AGL, whose assets include the Loy Yang coal-fired power station which provides about 30 percent of Victoria state’s electricity will close all its coal plants within 35 years and expand its investments in renewable energy.

Category Archives: Finance

Should China Cut US Treasury Holdings?

Should China cut US Treasury Holdings? Yuhua Zhang writes; In February, China cut US treasury securities holdings by $15.4 billion to $1223.7 billion, which is the sixth consecutive month that China has reduced US treasuries and falls to the lowest US debt holdings since January 2013. Although China is no longer US largest creditor, the further cut in US treasury holdings would still be a wise strategy to China.

In all, cutting US treasury securities holdings is a reasonable choice for China during the period of economic reform because China will encounter economic slowdown for its “new normal” and diversifying its economy.

However, some economists are anxious that the strategy may bring negative effect on US economy.

On the one hand, in comparison with US treasury securities holdlings by top foreign creditors during the past year, the amount of treasuries sold by China is not large enough to disturb the market, and some other top US foreign creditors such as Japan are still willing to increase their holdings. In other words, it is quite limited effect on US treasury market for China (or some other governments’ authorities) to pursue diversification out of US treasury securities.

Instead of facing problems, the US dollar strength and current yield advantage still guarantee high attractiveness and liquidity for US treasury securities market, which positive trend is expected to continue in the future.

Entrepreneur Alert: Men Pay 100%, Women Pay 76%

Elizabeth Daley writes: Elana Schlenker’s small pop-up shop, which opened on a struggling businesses corridor in April, drew customers, news crews and guest speakers not solely for its female-made merchandise but also its premise. At 76 < 100, as the boutique was called, men paid full price, while women paid 76 percent of that.

Schlenker wants to draw attention to gender-based wage inequality, prevalent around the world. At the chic store on Penn Avenue in Pittsburgh, items for sale ranged from honey collected by a female beekeeper to books by the Guerilla Girls art activist collective, with a quarter of products produced locally. Schlenker sourced female talent to cater events and design and build the store’s modern wooden displays.

Now, Schlenker is looking to take her wage-gap crusade down south to Louisiana. For the New Orleans pop-up, Mercure is scouting locations primarily in the Central Business District and the pair are aiming for a November opening.

In Pittsburgh, patrons were drawn to the shop for its programming but gender-based pricing was also an attraction.

The items for sale at 76 < 100 were made by female artists and craftspeople, with about a quarter of the products produced locally.

Schlenker, a Pittsburgh-based freelance graphic designer, said she got the idea for her temporary store from an art project she read about. “The artist had printed copies of a work and charged women $1 and men $2,” she said, explaining that she was reading articles on the wage gap at the time, and the ideas converged.

Fair compensation has nudged its way to the forefront of national conversation, with increasing public pressure to raise the federal minimum hourly wage from $7.25 (where it has remained since 2009), the Fight for $15 campaign (aimed at obtaining higher wages for fast-food employees) and lawsuits targeting unpaid internships.

Mary-Wren Ritchie, a Planned Parenthood employee who attended a panel discussion on the wage gap at 76 < 100, said she was frustrated by the injustice.

“It’s insane that it’s 2015 and we are still fighting to make an equal wage,” she said. “The system was built by men to benefit men, and we work so hard to be on an equal playing ground, but it sucks that we are still fighting.

Though Babcock’s work aims to improve women’s status, she said she is often afraid her research might be used to reinforce negative gender stereotypes.

Cronyism Greases the Wheels?

Jonathan Rausch writes:

- Government cannot govern unless political machines or something like them exist and work, because machines are uniquely willing and able to negotiate compromises and make them stick.

- Progressive, populist, and libertarian reformers have joined forces to wage a decades-long war against machine politics by weakening political insiders’ control of money, nominations, negotiations, and other essential tools of political leadership.

- Reforms’ fixations on corruption and participation, although perhaps appropriate a long time ago, have become destabilizing and counterproductive, contributing to the rise of privatized pseudo-machines that make governing more difficult and politics less accountable.

- Although no one wants to or could bring back the likes of Tammany Hall, much can be done to restore a more sensible balance by removing impediments which reforms have placed in the way of transactional politics and machine-building.

