Patrick Chovanec writes: Contrary to popular mythology there’s absolutely no reason why being “competitive” should mean running a trade surplus. As far back as 1817, the economist David Ricardo pointed out that the optimal basis for trade is comparative, not absolute, advantage. In other words, even if a country is better at everything, it should export what it is best at and import what it is less better at. Having an across-the-board advantage does not imply that it makes good economic sense to produce everything yourself, much less to sell more than you want in return.

Trade surpluses take place when a country chooses to spend less than it produces — when it has excess savings, beyond its domestic need for credit. It lends that excess savings abroad, financing another country’s ability to spend more than it produces and, by running a trade deficit, purchase the lender’s excess production. It’s true that a highly productive country might have the wherewithal to conjure up excess savings, while a less productive country might be inclined to borrow rather than scape up the savings it needs. But fundamentally, trade imbalances arise not from competitive advantage but from choices about how much to save and where that savings should be deployed — at home or abroad.

The eurozone crisis is often called a debt crisis. But, in fact, Europe as a whole did not have an external debt problem, but an internal one.

German surpluses and mounting debt in Europe’s periphery were two sides of the same coin. Germans saved (a lot), and the single currency induced them — rather than save less or invest it at home — to lend it to their eurozone trading partners, which used the money to buy German goods.

Normally, each country would pursue its own monetary policy, relying on exchange rate adjustments to shift the locus of demand from those that could not afford it to those that could. Under a single currency, though, this could not happen. Instead, Europe’s debtors were forced to slash demand, through a combination of fiscal austerity and debt deleveraging. Their trade deficits with Germany fell dramatically — but by buying less, not selling more. All of the so-called PIIGS (Portugal, Ireland, Italy, Greece, and Spain) saw their total trade with Germany shrink. To the extent Europe rebalanced, it did so at the cost of growth.

The eurozone was caught in a trap. Its countries needed to move in two separate directions, but under a single currency, they could only move in lock step. A Europe that lived within its means meant a Germany that continued to save more than it spent, rather than driving much-needed demand. Monetary easing — and a weaker euro — merely redirects Europe’s internal imbalances outward. Germany’s trade surplus with the United States exploded (up 49 percent from 2007 to 2013), and deficits with China and Japan collapsed (by negative 71 percent and negative 78 percent respectively). Meanwhile, Germany’s trade balance with Brazil and South Korea flipped from deficit to surplus.

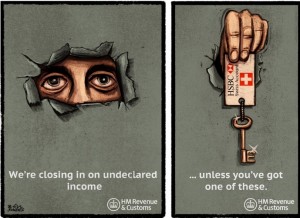

Since 2012, virtually all of the eurozone’s net GDP growth, on an annual basis, has come from net exports — further testament to the weakness of domestic European demand as a driver of growth. It’s doubtful, however, whether relying on Americans to pile on more debt — and risk going the way of Greece — is really a reliable strategy. In principle, narrowing Europe’s trade deficit with China makes more sense. But in practice, this has consisted less in tapping China’s mass consumer market than in selling machinery and luxury goods into China’s credit-fueled investment boom, which itself is predicated on maintaining an outsized trade surplus with the United States. The issue isn’t — as it’s so often framed — what’s fair, but what’s sustainable. And Americans playing the world’s consumer of last resort, by borrowing to live beyond their means, isn’t sustainable.

So what should be done? The best solution — and the least likely to be adopted — is for Germany to leave the euro and let a reintroduced Deutsche mark appreciate. Here, the experience of the 1985 Plaza Accord offers some encouragement. While a stronger yen made barely a dent in Japan’s structural trade surplus, German behavior proved far more responsive to the incentives embodied in a stronger mark.

In the past year, German politicians have proved far more willing to try boosting demand by raising the minimum wage, cutting the retirement age, and increasing pensions — moves that may work, but risk harming productivity, which is ultimately the source of Germany’s capacity to consume. Perversely, those same politicians refuse to cut taxes or boost public spending, which in 2014 resulted in Germany posting its first balanced federal budget since 1969, a year earlier than planned. To most Germans, any suggestion that they should relax this fiscal discipline smacks of Greek-style profligacy, but there’s another way to think about it. The excess savings are already there; the only question is where to lend it all. Borrowing it domestically to drive a genuine European recovery might be preferable to (once again) throwing it at foreigners to buy things they really can’t afford.

With an aging population, perhaps it’s understandable why Germans want to save. But there is no inherent reason to direct that savings abroad when there is a far more crying need to deploy it at home. The “growth” Germany generates by funding unsustainable trade imbalances — inside and outside the eurozone — is an illusion. It is growth that is borrowed, for only a while. For Germany, and for the world, it’s a bad trade.