Part of the reason for the rise of extremism is economics; the failure in recent decades to generate real income gains for workers and the financial collapse of 2007-2008. Economists argue about the causes for these developments – skill-biased technological change, globalization or political capture (a wealthy elite funds politicians who then devise policies that help the elite). If the first two factors are to blame, then we really need to worry since there is little we can do about it (read The Rise of the Robots, the book that won the FT Business book prize if you want to get depressed). On the most pessimistic view, one can see such diverse trends as the rise of Le Pen in France, the debate over free speech in American universities and the challenge of Islamic fundamentalism as signs that liberal democracy is in remorseless decline. But history suggests it is more likely to commit suicide (by electing a party that does not believe in it) than to be murdered by outsiders. In the end, one has to hope that the broad mass of the public will turn away from the extremes when faced with the prospect of them getting into government. But someone, somewhere, may even now be finishing the first draft of “The Strange Death of Liberal Democracy”.

Category Archives: Finance

Is a National Basis Income Around the Corner?

Is national basis income the answer? FInland may become a laboratory test of the idea.

The Finnish government is currently drawing up plans to introduce a national basic income. A final proposal won’t be presented until November 2016, but if all goes to schedule, Finland will scrap all existing benefits and instead hand out 800 euros per month—to everyone.

It sounds far-fetched, but it’s looking likely that Finland will carry through with the idea. Whereas several Dutch cities will introduce basic income next year and Switzerland is holding a referendum on the subject, there is strongest political and public support for the idea in Finland.

A poll commissioned by the government agency planning the proposal, the Finnish Social Insurance Institution or KELA, showed that 69% support (link in Finnish) a basic income plan. Prime minister Juha Sipilä is in favor of the idea and he’s backed by most of the major political parties.

Lagarde to Dubai for Global Women’s Forum

Christine Lagarde will be featured among the keynote speakers at Global Women’s Forum Dubai 2016, taking place on 23rd-24th February at the Madinat Jumeirah in Dubai, under the patronage of Vice President and Prime Minister and Ruler of Dubai, His Highness Sheikh Mohammed Bin Rashid Al Maktoum and led by Sheikha Manal Bint Mohammed Bin Rashid Al Maktoum, President of the UAE Gender Balance Council, President of Dubai Women Establishment and wife of Sheikh Mansour Bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs.

Lagarde joined the French government in 2005 as the Minister of Foreign Trade, and became the first woman to hold the post of Finance and Economy Minister of a G-7 country in 2007.

In 2011, Lagarde became the first woman to assume the role of Managing Director of the International Monetary Fund, an organisation of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

Ranking sixth on the latest Forbes list of the ‘World’s 100 Most Powerful Women,’ Lagarde has championed efforts to increase the participation of women in the workforce as a means of reducing poverty and inequality. In a recent interview, she urged governments to implement policies to improve the education levels of girls and women, pointing to recent IMF data, which demonstrates how countries can increase GDP as a direct result of allowing young girls to access education.

Mona Ghanem Al Marri, Chairperson of the Board of Dubai Women Establishment, DWE, and Vice President of the UAE Gender Balance Council, said, “Christine Lagarde has always been a powerful advocate and voice for enhancing female engagement and participation in the workforce, highlighting the major role that women’s empowerment plays in boosting economic growth. Over the past few decades, the UAE has made great strides in strengthening the influence of Emirati women and achieving gender parity, paving the way for women to play their part in the progress and development of our nation. As we continue on our journey towards achieving gender balance and equality, there is much that we can learn from female leaders such as Christine, and we look forward to welcoming her to Dubai in 2016.”

Global Women’s Forum Dubai 2016, co-organised by the Women’s Forum for the Economy and Society and the Dubai Women Establishment, brings together leaders from around the world, women and men, representing business, government, academia as well as art and culture. The event will highlight new perspectives for today and tomorrow, creating a powerful, global network capable of boosting the influence of women throughout the world, conceiving innovative and concrete action plans to encourage women’s contribution to society, and promoting diversity in the business world.

