Nikos Chrysoloras and Eleni Chrepa write: Running out of options to keep his country afloat, Greek Prime Minister Alexis Tsipras ordered local governments to move their funds to the central bank.

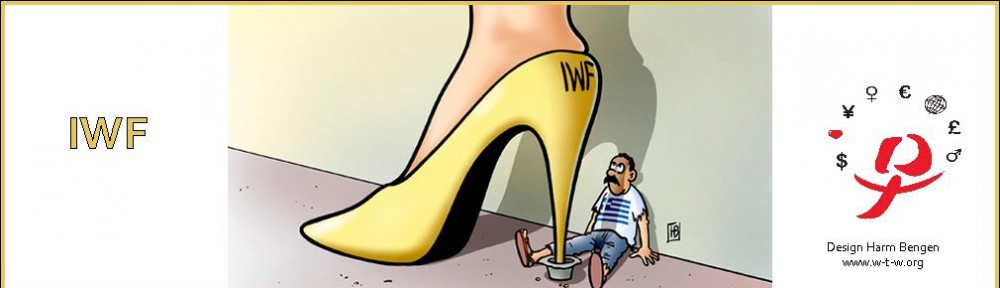

With negotiations over bailout aid deadlocked, Tsipras needs the cash for salaries, pensions and a repayment to the International Monetary Fund. Greek bonds fell after the move, pushing three-year yields to the highest since the nation’s debt restructuring in 2012. The order was questioned by local officials and slammed by the leading opposition party.

The decree to confiscate reserves now held in commercial banks and transfer them to the central bank could raise about 2 billion euros ($2.15 billion), according to two people familiar with the decision. The move, reminiscent of step that cash-strapped Argentina has taken over the past decade, shows how time is running out for Tsipras, a point made by European officials who addressed the matter at IMF meetings in Washington in recent days.

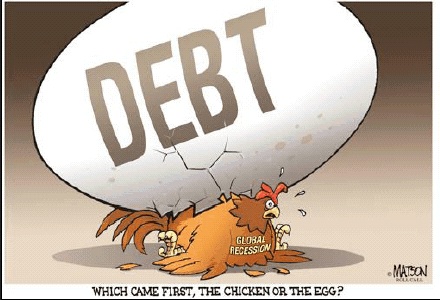

A default on the country’s 313 billion euros of obligations and a euro exit would be traumatic for the currency area and plunge Greece into a major crisis.

The new funds may be just enough for salaries and a 770 million-euro payment to the IMF due on May 12, the people said.

The move is a sign of the “dire liquidity situation for the Greek financial system as the government pools all liquidity available,” said Gianluca Ziglio, executive director of fixed-income research at Sunrise Brokers LLP in London. The “next step may be forcing all public-sector entities, including public-sector companies to do the same,” he said.

Greece and its creditors remained at loggerheads with time running out. The sides haven’t even set 2015 budget targets, let alone policies to meet them, an official representing creditors said Monday, asking not to be named as talks aren’t public.

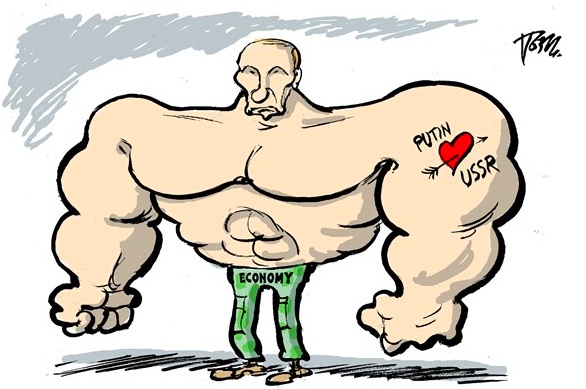

European leaders want Greece to do more to revamp its debt-burdened economy, with progress to be reviewed on April 24 in Riga, Latvia, when finance ministers from the currency bloc meet. European Commission Vice President Valdis Dombrovskis said in an interview in Washington that creditors might need to wait until mid-May to see what

“The situation with Greece needs to be resolved soon,” Cypriot Finance Minister Harris Georgiades said.

Greek officials, including Deputy Prime Minister Yannis Dragasakis, remained defiant saying the government won’t betray its electoral promises and worsen the pain that came from previous austerity measures.

While “so-called” partners, including unidentified IMF officials, want to “blackmail” Greece into adopting measures that would hurt the working class, “we won’t betray the people’s mandate,” Energy Minister Panagiotis Lafazanis said, according to an interview published in Athens-based Real News newspaper.