- Political realism, while coming in many flavors, is emerging as a coherent school of analysis and offers new directions for a reform conversation which has run aground on outdated and unrealistic assumptions.

Rauch also explores possible realist solutions, such changes to campaign finance laws, congressional earmarks, primary elections, and transparency rules.

Currency Wars and Trade?

Nouriel Roubini writes: In a world of weak domestic demand in many advanced economies and emerging markets, policymakers have been tempted to boost economic growth and employment by going for export led-growth. This requires a weak currency and conventional and unconventional monetary policies to bring about the required depreciation.

Since the beginning of the year, more than 20 central banks around the world have eased monetary policy, following the lead of the European Central Bank and the Bank of Japan. In the eurozone, countries on the periphery needed currency weakness to reduce their external deficits and jump-start growth.

In Japan, quantitative easing was the first “arrow” of “Abenomics,” Prime Minister Shinzo Abe’s reform program. Its launch has sharply weakened the yen and is now leading to rising trade surpluses.

The upward pressure on the US dollar from the embrace of quantitative easing by the ECB and the BOJ has been sharp. The dollar has also strengthened against the currencies of advanced-country commodity exporters, like Australia and Canada, and those of many emerging markets. For these countries, falling oil and commodity prices have triggered currency depreciations that are helping to shield growth and jobs from the effects of lower exports.

The dollar has also risen relative to currencies of emerging markets with economic and financial fragilities: twin fiscal and current-account deficits, rising inflation and slowing growth, large stocks of domestic and foreign debt, and political instability. Even China briefly allowed its currency to weaken against the dollar last year, and slowing output growth may tempt the government to let the renminbi weaken even more.

Things look different today, and US officials’ exchange-rate jitters are becoming increasingly pronounced. The dollar appreciated much faster than anyone expected; and, as data for the first quarter of 2015 suggest, the impact on net exports, inflation, and growth has been larger and more rapid than that implied by policymakers’ statistical models. Moreover, strong domestic demand has failed to materialize; consumption growth was weak in the first quarter, and capital spending and residential investment were even weaker.

As a result, the US has effectively joined the “currency war” to prevent further dollar appreciation.

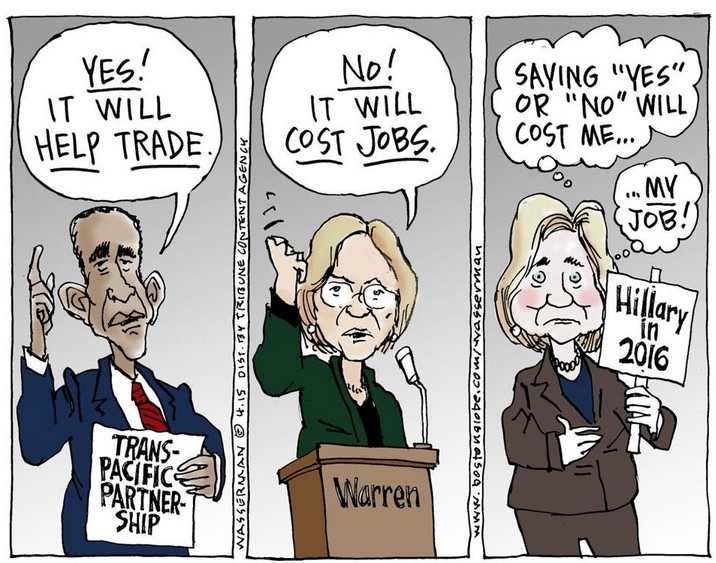

Currency frictions can lead eventually to trade frictions, and currency wars can lead to trade wars. And that could spell trouble for the US as it tries to conclude the mega-regional Trans-Pacific Partnership. Uncertainty about whether the Obama administration can marshal enough votes in Congress to ratify the TPP has now been compounded by proposed legislation that would impose tariff duties on countries that engage in “currency manipulation.” If such a link between trade and currency policy were forced into the TPP, the Asian participants would refuse to join.

The world would be better off if most governments pursued policies that boosted growth through domestic demand, rather than beggar-thy-neighbor export measures. But that would require them to rely less on monetary policy and more on appropriate fiscal policies (such as higher spending on productive infrastructure). Even income policies that lift wages, and hence labor income and consumption, are a better source of domestic growth than currency depreciations (which depress real wages).

