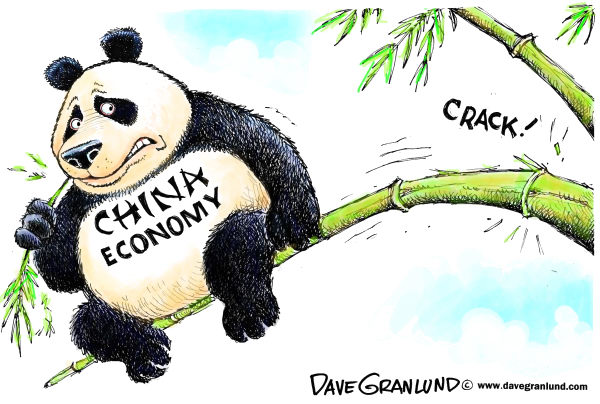

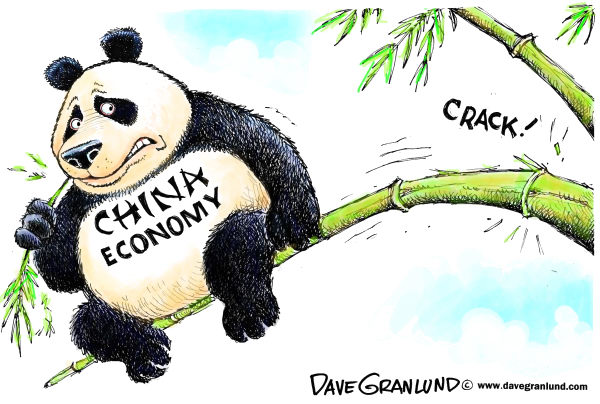

On the Rocky Road to Globalization the impact of China’s slowing economy is felt around the world.

Paul Wiseman and Rod McGuirk write: China’s economic troubles have dropped on the doorstep of a sun-weathered house at 18 Edgar St. in Port Hedland on Australia’s northwest coast.

Four years ago, the 50-year-old home, fabricated from cheap asbestos cement, sold for the equivalent of $1.3 million. It’s now for sale again — recently priced at $310,000.

What happened to $1 million in home equity? It vanished down the China sinkhole.

From Australia to Zambia, Chile to Indonesia, the pain of China’s sharp economic slowdown is being felt in the form of depressed commodity prices, elevated unemployment and shrunken home prices in towns like Port Hedland that once thrived from supplying materials to Chinese factories.

China’s deceleration isn’t surprising. The extent of the collateral damage is. And it’s raising fears of a global recession.

Noting that the harm from China’s woes has been worse than expected, the International Monetary Fund has downgraded its outlook for worldwide growth this year to 3.1 percent, which would be the slowest since the recession year of 2009.

Citigroup has warned of a possible new worldwide recession caused by China’s slump. So has the Organization for Economic Cooperation and Development.

China has an outsize effect on the world because it accounted for 30 percent of global growth last year, up from just 13 percent a decade earlier, according to the World Bank. The impact is seen in Standard & Poor’s GSCI commodities index: The index, reflecting prices of 24 items, including crude oil, copper and cattle, shrank 19 percent from July through September

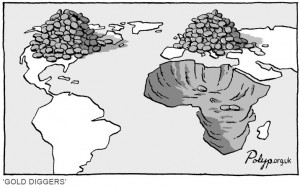

What is sure is that an impact is being felt in countries that export raw materials___

AUSTRALIA

China’s investment boom richly benefited Australia. Between 2007 and 2013, the percentage of exports to China jumped from 14 percent to 36 percent — the biggest such share among wealthy countries, according to the Peterson Institute for International Economics. Australian iron ore, coal and copper fed China’s factories.

The China connection shielded Australia from the Great Recession: Unlike the United States and the countries that use the euro currency, Australia’s economy kept growing through the recession years of 2008 and 2009.

But Australia was uniquely vulnerable to China’s slowdown and its move away from heavy investment. Australia produces a third of the world’s iron ore, and China’s slump has sent the price of iron ore from a peak of $185 per metric ton in 2011 to below $60. The research firm AlphaBeta notes that every 1 percent drop in China’s investment shaves 0.2 percentage point off Australia’s economy.

CHILE

China’s troubles have delivered a painful blow to Chile, the world’s top copper producer. Its economy grew just 1.9 percent last year, the weakest since 2009. As China’s demand dropped, the price of copper went into freefall — to a six-year low $2.25 a pound. The state-owned miner Codelco has reduced or delayed projects, including the expansion of its main Andina mine and a plan to turn the world’s largest open-pit mine into an underground operation.

Chileans are suffering. Mining jobs offered low-income families their best shot at middle-class lifestyles. Now, the mines are retrenching. In September, Arizona-based Freeport-McMoran laid off more than 640 workers at its El Abra copper mine in northern Chile.

INDONESIA

Arbona Hutabarat of Bank Indonesia, the country’s central bank, says every 1 percentage drop in China’s economy cuts 0.6 percentage point off Indonesia’s. The IMF thinks Indonesia’s economy this year will post its weakest growth since 2002: 4.7 percent.

Indonesia’s exports have sunk 13 percent through September from a year earlier. Exports to China are down 21 percent. The coal industry has been slammed. In the province of East Kalimantan, 125 coal-mining companies have suspended operations, putting 5,000 miners out of work, according to the industry journal Coal Age.

ZAMBIA

The African nation of Zambia is 6,300 miles from the factories of southern China, but its economy is absorbing a direct hit from the slowdown in China’s growth and demand for copper.

Zambia‘s currency, the kwacha, has dropped 53 percent against the dollar this year. A weak currency stokes inflation. So Zambia’s central bank has raised its benchmark interest rate to 15.5 percent — which will likely squeeze the economy just as it is weakening.

Glencore, an Anglo-Swiss commodities company and one of Zambia’s biggest employers, is cutting 4,000 jobs at the Mopani Copper Mine. The Konkola Copper Mine has laid off 150 and is expected to cut more.

The Chinese-owned company CNMC Limited has suspended operations at the Baluba mine in Luanshya, laying off 1,600. Spokesman Sydney Chileya blamed plummeting copper prices.