Nouriel Roubini writes: The latest economic data from the eurozone suggest that recovery may be at hand. What is driving the upturn? What obstacles does it face? And what can be done to sustain it?

The immediate causes of recovery are not difficult to discern. Last year, the eurozone was on the verge of a double-dip recession. When it recently fell into technical deflation, the European Central Bank finally pulled the trigger on aggressive easing and launched a combination of quantitative easing (including sovereign-bond purchases) and negative policy rates.

The financial impact was immediate: in anticipation of monetary easing, and after it began, the euro fell sharply, bond yields in the eurozone’s core and periphery fell to very low levels, and stock markets started to rally robustly. This, together with the sharp fall in oil prices, boosted economic growth.

Other factors are helping, too. The ECB’s easing of credit is effectively subsidizing bank lending.

Eurozone growth has resumed, and eurozone equities have recently outperformed US equities. The weakening of the euro and the ECB’s aggressive measures may even stop the deflationary pressure later this year.

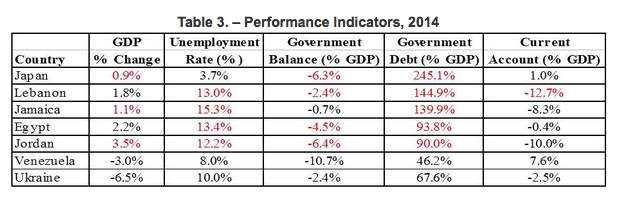

But a more robust and sustained recovery still faces many challenges. Podemos, a leftist party in the Syriza mold, could come to power in Spain. Populist anti-euro parties of the right and the left are challenging Italian Prime Minister Matteo Renzi. And Marine Le Pen of the far-right National Front is polling well ahead of the 2017 French presidential election.

Slow job creation and income growth may continue to fuel the populist backlash against austerity and reform.

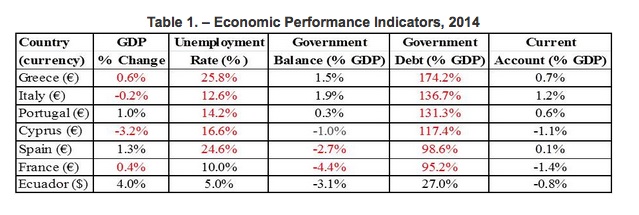

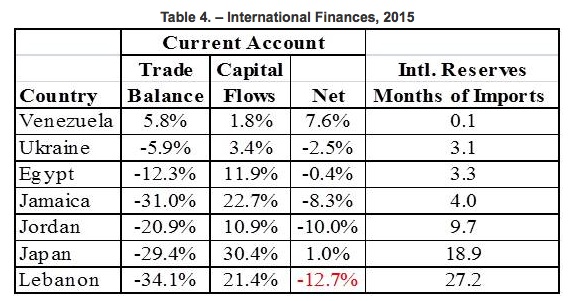

A second obstacle to sustained recovery is the eurozone’s bad neighborhood. Russia is becoming more assertive and aggressive in Ukraine, the Baltics, and even the Balkans. The Middle East is burning just next door.

While ECB policies keep borrowing costs lower, private and public debt in the periphery countries, as a share of GDP, is high and still rising, because the denominator of the debt ratio – nominal GDP – is barely increasing.

Fscal policy remains contractionary, because Germany continues to reject a growing chorus of advice that it should undertake a short-term stimulus.

Structural reforms are still occurring at a snail’s pace, holding back potential growth. Europe’s monetary union remains incomplete. Its long-term viability requires the development over time of a full banking union, fiscal union, economic union, and eventually political union. But the process of further European integration has stalled.

If the eurozone unemployment rate is still too high by the end of 2016, annual inflation remains well below the ECB’s 2% target, and fiscal policies and structural reforms exert a short-term drag on economic growth, the only game in town may be continued quantitative easing.

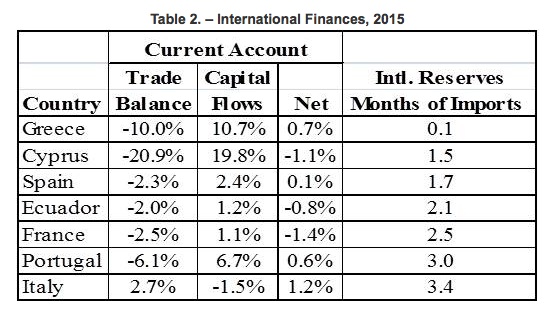

As the euro weakens, the periphery countries’ external accounts have swung from deficit to balance and, increasingly, to surplus. Germany and the eurozone core were already running large surpluses.

To avoid this outcome, Germany needs to adopt policies – fiscal stimulus, higher spending on infrastructure and public investment, and more rapid wage growth – that would boost domestic spending and reduce the country’s external surplus. Unless, and until, Germany moves in this direction, no one should bet the farm on a more robust and sustained eurozone recovery.