Building on the theme of innovation, Global Women’s Forum Dubai will move beyond the usual expectations for and reservations about technology to address the sustainable role of women as well as the role tradition can play in innovation. The agenda streams for Global Women’s Forum Dubai fall under five pillars: Achieving, Creating, Giving, Energizing and Sustaining. Each pillar will serve to orient sessions to show how the development of innovative ideas and practices can benefit women, society or the economy. The Discovery, the renowned creativity space at Women’s Forum meetings, will be among the highlights of Global Women’s Forum Dubai 2016.

The Discovery will feature a wide variety of ‘hubs’ presenting complementary workshops and enlightening exhibits to expand upon the numerous concepts discussed during the main panel discussions. CEO Champions, a Women’s Forum initiative launched in 2010 to drive progress and accountability for women’s advancement in the private and public sectors, will also be part of Global Women’s Forum Dubai 2016, in addition to key Women’s Forum initiatives such as Rising Talents, Women in Media, and the Cartier Women’s Initiative Awards.

Raqqua’s Rockefellers Smuggling Oil for ISIS

Ben Taub writes:

One of Russia’s nine deputy defense ministers, said that recently collected images constitute “hard evidence” that there is “a single team acting in the region, composed of criminals and Turkish elites,” who are buying oil from ISIS “on an industrial scale.”

Russian President Vladimir Putin announced, “We have every reason to think that the decision to shoot down our plane was dictated by the desire to protect the oil-supply lines to Turkish territory,” specifically, those funding ISIS.

A defense minister went a step further. “This illegal business involves the country’s senior political leadership, including President Erdoğan and his family members,” he said. “Maybe I’m being too blunt, but one can only entrust control over this thieving business to one’s closest associates.” Erdogan’s son-in-law had recently been appointed minister of energy and natural resources. “Of course, the dirty oil money will work,” he added.

In fact, one of Russia’s satellite photographs showed a very familiar place. I first walked through the Bab al-Salama border crossing in April, 2013, and lived within sight of it for the next two summers. Then, too, trucks often lined the road leading down to the border gates, many of them parked for hours while drivers napped in an olive grove nearby, waiting for inspectors to finish checking the vehicles ahead of them. On the Turkish side, fourteen thousand Syrian refugees lived in a container camp nestled against the border. Beyond the Syrian gates, a comparable number of civilians lived at a transit camp under wretched conditions. A system of hoses transported clean drinking water from Turkey into huge tanks at the Syrian camp, but there was no way to dispose of waste, and it gathered in puddles next to the road and ruts in the mud. Both camps sprang up from nothing, out of necessity, as people from Aleppo and the villages to its north tried to escape the war. (Fleeing didn’t always help; in June, 2013, a Syrian jet strafed the transit camp, killing seven refugees.) Both camps are plainly visible in the Russian satellite pictures..

The practice of smuggling at the Turkish-Syrian border is decades older than the war. Aleppo once belonged to the Ottoman Empire; when it was cut off from Turkey, in 1924, after the Treaty of Lausanne established most of the modern border, locals continued transporting all manner of goods from the cheaper side to the more expensive side.

Syria’s most potent oilfields are in the Deir Ezzor province, largely under ISIS control. The group earns most of its money by taxing locals and confiscating valuables at checkpoints, but oil sales still account for hundreds of millions of dollars of revenue.

Last year, the journalist Mike Giglio found that much of the oil was coming through a smuggling post and originated in ISIS territory, many miles away. It was transported by middlemen to a nearby area in northwest Syria. In Besaslan, traders received the oil through a network of buried pipes, while spotters looked out for police. They filled drums and sold them to local Turkish businessmen, who, in turn, cut secret deals with gas stations or set up illegal filling stops.

The Turkish government maintains murky alliances with a number of Islamist rebel groups in Syria. In January, 2014, three trucks escorted by the intelligence services were found to be transporting huge quantities of ammunition to a camp frequented by rebels with connections to Al Qaeda, according to an arrest order for one of the drivers. The Turkish newspaper Cumhuriyet published a video of the trucks, and last week its editor-in-chief was arrested on charges of collecting and revealing secret documents. Erdoğan insisted the trucks were carrying “humanitarian aid” for Turkmen in Syria, and personally accused the Cumhuriyet editor of “attempting to overthrow the government” of Turkey.

