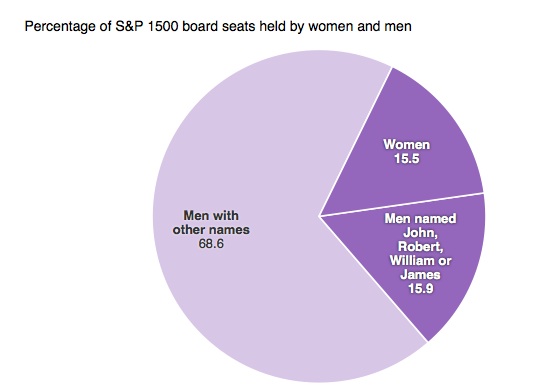

Justin Fox writes: The Federal Reserve System is a strange, ungainly beast. Its strangest and ungainliest appendages are the regional Federal Reserve Banks, 12 technically private institutions scattered unevenly across the nation. The Federal Reserve Bank presidents are chosen by boards of local citizens — although not, since the Dodd-Frank Act, by local bankers, and are paid on a scale that only state-university football and basketball coaches as government officials).

Yet these well-remunerated private citizens get to help set the nation’s monetary policy. The New York Fed president has a permanent say in the deliberations of the rate-setting Federal Open Market Committee; the other 11 presidents rotate through four voting spots — and they can come to the meetings even when they don’t vote.

Is this weird? Probably. But it is not a bad system that has reduced the effectiveness of the Fed and public trust in it.

In a Brookings Institute report which is great on the Fed history even if you disagree with the conclusions, Conti-Brown argues that the Fed would be more effective and more trusted if some or all of the Federal Reserve Bank presidents were appointed by the president and approved by Congress — or, better yet, if the Federal Reserve Board appointed them.

Former Philadelphia Fed President Charles Plosser argued that this was a solution in search of a problem. None of the Fed’s big historical failures — the Great Depression, the Great Inflation of the 1970s, and the 2007-2008 financial crisis — could really be attributed to the appointment process at regional reserve banks.

The Federal Reserve Bank presidents were a big cause of the Fed’s dawdling in the early 1930s; in 1935 Congress shifted the balance of power away from them to the Federal Reserve Board in Washington. But his bigger point that it isn’t clear what Conti-Brown’s proposal would fix seems right. In fact, I could think of a couple of things it would mess up.

The first is the Fed’s status as one of the last islands of technocratic, largely nonpartisan policy making in Washington. Technocracy and nonpartisanship aren’t always positives; they can be used to disguise interests and power relationships. Also, the technocrats can be terribly wrong, as they were in the lead-up to the financial crisis (not that the politicians were any righter). But at a time when Congress is riven by the deepest partisan divide in more than a century and even the deliberations of such supposedly technocratic agencies as the Securities and Exchange Commission and the Federal Communications Commission have become increasingly hijacked by party-line disputes, the tone of discourse within the Federal Reserve System stands out as a refreshingly civil and thoughtful exception.

The second thing is that having the Federal Reserve Bank presidents on the FOMC increases the diversity of opinion and economic methodology on the committee.

The unique appointment process for Federal Reserve Bank presidents brings people into policy making who might not be willing to take conventional government jobs. It then gives them the freedom to entertain new ideas and diverge from the consensus in a way that would be much harder for Federal Reserve Board employees to do. And it does this within a structure that still leaves the political appointees in Washington with a clear power advantage that makes early-1930s-style deadlock unlikely. That seems more like a desirable feature than a bug.