensable to achieve this, and protects countries from contagion. But the crisis experience suggests that, in times of extreme market tensions, even a sound initial fiscal position may not offer absolute protection from spillovers.

This is a further reason why we need economic union: markets would be less likely to react negatively to temporarily higher deficits if they were more confident in future growth prospects. By committing governments to structural reforms, economic union provides the credibility that countries can indeed grow out of debt.

Ultimately, economic convergence among countries cannot be only an entry criterion for monetary union, or a condition that is met some of the time. It has to be a condition that is fulfilled all of the time. And for this reason, to complete monetary union we will ultimately have to deepen our political union further: to lay down its rights and obligations in a renewed institutional order.