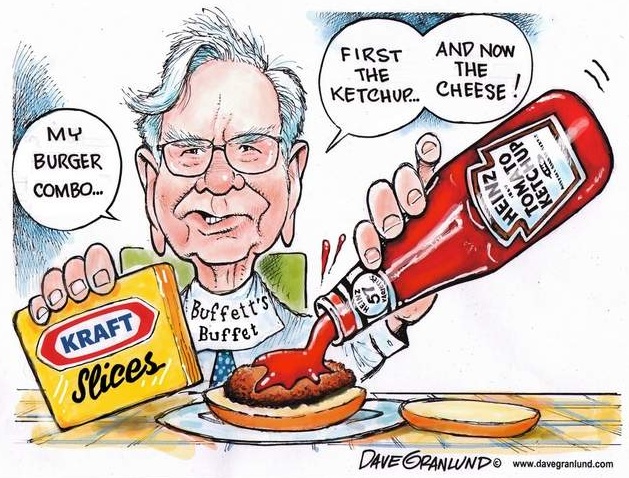

Matt Levine writes: To recap that math: Berkshire Hathaway and 3G Capital together invested $8.5 billion in the common stock of Heinz two years ago. (Berkshire also invested $8 billion in its preferred stock.) Yesterday, they announced that they were investing a total of an additional $10 billion in Heinz’s stock, in order to fund a cash payment to Kraft shareholders as part of Heinz’s merger with Kraft. I did some loose calculations and concluded that the market valued the combined company at about $83 billion, giving Heinz an equity value of about $42 billion. This math was fairly uncontroversial. I then said: Well, okay, Berkshire and 3G invested $10 billion in cash yesterday, so that’s worth $10 billion. That means that their shares in Heinz — the ones they bought for $8.5 billion two years ago — are worth $32 billion, roughly quadrupling their money.

I got some resistance to that math. The theory behind the resistance was, more or less: No, the $10 billion in cash isn’t worth $10 billion, it’s worth more. The value accruing to Heinz isn’t just the value of the standalone company — it’s not like Heinz has, by itself, quadrupled in value in two years. Instead, what makes Heinz’s share of the combined company worth $42 billion is the combination: Heinz has jumped in value in large part because of the Kraft deal, and to get the Kraft deal Berkshire and 3G had to kick in another $10 billion. So the real math is that they’ve put in $18.5 billion for a thing worth $42 billion — still a quite respectable 130 percent return on investment.

This is a pleasant philosophical debate — neither version is exactly “right” or “wrong” — but it also has practical implications for some people. For instance, if you are a manager of Heinz paid in stock options, you want that full $32 billion valuation attributed to your work, and none of it to the new money coming in: You want that new money to buy in at, effectively, a $42 billion post-money Heinz valuation. And that’s a subject for negotiation in the merger agreement. The new money buys some number of shares. The more shares it buys, the better deal the new money is getting, and the lower the returns on the old money. (Since both new and old money come mostly from Berkshire and 3G, this may not matter too much.

Roughly speaking, Berkshire and 3G are valuing their initial Heinz equity stakes — which they bought for $4.25 billion each two years ago — at about $12.8 billion each, more than tripling that money (on paper). They’re attributing $14.6-$17.9 billion of value to their new $10 billion equity investment — a 46 to 79 percent return in, um, no time at all. (Put another way, that new $10 billion came in at a valuation for standalone Heinz of about $26 to $29 billion.) But fair enough: That money is what allowed them to do this deal, and Heinz is worth more to Buffett and 3G with Kraft than without it.