The sum of all trade balances in the world is equal to zero, which means that not all countries can be net exporters – and that currency wars end up being zero-sum games. That is why America’s entry into the fray was only a matter of time.

Economic Debates

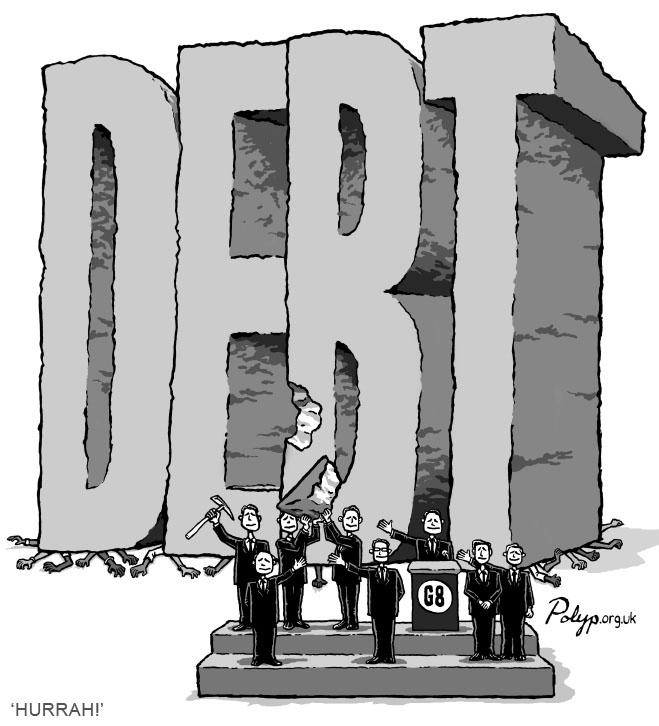

J. Bradford DeLong writes: For the past 25 years, a debate has raged among some of the world’s leading economists. At issue has been whether the nature of the business cycle underwent a fundamental change after the end of the “30 glorious years” that followed World War II, when the economy was characterized by rapid growth, full employment, and a bias toward moderate inflation. Three positions have been staked out.

First out of the gate, in 1991, was Larry Summers, with his seminal paper, “How Should Long-Term Monetary Policy Be Determined?” Summers was unconvinced that the underlying economic reality had changed, so his focus was technical – an attempt to guard against a repetition of the inflationary disturbances of the 1970s that marked the end of the glory years. His prescription was to strengthen the technocratic independence of central banks.

The debate continued with Paul Krugman’s 1998 paper, “It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap” and his book The Return of Depression Economics, published the following year. Krugman made the case that central banks had already succeeded in anchoring inflation expectations to low levels, but had nonetheless failed to put the economy back on track.

Then Ken Rogoff entered the fray with a comment on Krugman’s paper. In Rogoff’s view, what Krugman described as a long-term return to “depression economics” was a temporary condition, the consequence of failures to regulate properly and curb debt accumulation.

Today, a degree of consensus has emerged. There is no longer much point in questioning whether the glory days are over. The models and approaches developed to understand the post-war business cycle and its bias toward moderate inflation are worse than useless today. Disagreement among economists nowadays reflects different positions not so much on the state of the economy, but on whether macroeconomic policy can provide an effective cure.

Summers has more or less abandoned his belief that central banks can, will, and perhaps even should attempt to prevent the return of depression economics. Central banks might have been able to attain the technocratic ideal of macroeconomic business-cycle management that Summers hoped for back in 1991, but they failed to do so. In Summers’s view governments need to assume greater responsibility for risk-bearing, long-term planning, and investment. Indeed, those governments lucky enough to issue the world’s reserve currencies are able to take on this role without overloading future taxpayers with inordinate debt burdens.

Whichever policies – macro or micro – turn out to work best for addressing today’s economic problems, one thing has become abundantly clear: optimism is out of fashion.

