Should Central Banks Be De-Fanged?

Holman W. Jenkins writes: Ben Bernanke wishes otherwise, but his historical reputation won’t rest only on his efforts to save the financial system, but on his contribution to the meltdown in the first place by letting Lehman fail.

“We had little doubt a Lehman failure would massively disrupt financial markets and impose heavy costs . . . on millions of people around the world who would be hurt by its economic shockwaves. . . . I never heard anyone from the Fed or the Treasury suggest that letting Lehman fail would be anything other than a disaster, or that we should contemplate allowing the firm to fail. . . . Lehman needed to be saved. We lacked the means to do so,” writes Bernanke.

When Lehman weekend rolled around in September 2008 and it wasn’t clear yet that even AIG would be saved, we were flummoxed. Fed intervention seemed a no-brainer, given the assumptions and priorities that have driven such decisions in the past. The Fed worried about the “end of our resources” and having to face the potential collapse of WaMu, Citigroup, Merrill Lynch and others with “no political support.”

Let’s try a thought experiment: Suppose President Bush, Candidate Obama, Nancy Pelosi and Harry Reid had all taken to their respective soapboxes and demanded that the Fed stop a Lehman crash. Would Mr. Bernanke have failed to bail out Lehman over a legalism? Of course not.

Maybe he and Hank Paulson were right: The highly political moment would have produced a populist backlash that would have inhibited their future rescue efforts. It doesn’t follow that the Fed would have taken losses. Lehman, after all, was liquidated in a world in which Lehman had been allowed to fail. Second, the Fed can print money.

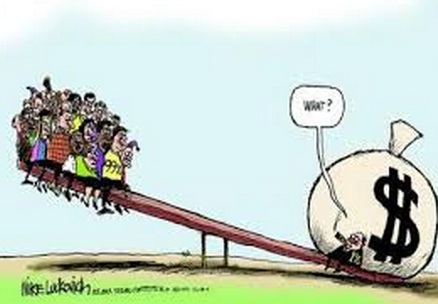

Less spin would be useful right now for one important reason: Politicians and the public still haven’t grown up about the too-big-to-fail problem. Mr. Bernanke says CEOs and shareholders won’t be eager to repeat the experience of Bear Stearns, Lehman, etc. If only it were so. Creditors were largely bailed out. That means, in the quest for competitive returns, shareholders and CEOs in the future inevitably will be led to press the limits on leverage because lenders believe them implicitly government-backed.

Mr. Bernanke is correct when he says the Lehman panic, not the relatively modest losses on subprime mortgages, caused the global crash. But let’s spell it out. Since the Great Depression, largely due to the scholarship of people like Mr. Bernanke, investors and savers were conditioned to believe the U.S. government would not let the failure of a mere financial institution crater the world economy. Now their confidence in the safety net was mortally shaken.

The time to worry about moral hazard is before a crisis, not in the middle of one.