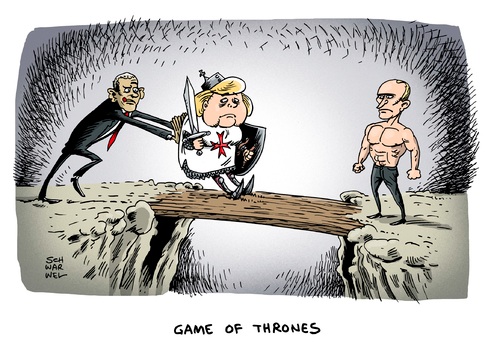

FIona Hill writes: In Ukraine, and in his whistle-stop trip to Hungary, Putin is out to score points for Russia. He is not out to win friends in Ukraine or Europe. Nor is he out to restore a Russian empire, or build a new Moscow-centric geopolitical order. Putin wants respect for Russia, not external obligations. He wants respect in the old-fashioned, hard-power sense of the word.

Putin is a practitioner of realpolitik in its starkest form. In his interactions with regional leaders, Putin has laid out his view that all the states that emerged from the USSR are appendages of Russia. They should pay fealty to Moscow. Other European countries, including the former great powers of France, Germany and the UK, are satellites of the United States, grouped under the umbrella of NATO and the European Union. The unaligned operate in the shadows of two blocs, as Putin put it once to Georgian leaders. The only open question for Putin is who gets to decide the final borders of his new Yalta, Russia or the United States. The future of Ukraine and the Donbas are one set of decision points. Elsewhere, Russia has announced it will lift border controls between Russia and Georgia’s separatist regions of Abkhazia and South Ossetia; and Putin is questioning other borders in the Soviet Union’s old stomping grounds in the Baltics and Eastern Europe. He is challenging the European Union’s frontiers by appealing to eastern Orthodox countries like Greece and Cyprus, where politicians and populations feel aggrieved at their treatment by the austere Protestant powers of northern Europe who set the tone for European economic reform.

Redrawing borders in Crimea was Putin’s first major victory. Putin has long expressed his personal sense of humiliation when Russia lost its geopolitical position in Europe with the fall of the Berlin Wall. Twenty-five years later, Putin told the world Russia was no longer in retreat.

Right now the West looks weak to Putin. In his view, the tables have been turned. The eurozone crisis has undermined the European Union politically and economically. The United States is overextended after more than a decade of wars in Afghanistan and Iraq and seems incapable of dealing with crises in the Middle East. China is the dominant player in East Asia. Putin is taking full advantage of the situation, snubbing his nose at sanctions and running rings around European diplomats who are anxious to end the war in Ukraine. He has rallied the population at home with emotional evocations of Russian imperial glories, Soviet nostalgia and the idea of a unique “Russian world.” He has depicted himself as the leader of an international coalition of conservative politicians and states confronting the excesses of a decadent West. Russian history, imperial nostalgia, religion and values have all proven potent instruments for Putin to reassert Russia’s position.

With no endgame in sight in Ukraine, Putin is now focusing on the European arena.