Pacific Trade Deal: Advantages

Tammy Kim writes: The TPP aims to establish the world’s largest free-trade zone, affecting an estimated 40 percent of global commerce. Japan and the U.S. are the biggest players in this 12-country agreement, nearly a decade in the works, but their citizens still know little of the agreement’s contents. Now, in the U.S. a fast-track bill moving through the Senate could accelerate the process for making the TPP binding.

All this trade talk can seem an impenetrable thicket of arcane economics and alphabet soup. Here we provide answers to some basic questions: Are accords like the TPP still necessary in our Internet-enabled, globalized world? What makes trade more or less free? And what does it all mean for workaday people in the U.S. and the other TPP nations? Trans Pacific Trade Deal

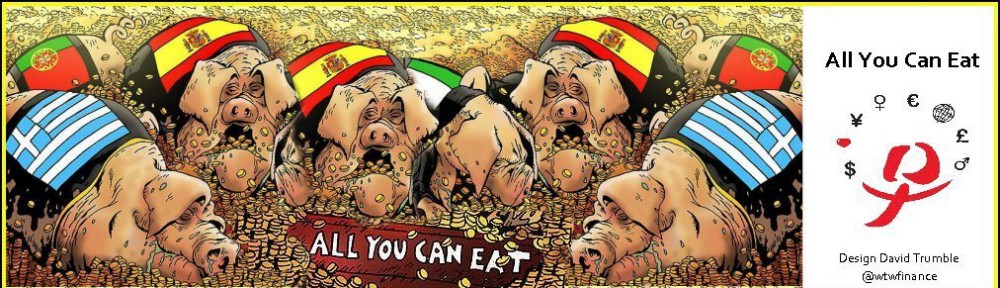

An Opportunity for Greece?

Joshka Fischer writes: One can only feel sorry for Greece. For more than five years, the “troika” (the European Commission, the European Central Bank, and the International Monetary Fund) has made it the object of a failed experiment with austerity that has exacerbated the country’s economic crisis. And now Prime Minister Alexis Tsipras’s government seems hell-bent on plunging Greece into the abyss.

It never had to be this way. By the time Tsipras’s leftist Syriza party came to power in January, a new, more growth-oriented compromise had become possible. Even hardcore German proponents of austerity – and certainly Chancellor Angela Merkel – had begun to reconsider their position, owing to their policy prescriptions’ undeniable adverse consequences for the euro and the stability of the European Union.

The Tsipras government, with some justification, could have presented itself as Europe’s best partner for implementing a far-reaching program of reform and modernization in Greece.

But Tsipras squandered Greece’s opportunity, because he and other Syriza leaders were unable to see beyond the horizon of their party’s origins in radical opposition activism.

Of course, it is precisely the acceptance of necessity that marks the difference between government and opposition. An opposition party may voice aspirations, make promises, and even dream a little; but a government party cannot remain in some imaginary world or theoretical system.

Indeed, Tsipras seems to have forgotten the Marxist tradition’s emphasis on the dialectical unity of theory and practice. If you want to negotiate a change of tack with your creditors, you are unlikely to succeed if you destroy your own credibility and rant and rave about those whose money you need to avoid default.

But Syriza’s inability to escape its radical bubble does not explain why it formed a coalition with the far-right Independent Greeks, when it could have governed with one of the centrist pro-European parties.

Within Europe’s monetary union, a consensus has been established that everything possible must be done to keep Greece inside. But Greece’s government needs to understand that other eurozone members will not be willing to accommodate its demands if it means delegitimizing their own painful reforms.

A disorderly Greek exit from the euro – currently the greatest danger – can be averted only if both sides operate on the assumption that the upcoming negotiations are not about who wins and who loses.

But others in Europe need to abandon their illusions as well. The Greek crisis cannot be used either to weaken European conservatives and change the balance of power within the EU, or to remove the Greek left from office.

The current crisis and the negotiations to resolve it are about only one thing: Greece’s future within Europe and the future of the joint European project.

EU: Immigrants for Some or All?

The European Union is once again struggling to come up with a coherent asylum strategy for its 28 members. In recent years, the rising number of asylum seekers entering the European Union through countries such as Italy and Greece has generated friction among member states, fueled criticism of the Schengen Agreement and contributed to the growing popularity of nationalist parties.

