Peter Tenebrarum writes: The privatization of the port of Piraeus, which Syriza had previously reportedly opposed is about to go forward after all, and is expected to bring in proceeds of around € 500 m. Pressure on the Greek government has recently increased, not only due to the fact that it is expected to run out of money soon, but also as a result of a downgrade of its credit rating by Fitch late last week to a lowly CCC rating. .

In a recent editorial in the FT, entitled “Greece versus the Baltics is not an argument for a heartless state”, John Dizard compares the successes achieved by the Baltic nations to the ongoing malaise in Greece. The Baltic countries lacked faith in state-directed investment or in policies to maintain demand through accommodative monetary policy and fiscal stimulus. So they collectively decided they would have to pay themselves less, but in real money — what was called “internal devaluation”, or “austerity”. Latvia had the sharpest fall in output, losing 24 per cent in two years, while sustaining a fiscal adjustment of 14.7 per cent. Over the same period, Greece’s fiscal adjustment was 6.6 per cent of GDP, even though its budget deficit and debt levels were far higher.

There were virtually no dismissals from the Greek civil service over this period. Salaries were cut, but public sector staffing was reduced with lay-offs of temporary contract workers and early retirements. This had the effect of reducing already low service levels and transferring costs from payrolls to pension obligations. Latvia fired one-third of its civil servants.

Even though EU money was made available to the Greek government for reducing the public’s compliance burden through the application of IT, resistance by public sector unions and the bureaucracy have left the public shuffling through even longer lines than before. The tax burden on salaried workers, compliant domestic businesses and property owners was substantially increased. In contrast, the Baltic states have fairly flat and relatively low tax rates, and are moving most of their compliance procedures online.”

David Stockman has written: “Today’s raging crisis in Greece was hidden from view for many years in the run-up to its first EU bailout in 2010 because the denominator of its reported leverage ratio—national income or GDP—–was artificially inflated by the debt fueled boom underway in its economy.

Looking at the trend in the share of government spending to GDP in Greece, it becomes immediately clear that “austerity” essentially means “austerity for the private sector, while the State remains largely untouched”, correctly describes the prevailing state of affairs (consider that Greece has recently reported a mild recovery in GDP as well):

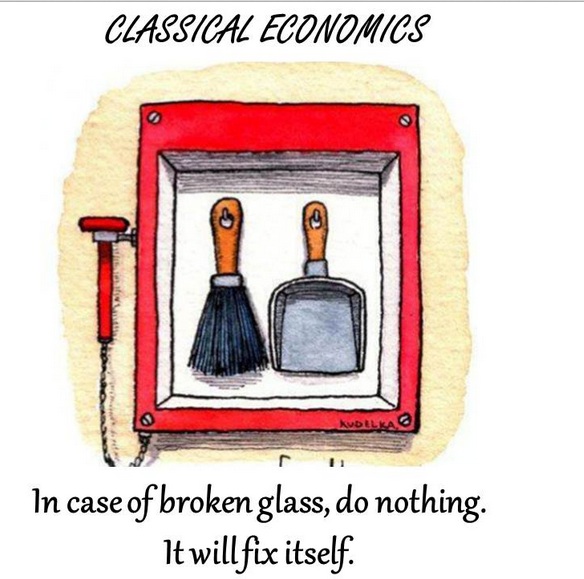

Latvia’s approach to the downturn was essentially the exact opposite of the standard Keynesian prescription. Since this path is only rarely chosen (one such rare instance was e.g. the 1921 recession in the US under president Harding), historical evidence is sparse, especially evidence of recent vintage. However, what evidence there is seems to confirm that the approach results in a thorough and swift clearing out of malinvestments in the economy and allows sound economic growth to resume fairly quickly. In a nutshell, it amounts to enduring severe short term pain in exchange for lasting long term gain.

One must keep in mind that every cent government spends is a cent the private sector can no longer spend or invest, since the private sector is the sole source of government funding. Whether government expenditures are financed by increasing taxation or by borrowing is secondary, as the funds must be obtained from the private sector in any case.

This should actually be blindingly obvious, but common sense has been missing in action from the public debate on this topic for quite some time.

It seems though that the idea of actually reducing the size of the State is still considered anathema in most of Europe, as tax hikes were generally favored over cutting spending in countries implementing austerity polices.

The EU and the Greek government may well come to an agreement this week that allows for the “extend and pretend” scheme to be resumed.

EU Commission president JC Juncker recently bemoaned the potential “loss of prestige” the EU would suffer if Greece were to be grexited. This remark didn’t received much attention in the press, but it basically represents word from the centralizers as to what they expect to be done. It should become clear in the course of this week whether an agreement that allows both sides to save face will indeed be struck.