The International Monetary Fund managing director Christine Lagarde warned that greater resilience would be needed from the world’s emerging economies to handle China’s slowdown, warning the road ahead could be “somewhat bumpy”.

The IMF chief also cautioned that global growth this year would be “likely weaker” than previously anticipated, less than two months after the IMF cut its global forecast for 2015 to 3.3%.

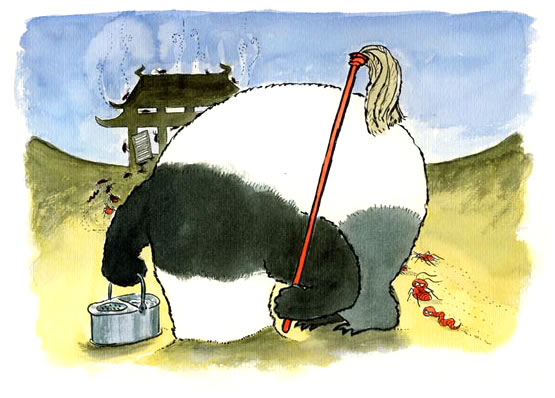

Emerging markets from Indonesia to Brazil have been bruised by the slowdown in the world’s second largest economy.

Lagarde’s two-day visit has nothing to do with the financial market turbulence and the steep rupiah depreciation Indonesia has been experiencing for the past few weeks. This visit has been in preparation since last year in light of a high-level international conference on the future of Asia’s finance that the IMF jointly organizes with the central bank, Bank Indonesia.

President Jokowi and the economics ministers may seize this opportunity for sharing views about the current turbulence in the global financial market and reiterate the urgent need for the IMF to be more responsive to regional needs. They should bring home a stronger message to Lagarde that three major emerging Asian economic powerhouses should be given a greater share of the spotlight in managing the multilateral agency.

The IMF’s shortcomings may be the market still trusts this institution more than the Indonesian government when it comes to economic, especially monetary, management. The IMF remains an opinion leader for creditors and investors. This is the market perception, however painful it may appear to the country’s political leaders.