Is Elizabeth Warren the Sheriff of Wall Street?

Richard Borosage writes: Time Magazine hails Sen. Elizabeth Warren as the “sheriff of Wall Street.” Her effectiveness stuns the powers that be.

Fox News’ Melissa Francis says people on Wall Street think, “Elizabeth Warren is the devil.” Bill O’Reilly fulminates that she’s a “socialist,” yet “in demand, a woman of stature.” The Wall Street wing of the Democratic Party accuses her of “McCarthyism”for outing think tank scholars who argue the brief of their deep pocket contributors. The Economist muses on the “mystery of Elizabeth Warren” who has made herself into a “national politician” even though she isn’t running for president.

Senator Warren has earned the brickbats and the praise because she’s willing to take on the most powerful financial interests in the country in defense of everyday Americans. She is a first term minority party senator, but she has already earned a national following and is transforming our political debate and disrupting the corrupted politics of Washington.

A Senate hearing last month illustrated the traits that make Warren so effective and so invaluable. Republicans brought Primerica President Peter Schneider to testify against the proposed rules – championed by Warren and President Obama – that would protect the retirement savings of working people from sketchy financial advisers more concerned about fleecing their clients than serving them.

Schneider portrayed his company as dedicated to everyday Americans, clients who make as little as $30,000 a year, from homes “all too often … headed by a single mother.”

“We all agree that we must act in a client’s best interests,” Schneider said, while opposing the proposed Obama rule requirements as so costly that Primerica would be forced to abandon its vulnerable clientele.

Senator Warren once more had done her homework. Primerica advisers were being sued for pushing firefighters and others nearing retirement to swap government guaranteed pensions for much more risky market investments that would earn Primerica far more fees. The company had put aside over $15 million to cover expected liability from 238 of these retirees.

“Do you believe,” Warren asked, “that people like these firefighters from Florida who are near retirement and have secure pensions with guaranteed monthly payments should move their money into riskier assets with no guarantees, just before they retire?”

It takes courage to challenge the Wall Street barons accustomed to getting their way in Washington. It takes intelligence and hard work to know enough to expose the hypocrisy and lies that are trotted out to justify rigging the rules.

Somehow this former law professor is pitch perfect in her ability to frame complicated issues for Americans to understand. Her speech at the 2012 Democratic Convention – “People think that the system is rigged against them. And here’s the painful part: they’re right”

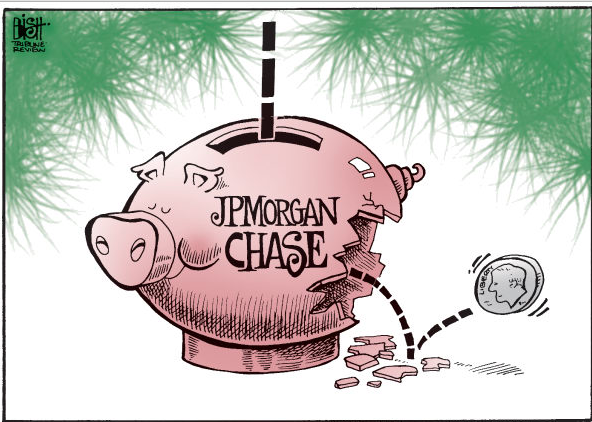

But she is more than a gifted orator. The Consumer Financial Protection Bureau – that she not only conceived but, against all odds, got enacted in the Obama financial reforms – has already returned over $10 billion to 17 million Americans tricked by deceptive credit card and other financial ripoffs. She’s championed student debt relief, expanding Social Security, breaking up the big banks, reinstating the Glass-Steagall wall between taxpayer guaranteed deposits and Wall Street’s casino. And she’s only just begun.

W-T-W.org notes: Warren thinks about the problems she presents and deeply understands them. For instance, she has taken what is mistakenly regarded as a right wing position that too many colleges exist in America; they charge too much and invite students who can sign up for debt but will not find a college education useful.

Her personal poise, her clear convictions and her direct charm should not be under-estimated.