IMF meetings in Lima, Peru suggest that debt in emerging countries if difficult to measure and even find. Yet this debt is an important factor in evaluating these economies.

Carmen Reinhart writes: When central bankers and finance ministers from around the globe gathered for the International Monetary Fund’s annual meetings here in Lima, Peru, which ended on Sunday, the emerging world was rife with symptoms of increasing economic vulnerability. Gone are the days when IMF meetings were monopolised by the problems of the advanced economies struggling to recover from the 2008 financial crisis. Now, the discussion has shifted back toward emerging economies, which face the risk of financial crises of their own.

While no two financial crises are identical, all tend to share some telltale symptoms: a significant slowdown in economic growth and exports, the unwinding of asset-price booms, growing current-account and fiscal deficits, rising leverage, and a reduction or outright reversal in capital inflows. To varying degrees, emerging economies are now exhibiting all of them.

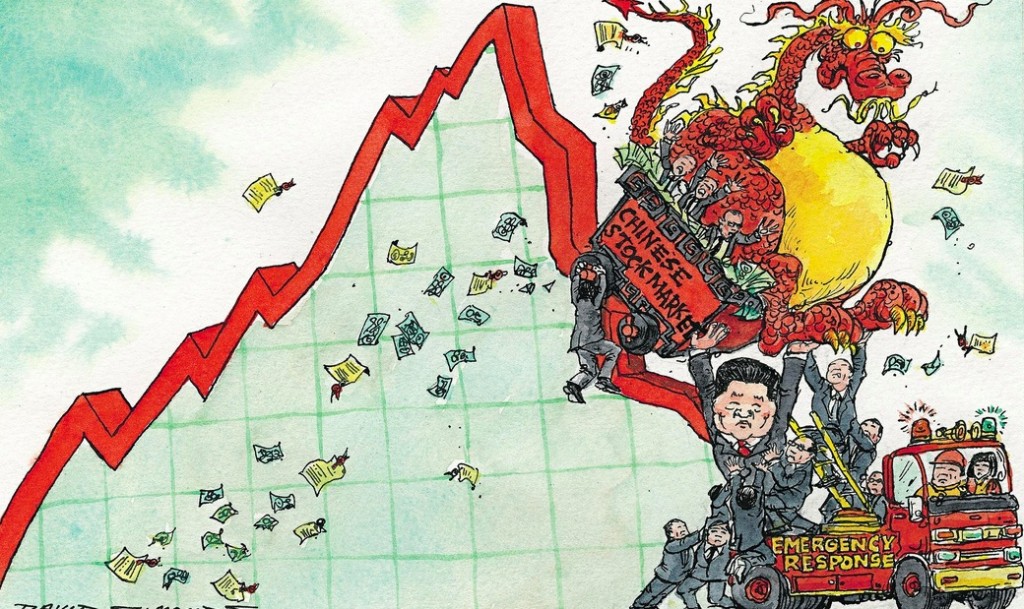

The turning point came in 2013, when the expectation of rising interest rates in the United States and falling global commodity prices brought an end to a multi-year, capital-inflow bonanza that had been supporting emerging economies’ growth. China’s recent slowdown, by fuelling turbulence in global capital markets and weakening commodity prices further, has exacerbated the downturn throughout the emerging world.

These challenges, while difficult to address, are at least discernible. But emerging economies may also be experiencing another common symptom of an impending crisis, one that is much tougher to detect and measure: hidden debts.

Sometimes connected with graft, hidden debts do not usually appear on balance sheets or in standard databases. Their features morph from one crisis to the next, as do the players involved in their creation. As a result, they often go undetected, until it is too late.

Indeed, it was not until after the eruption of the 1994-1995 peso crisis that the world learned that Mexico’s private banks had taken on a significant amount of currency risk through off-balance-sheet borrowing (derivatives). Likewise, before the 1997 Asian financial crisis, the IMF and financial markets were unaware that Thailand’s central-bank reserves had been nearly depleted (the $33 billion total that was reported did not account for commitments in forward contracts, which left net reserves of only about $1 billion). And, until Greece’s crisis in 2010, the country’s fiscal deficits and debt burden were thought to be much smaller than they were, thanks to the use of financial derivatives and creative accounting by the Greek government.

So the great question today is where emerging-economy debts are hiding. And, unfortunately, there are severe obstacles to exposing them – beginning with the opaqueness of China’s financial transactions with other emerging economies over the past decade.

During its domestic infrastructure boom, China financed major projects – often connected to mining, energy, and infrastructure – in other emerging economies. Given that the lending was denominated primarily in US dollars, it is subject to currency risk, adding another dimension of vulnerability to emerging-economy balance sheets.

But the extent of that lending is largely unknown, because much of it came from development banks in China that are not included in the data collected by the Bank for International Settlements (the primary global source for such information). And, because the loans were rarely issued as securities in international capital markets, it is not included in, say, World Bank databases, either.

Even where data exists, the figures must be interpreted with care.

Other forms of borrowing – such as trade finance, which is skewed toward shorter maturities – are not included in these figures. Currency-swap agreements, which have been important for Brazil and Argentina, must also be added to the list. (This highlights the importance of tracking net, rather than gross, reserves.)

In short, though emerging economies’ debts seem largely moderate by historic standards, it seems likely that they are being underestimated, perhaps by a large margin. If so, the magnitude of the ongoing reversal in capital flows that emerging economies are experiencing may be larger than is generally believed – potentially large enough to trigger a crisis. In this context, keeping track of opaque and evolving financial linkages is more important than ever.