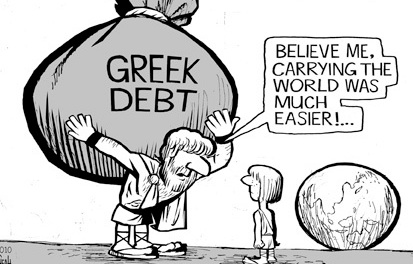

Leonid Bershidsky writes: Ukraine now has a four-year bailout deal with the International Monetary Fund. It’s still too early to celebrate. Like the cease-fire, the aid package isn’t very generous to Ukraine. But if it helps convince Kiev it needs economic reforms, that won’t be a bad thing.

In January, financier and philanthropist George Soros suggested putting together a $50 billion rescue deal for Kiev. IMF Managing Director Christine Lagarde talks about $40 billion, but that’s pretty meaningless.

About $17.5 billion of that is supposed to come from the IMF. But even if all that money were disbursed immediately, it would only just bring Ukraine’s $6/4 billion foreign reserves to the levels they had in January 2013. That month, the reserves amounted to $24.5 billion.. The package’s small size could spur the country to more efficiency.

Lagarde said Ukraine had shown commitment to reform, but the proof she cited was meager.

The program will require the authorities’ steadfast determination to reform the economy,” If the cease-fire holds, however, the government will no longer be able to use the war in the east as an excuse.

Yatsenyuk says his government isn’t looking for excuses. So far, Ukrainian government bonds — the three-year one trades at a 37.89 percent yield — and the hryvnia’s exchange rate have shown no positive reaction to the deal, however. The markets don’t trust the current Ukrainian government to do a better job than its predecessors.

Ukraine’s best hope is that civil society, empowered by last year’s anti-corruption revolution again former president Viktor Yanukovych, will push the political leadership and bureaucracy toward positive change. As Valeri Pekar, head of Ukraine’s main business lobby, the Union of Industrialists and Entrepreneurs, writes: “The political system is too slow in catching up to the growing demands of society. Our job is to help align it with the forces of reform.”

Experience tells me the fresh start, offered by the cease-fire and the IMF deal, will be one more in a long series of Ukraine’s missed opportunities. Yet I want to believe the country will finally seize this chance. If Ukraine shows that a large post-Soviet country can turn itself into an economically viable democracy, it will be a positive example for its neighbors, rather than a laughingstock or easy prey. That’s the only way for it to win a lasting victory over President Vladmir Putin’s Russia.