The Asia/Pacific Group on Money Laundering is an intergovernmental organisation, consisting of 41 member jurisdictions, focused on ensuring that its members effectively implement the international standards against money laundering, terrorist financing and proliferation financing related to weapons of mass destruction.

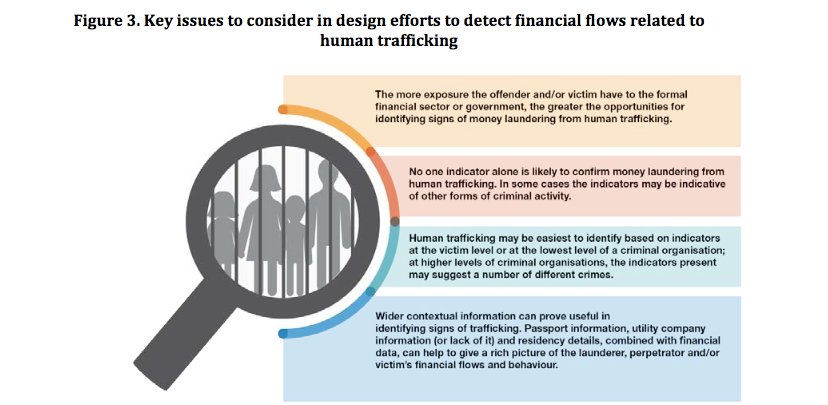

In addition to its enormous human cost, human trafficking is estimated to be one of the most profitable proceeds generating crime in the world, with the International Labour Organisation estimating that forced labour generates USD 150.2 billion per year. While in the past, many aspects of the crime went ‘unseen’, there is now an increased understanding of the breadth and gravity of human trafficking, particularly with respect to domestic human trafficking and human trafficking for labour exploitation. Human trafficking is also one of the fastest growing forms of international crime. The increased displacement and vulnerability of people in, and around, conflict zones increases instances of human trafficking, including potential involvement by opportunistic terrorist organisations…. Human-Trafficking-2018

The Panama Papers

The Panama Papers