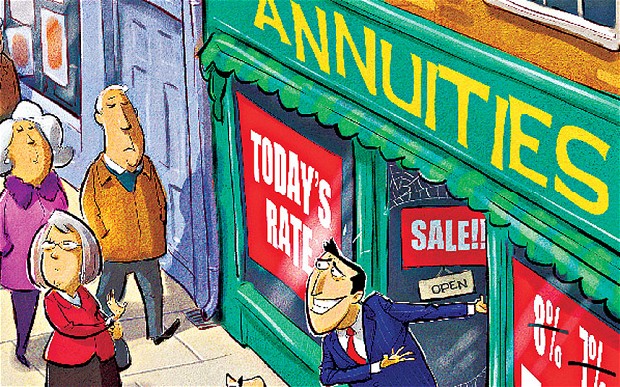

Kickbacks are prevalent in the annuities industry in the US. Senator Elizabeth Warren wants to clean up the business..

Her report examines responses from 15 leading annuities providers to letters sent by Senator Warren earlier this year, highlights the ways that annuity companies can incentivize agents to put their own interests ahead of their clients.

Overall, thirteen of the fifteen companies investigated admitted to offering kickbacks either directly to agents, indirectly through third party gift payments, or both. Two of the fifteen leading annuities providers indicated that they refuse to provide non-cash direct or indirect kickbacks, suggesting it is straightforward – though uncommon – to build a successful advising business without offering such inducements.

“Companies shouldn’t be allowed to offer expensive vacations, prizes and other kickbacks to agents in exchange for selling costly, second-rate investment products to unsuspecting customers,” Senator Warren said. “This investigation highlights the need for a strong Conflict of Interest Rule to protect the savings of families trying to save for retirement and to ensure a level playing field for companies and advisers who want to do right by their clients.”

Key findings of the report include:

• The vast majority of companies investigated admitted to providing rewards and inducements, such as expensive vacations and other prizes, to annuity agents in exchange for sales.

• Annuity companies also create conflicts of interest and evade some existing restrictions by offering perks and inducements to annuity sales agents through third party marketing organizations.

• Current disclosure rules are inadequate to ensure that customers are informed about the incentives agents receive for selling them specific financial products.

• Existing rules and regulations to deter conflicts of interest are completely inadequate.

Because of loopholes in the law, it is perfectly legal for some advisers to steer customers into complex financial products that will earn the highest rewards, perks and prizes for the advisers – even if they are bad options for their customers. Research suggests that this loophole costs Americans an estimated $17 billion every year. In order to protect consumers from these types of abuses, the Department of Labor has proposed a draft rule to put an end to these conflicts of interest by closing these loopholes.