However, the European Union will not reform its asylum policies in any significant way. Member states will provide more financial assistance to Mediterranean countries, but they will refuse to accept quotas of immigrants over the coming months and years. Anti-immigration sentiments will persist across the Continent, putting substantial pressure on one of the European Union’s founding principles: the free movement of people.

On April 23, the European Union submitted to pressure from Italy and Malta and held an emergency summit to address the immigration crisis in the Mediterranean. Between January and April, more than 1,750 migrants died in shipwrecks at sea, a death toll 30 times higher than that of the same period in 2014. Over the past year and a half, Italian ships have rescued more than 200,000 people in the Mediterranean Sea.

After the summit concluded, EU leaders decided to triple the financial resources for the bloc’s operations in the Mediterranean Sea and to boost cooperation with certain countries like Tunisia, Egypt, Sudan, Mali and Niger to better control borders and combat human trafficking. They also asked EU Foreign Affairs Chief Federica Mogherini to begin preparing for a possible military operation aimed at identifying, capturing and destroying vessels before traffickers could use them. However, the bloc’s leaders did not reach any agreements on the distribution of asylum seekers across the Continent. Moreover, many of the goals discussed during the summit will prove difficult to achieve. EU Immigration

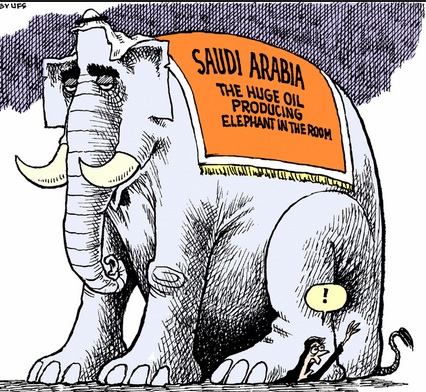

Saudia Arabia Struggles with Oil

Nafeesa Syeed and Rinat Gaynullin write: Saudi Arabia is burning through foreign reserves at a record pace as the largesse of the new king and regional turmoil ratchet up pressure on public finances already hurt by the oil price slump.

The kingdom spent $36 billion of the central bank’s net foreign assets — about 5 percent of the total — in February and March, the biggest two-month drop on record, data released this week show. The fall was in part due to King Salman’s order to give government employees and pensioners a two-month bonus after he ascended to the throne of the world’s biggest oil exporter in January.

The early months of Salman’s rule also saw a sharpening of the country’s rivalry with Iran — most strikingly over the Saudi-led air offensive in Yemen — and mounting security threats at home, challenges that had already led to a surge in military spending in 2014. The 48 percent drop in oil prices last year has prompted the government to use reserves and borrow from domestic banks to maintain spending on wages and investments.

The task of balancing Saudi Arabia’s economic and regional policies is increasingly falling to a new generation of princes, including the king’s son, Prince Mohammed Bin Salman. The prince, who was made second-in-line to the throne on Wednesday, heads a newly-created economic council and, as defense minister, is instrumental in the bombing campaign against Houthi rebels and their allies in Yemen.

The budget deficit is expected to widen to 14.5 percent of gross domestic product this year, compared with a gap of 1.9 percent in 2014. The king’s handouts are likely to boost domestic consumption, supporting non-oil economic growth, she said.

Saudi Arabia accumulated tens of billions of dollars in reserves amid high oil prices. King Salman’s predecessor King Abdullah increased social and infrastructure spending after the 2011 revolts toppled rulers elsewhere in the region.

Military Spending

Military spending had increased well before the kingdom gathered a coalition of mainly Sunni-led countries behind its Yemen campaign. The “big $10-$15 billion” procurement deals have already been signed for the next three years, Michael Stephens, head of the Royal United Services Institute in Qatar, said by phone.

Saudi Arabia’s desire to play a larger role in the region means it’s likely to continue spending, Ibrahim Sharqieh Frehat, a professor of conflict resolution at Georgetown University in Qatar, said by phone.

The kingdom became the largest buyer of defense equipment last year, surpassing India, with inbound shipments jumping 54 percent.

“We are going to see this policy continuing and being reinforced,” which sits “neatly with the vision of the king of taking a regional leadership role,” said Frehat.