Simon Kennedy and Matthew Simon write: As the chattering chieftains of the global economy gather this week in Davos, Switzerland, they’re facing the darkest outlook since the financial crisis tipped the world into recession seven years ago.

The Chinese slowdown and accompanying slide in the yuan are imperiling already sluggish international growth, oil is trading at its lowest level in more than a decade, stocks have suffered their worst January ever, and the prospects for corporate earnings are the most pessimistic in years.

Economic frustrations have driven the rise of populists in the U.S. and France while sowing doubts about the longevity of German Chancellor Angela Merkel and Britain’s membership in the European Union.

China has confirmed its weakest quarter since 2009 and its slowest annual growth since 1990. The International Monetary Fund, meanwhile, cut its estimate for expansion in the world economy this year to 3.4 percent from 3.6 percent.

Meantime, the International Labor Organization predicted that global unemployment will climb this year by almost 2.3 million to 199.4 million, led by emerging markets. PriceWaterhouseCoopers LLC said only about a third of chief executive officers it polled were “very confident” about their companies’ growth prospects.

Also causing some concern is the Federal Reserve’s decision to raise interest rates last month for the first time in nine years even with tame inflation. That’s pushed up the dollar, hurting those emerging markets that boosted borrowing in greenbacks when rates were at rock-bottom.

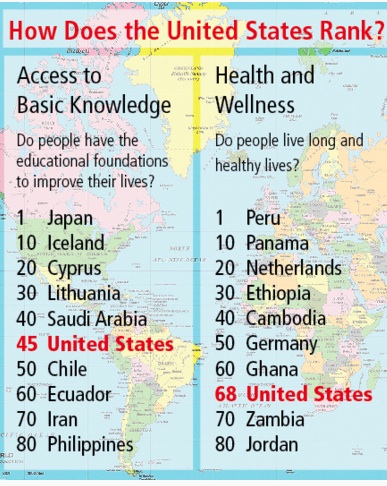

In developed countries, there is a sense of frustration as once-robust middle classes fall ever further behind the have-lots. The charity Oxfam said on Monday that the richest 1 percent of people on Earth now control more wealth than the rest of the world’s population combined.

Political activity in the US, the world’s largest economy, which large companies and investors have relied on to drive growth as Europe stagnates and emerging markets underperform is unnerving.