Are Low Interest Rates a Price Ceiling?

The central banks’ manipulation of interest rates is a prominent tool, reported daily in the press. Now the world’s attention is on the actions of the US Fed, an anticipated announcement to raise rates a smidgeon on December 16th.

Bradford DeLong writes about the economic doctrines propounded since the beginning of the global financial crisis put forward by John Taylor, an economist at Stanford. Taylor claims the post-crisis economic policies being carried out in the United States, Europe, and Japan are putting a ceiling on long-term interest rates that is “much like the effect of a price ceiling in a rental market where landlords reduce the supply of rental housing.” The result of low interest rates, quantitative easing, and forward guidance, Taylor argues, is a “decline in credit availability [that] reduces aggregate demand, which tends to increase unemployment, a classic unintended consequence.”

Taylor’s analogy fails to make sense at the most fundamental level. The reason that rent control is disliked is that it forbids transactions that would benefit both the renter and the landlord. When a government agency imposes a rent ceiling, it prohibits landlords from charging more than a set amount. This distorts the market, leaving empty apartments that landlords would be willing to rent at higher prices and preventing renters from offering what they are truly willing to pay.

However, when a central bank reduces long-term interest rates via current and expected future open-market operations, it does not prevent potential lenders from offering to lend at higher interest rates; nor does it stop borrowers from taking up such an offer. These transactions don’t take place for a simple reason: borrowers choose freely not to enter into them.

So how does Taylor arrive at his analogy? My intuition is that his reasoning has become entangled with his beliefs about the free market. Taylor and others who share his view probably begin with a sense that current interest rates are too low. Given their belief that the free market cannot fail (it can only be failed), they naturally assume that some government action must be behind the unnaturally low rates. The goal then becomes to figure out what the government has done to make interest rates so wrong. And, because any argument that treats government action as appropriate can only be a red herring, the analogy to rent control emerges as one of the possible solutions.

Given real economic conditions, European and American monetary policy is not too loose; if anything, it is too restrictive. The “natural” interest – what would be ground out by the Walrasian system of general equilibrium equations – is actually lower than what current monetary policy is producing. Yes, the inertial expectations of the economy have combined with monetary policy to distort interest and inflation rates, but not in the direction that Taylor is proposing. On the contrary, compared to what is needed (given the current state of the economy) or to what a free-market, flexible-price economy in proper equilibrium would deliver, interest rates are too high and inflation is too low.

There is indeed something wrong with today’s interest rates. Why such low rates are appropriate for the economy and for how long they will continue to be appropriate are deep and unsettled questions; they call attention to the “dark corners” of economics, where research has so far shed too little light. What Taylor and his ilk fail to understand is that the reason interest rates are wrong has little to do with the policies put in place by central bankers and everything to do with the situation that policymakers confront.

Entrepreneur Alert: Diamonds are A Girl’s Best Friend?

Prices of diamonds have been lackluster for a while. In Botswana, the second largest diamond yet discovered, plucked from the earth’s depths by machines, will probably fetch a very good price. It may even be sold on its own at auction.

The only larger stone discovered to date was in 1905 in South Africa. It is part of the British crown jewels.

It is projected that Global diamond production is expected to peak in 2017, when 164 million carats of diamonds are forecast to be produced, according to McKinsey & Co. After that, production is expected to go into a long-term decline, unless significant new discoveries are made, McKinsey’s forecasts show. Is there room for an entrepreneurial move here?

PwC: The Greenest Office in London

Are environmentalists overlooking the impact of for-profit businesses on the greening of the world.

When PwC decided to refurbish its unloved central London office, it thought it would be doing well to achieve a BREEAM “excellent” rating. Then it realised it could do rather better than that …

Which office building has the highest BREEAM rating ever? Could it be the Co-op’s glamorous new headquarters in Manchester? Or that beacon of sustainability in London’s Docklands, the Siemens

Crystal? Or could it be Embankment Place, a nineties air rights scheme over London Charing Cross station that is so leaky it couldn’t be sufficiently pressurised to get a test reading?

