Lisa Rein writes: The world’s largest defense contractor has agreed to pay $4.7 million to settle charges that it illegally used government money to lobby top federal officials to extend its contract to run one of the country’s premier nuclear weapons labs.

Over five years starting in 2009, top executives for Lockheed Martin — who were being paid by the federal government to run Sandia National Laboratories — ran a fierce campaign to lobby members of Congress and senior Obama administration officials for a seven-year extension of their contract, according to the settlement the Justice Department announced Friday.

Lockheed executives, who hired a former New Mexico congresswoman to help them, didn’t just press people with influence to re-hire them for a deal worth $2.4 billion a year.

Mizer said the lab, a subsidiary of Lockheed, allegedly used federal money to lobby Congress and other federal officials from 2008 and 2012, “to receive a non-competitive extension” of its contract in violation of federal law.

The case opened a window on the inner workings of power and influence in Washington. It’s not surprising that a big, politically connected defense contractor would lobby hard to keep a lucrative slice of federal business. But this case went further. It was taxpayers, not Lockheed’s corporate lobbying arm in Bethesda, Md., who paid for the influence peddling.

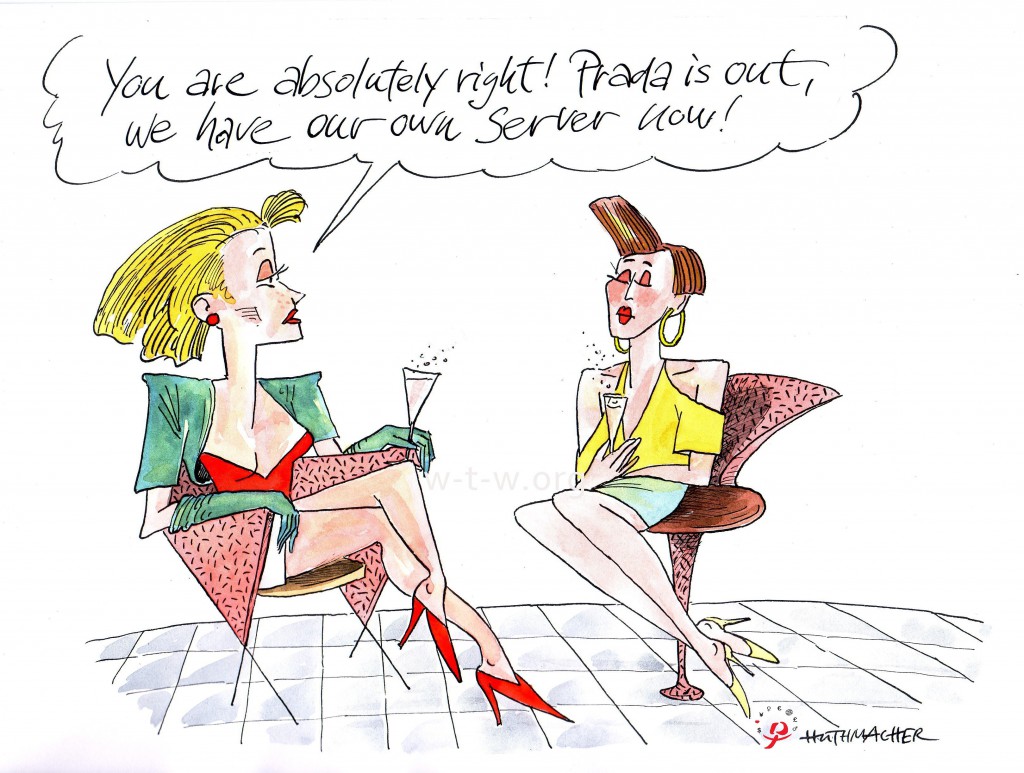

Excerpt from guidance that former New Mexico Republican Rep. Heather Wilson gave Lockheed Martin officials to ensure that the company’s contract to run a premier nuclear lab would be renewed. (Source: Energy Dept. Inspector General)

To clinch the contract extension, Sandia labs officials hired high-priced consultants — including a former congresswoman who was paid $226,000 — to write up a “contract extension strategy.” Among the tactics suggested by Heather A. Wilson (R-N.M.) were “working key influencers” by targeting then-Energy Secretary Steven Chu’s staff, and even his family, friends and former colleagues at another federal lab, all with the goal of keeping Lockheed Martin in charge of Sandia in Albuquerque.

Wilson was not just on Lockheed’s payroll. From 2009 through 2011, she had consulting jobs for Lockheed and three other contractors managing the Energy Department’s national lab, charging taxpayers a total of $450,000.

Wilson, who left Congress in 2009 after an unsuccessful run for the Senate, has publicly denied that she took part in any lobbing involving the Sandia contract. But Friedman at the time that she was “deeply, deeply involved” in Lockheed’s effort to renew its contract.

he world’s largest defense contractor has agreed to pay $4.7 million to settle charges that it illegally used government money to lobby top federal officials to extend its contract to run one of the country’s premier nuclear weapons labs.

Over five years starting in 2009, top executives for Lockheed Martin — who were being paid by the federal government to run Sandia National Laboratories — ran a fierce campaign to lobby members of Congress and senior Obama administration officials for a seven-year extension of their contract, according to the settlement the Justice Department announced Friday.

Congresswoman who was paid $226,000 — to write up a “contract extension strategy.” Among the tactics suggested by Heather A. Wilson (R-N.M.) were “working key influencers” by targeting then-Energy Secretary Steven Chu’s staff, and even his family, friends and former colleagues at another federal lab, all with the goal of keeping Lockheed Martin in charge of Sandia in Albuquerque.