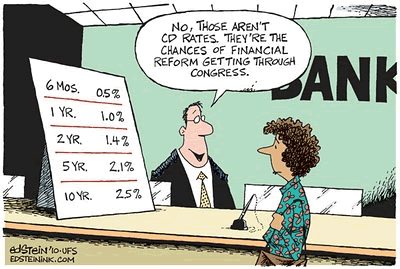

Matt Taibbi writes: When Bill Clinton took office, it was still illegal in the United States for commercial banks to merge with investment banks and insurance companies. But toward the end of Clinton’s second term, he signed a bill called the Gramm-Leach-Bliley Act that essentially created Too Big to Fail “supermarket” banks like Citigroup.

This isn’t the only reason the financial system is so dangerous now. There’s also the matter of the extreme interconnectedness of the financial services industry. This problem came violently into play in 2008, when the failure of a single idiot investment bank, Lehman Brothers, caused a chain reaction that nearly blew up the whole financial system.

This latter problem was partially a consequence of another Clinton-era law, the Commodity Futures Modernization Act, which deregulated derivatives like swaps that were the agent of many of those chain-reaction losses.

Hillary Clinton has problems with a financial system that became dangerously over-concentrated thanks to multiple laws passed during her husband’s administration.

Mrs. Clinton says: “Well, my plan is more comprehensive. And, frankly, it’s tougher because of course we have to deal with the problem that the banks are still too big to fail. We can never let the American taxpayer and middle-class families ever have to bail out the kind of speculative behavior that we saw. But we also have to worry about some of the other players: AIG, a big insurance company; Lehman Brothers, an investment bank. There’s this whole area called ‘shadow banking.’ That’s where the experts tell me the next potential problem could come from.”

First, it’s definitive now that Hillary has no intention of reinstating Glass-Steagall.

The second and probably more important observation is about Hillary’s rhetorical choices.

Hillary, like her close advisor Barney Frank, has been pushing an idea that banks aren’t at the root of any financial instability problem. Last night, she pointed a finger instead at “shadow banking,” non-bank actors like AIG, and a dead investment bank in Lehman Brothers. (Interesting she didn’t mention a still-viable investment bank like Goldman, Sachs, which has hosted her expensive speaking engagements.)

This squeamishness about criticizing banks is laughable to people in the industry. But of course, that’s probably the point – that the average voter won’t know how absurd and desperate it is to point to faceless “shadow” financiers as villains when the real bad guys are famed mega-firms that are right out in the open, with their names plastered all over every second city block.

The root of the 2008 crisis lay in a broad criminal fraud scheme, in which huge masses of home loans were given to people who couldn’t afford them. Those loans in turn were bought back up by giant banks and resold to investors who weren’t told how crappy the merchandise was.

The question there is how to make sure companies are small enough that the really corrupt ones can be allowed to implode organically, rather than requiring mass bailouts.

How do you make Too Big to Fail companies smaller and safer? Probably, you just do it. Mrs. Clinton will not.