Incredibly, the last building on this list has pipped the others with a chart-topping post-completion BREEAM score of 96.31%. This isn’t the first time occupier PwC has been at the top of the BREEAM charts. The professional services firm achieved the first BREEAM “outstanding” rating with its More London office near London Bridge in 2011. But making a brand new building super-efficient is relatively easy compared with a refurbishment, particularly this one, as Embankment Place is a post-modern warren of oddly shaped rooms and isolated eyries and is in one of the most congested parts of London, making the refurbishment particularly challenging.

According to PwC’s real estate director Paul Harrington, staff had mixed feelings about the office. “It’s a fantastic location but everyone hated the building,” he explains, adding that the entrance was particularly depressing. “It was heavy, monolithic and dark with a fountain that stank of chlorine.” Two atriums in the building were ringed by cellular offices, leaving the main floorplates devoid of any natural light. Vertical circulation was difficult and hidden away stairwells meant the only practical way to travel between floors was in the overused lifts.

The lease was due to expire in 2015 so PwC was faced with the choice of moving or refurbishing the building to make it more acceptable to staff. It plumped for the latter which included making the building much more energy and water efficient. Harrington says sustainability was a priority for PwC but an accountancy firm inevitably wants a return on its investment. “There is no point throwing money at something unless there is a good return,” he says, adding that measures to improve building performance must have a payback of less than four years.

The building entrance is below Charing Cross station, with the main building over the station

Initially a BREEAM “excellent” rating was targeted. “We had a clear aspiration at More London to get a BREEAM ‘outstanding’,” says Harrington. “Here we thought ‘excellent’ was the best we could get but as we developed our thinking we thought we could take this further.”

The BREEAM analysis has been done by services engineer ChapmanBDSP. “We looked at what the key credits were to get a BREEAM ‘outstanding’ and saw we didn’t have to go much further to achieve this,” says Darren Coppins, ChapmanBDSP’s head of sustainability. He adds PwC wanted an EPC A rating even though a BREEAM “outstanding” can be achieved with an EPC rating of B. This meant the primary focus was on energy. Coppins says a range of options was explored including covering the whole roof of the building with PV panels and wind turbines and using a fuel cell to provide heat and power. The Greenest Office in London- PwC

EU Slapping Tax Evasion Specialists Like Luxembourg

The Rocky Road to Globalization: Tax codes vary widely from country to country. International businesses are faced with a conundrum: In order to compete they must level their tax burden across the globe. This has led to the location of all American companies like Caterpillar and Starbucks in Switzerland. Luxembourg has been an attractive host to international companies. McDonalds and Fiat are now getting the heat.

Luxembourg is appealing a European Union decision that it made illegal fiscal deals with a Fiat Chrysler Automobiles NV unit, vowing to show that the bloc’s antitrust regulator failed to establish any illegal state aid.

It’s the first challenge to reach the EU courts since the European Commission’s precedent-setting decisions in October that the Italian carmaker and Starbucks Corp. benefited from favorable tax deals by Luxembourg and the Netherlands. Each company was ordered to pay as much as 30 million euros ($32.8 million) in back taxes.

The European Commission “used unprecedented criteria” for its decision that a tax ruling for Fiat in Luxembourg violated state aid rules and put “into jeopardy the principle of legal certainty,” the nation’s finance ministry said in an e-mailed statement Friday. “The commission has not established in any way that Fiat received selective advantages.”

The Grand-Duchy’s decision to appeal comes a day after the Brussels-based watchdog opened a probe into whether McDonald’s Corp. unfairly exploited a fiscal deal with Luxembourg to avoid tax on hundreds of millions of euros in profits for more than half a decade. The McDonald’s case is the third to focus on Luxembourg, adding to the Fiat case and an ongoing probe into tax rulings obtained by Amazon.com Inc.

Luxembourg and the fiscal deals that international companies have received over the years there came out into the open last year, when hundreds of documents were leaked showing that more than 340 companies such as PepsiCo Inc., Ikea Group and FedEx Corp. transferred profits to the country through tax arrangements.

“The vast majority of EU member states use tax rulings to provide legal certainty for the taxpayer,” the finance ministry said, adding it “is strongly committed to tax transparency and the fight against harmful tax avoidance.”

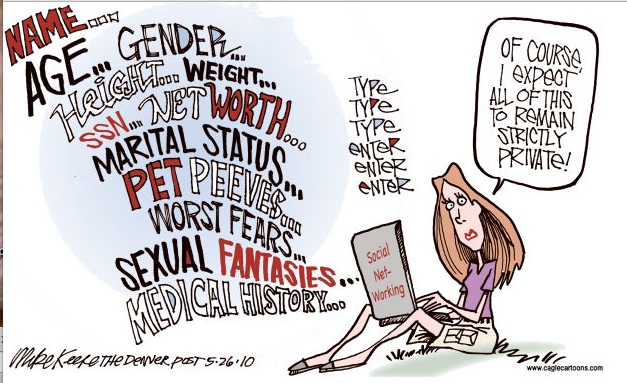

Entreprenuer Alert: Privacy in the Social Media

Europeans are concerned about privacy and particularly young people in the US tend not to be. Providing security on the internet is a good and growing global business.

Facebook will stop tracking browsers of Facebook pages in Belgium who are not signed into a Facebook account, seeking to comply with a court ruling last month ordering it to do so or face daily fines.

The company’s action means Belgians will have to log into Facebook before they can see Facebook pages, forcing them to create and sign into an account if they want to view the pages or related content.

Previously non-users could view public Facebook pages from sports teams, celebrities, tourist attractions and businesses without needing to log into Facebook. As a result of the changes registered Facebook users in Belgium who attempt to log in from an unrecognised web browser will be forced to comply with some added security steps, the company said.

At issue is Facebook’s use of a so-called “datr” cookie, which it places on users’ browsers when they visit Facebook or click a Facebook “Like” button on other sites, allowing it to track the activities of that browser.

Facebook says the tiny bit of software code only identifies browsers, not individuals, and helps Facebook to distinguish legitimate visits from those by attackers.

“(Removing the cookie) will cause a marginal privacy hit. That will decrease the privacy of Belgian users,” Facebook chief security officer Alex Stamos said last month.

Facebook is appealing the ruling.

Belgium’s data protection regulator took the US company to court in June, accusing it of trampling on EU privacy law by tracking people without a Facebook account without their consent.

Facebook plans to appeal against the court ruling but, in complying with the order, expects it will no longer face a €250,000 (£177,000) daily fine.

The company has argued that Belgium has no authority on this issue, since it has its European headquarters in Ireland and as such should be policed solely by regulators there.

Belgium’s privacy regulator said the fact that the Brussels court had ruled meant it had jurisdiction over the company. The changes will be implemented as soon as the regulator serves Facebook with the order, expected sometime this week.

Draghi Hints and Backs Off More QE

The Rocky Road to Globalization: Draghi, the head of the European Central Bank didn’t do exactly what the world thought he would. The euro rose against the dollar, and currencies around the world also adjusted. When George Soros made his money betting on currency fluctuations, he was one of the few people who followed these ins and outs. Now everyone knows and reacts.

The European Central Bank unveiled a package of measures to tackle too-low inflation, from a cut in the floor for interest rates to an expansion of its bond-buying program by at least 360 billion euros ($390 billion). Investors were unimpressed.

The Frankfurt-based ECB will extend quantitative easing by six months until at least March 2017 at the current rate of 60 billion euros a month, and broaden the assets purchased to include local and regional debt, ECB President Mario Draghi said on Thursday. The Governing Council earlier reduced its deposit rate by 10 basis points to minus 0.3 percent.

The fresh stimulus coincides with a shift in global monetary policy, with the ECB adding stimulus as the U.S. Federal Reserve prepares to start its process of normalization. Even so, financial markets reacted with skepticism, sending the euro up as much as 2.6 percent and equities and government bonds down in a sign that Draghi’s measures fell short of expectations.

“The expectations were too high, and this was the minimum he could do,” said Marco Valli, chief euro-area economist at UniCredit SpA in Milan. “I think this was a mix of Draghi being held back by the conservatives, but also him wanting to keep some powder dry in case more is needed.”