William Greider asks: If women were in charge of banking regulation, could they save us from the Wall Street cowboys who crashed the global financial system?

That provocative question was the implicit subtext for an all-day conference of banking and financial officials in Washington this week, held at, of all places, the soberly serious International Monetary Fund. The IMF’s managing director, as it happens, is a woman—Christine Lagarde of France—and she appeared alongside an even more powerful woman—Janet Yellen, chair of the US Federal Reserve System. Neither of them was in charge when the system crashed in 2008.

The IMF event was not a rump rally of feminists who somehow crashed the halls of power. But all of the 18 speakers on various panels were women, prominent as bank regulators or financial authorities. The one-sided gender line-up was not exactly an accident. The men in suits could hardly miss the message.

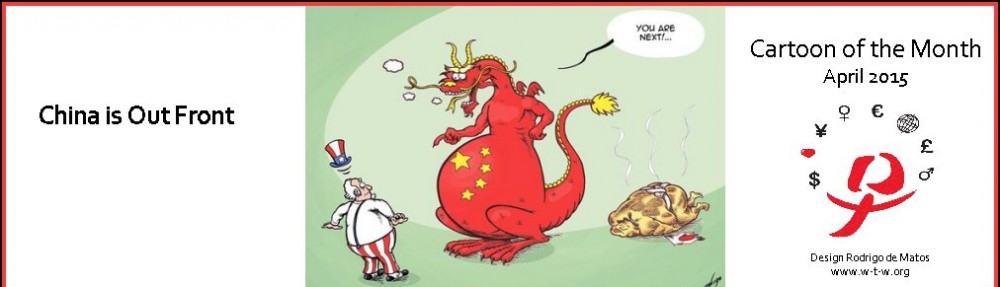

But just in case they did, IMF Director Lagarde prompted them with a droll question: “What would have happened if Lehman Brothers had been Lehman Sisters?”

What she meant was that different values might have prevailed if women had held the controlling positions at the brokerage or were the government regulators enforcing prudent standards. Women, as Lagarde has observed, worry more about financial exclusion. Worldwide, 42 percent of women have no access to financial services. Only a measly 3 percent of bank CEOs are women.

More to the point, Largarde said research shows women are more risk-averse—a quality utterly missing in the reckless banks and brokerages rushing like lemmings to the cliff. Women in charge might have asked tougher questions.

Fed Chairwoman Yellen stayed away from the gender question. But Lagarde has invoked “Lehman Sisters” numerous times since the financial collapse and disappointing recovery.

“It takes a great deal of will power to direct the French economy,” Largarde wrote in 2010 when she was France’s finance minister. “I am not doing this for women but as a woman I am, perhaps, more keenly aware of the damage that the crisis has done through greed, pride and a lack of transparency…. I am determined to do everything within my power to change the rules of the game and do my best to ensure that a crisis such as this can never happen again.”

What women want, she wrote, is to be judged, like men, on the basis of their deeds. She added what Eleanor Roosevelt had to say on the subject. “A woman is like a tea bag—you never know how strong it is until it’s in hot water.”

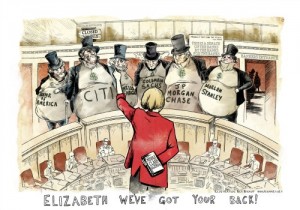

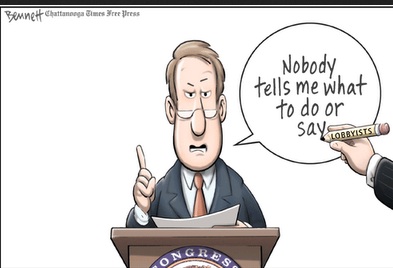

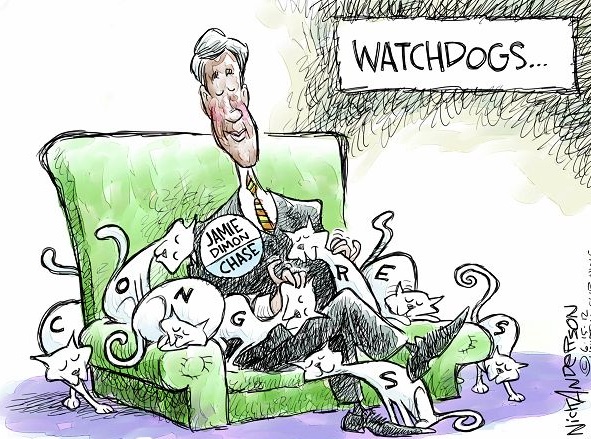

One of the conference speakers, Brooksley Born, is a courageous example. Born was nearly drowned by “hot water” dumped on her by Robert Rubin, Alan Greenspan, and Larry Summers during the Clinton administration. As a regulator she was trying to impose some limits on dangerous derivatives. The men hammered her, blocked her, and effectively drove her out of government.

Institute for New Economic Thinking was co-founded and funded by investor George Soros and others, and it set out to sweep worldwide in search of new ideas and new economists who are breaking free of the old orthodoxy that failed.

Johnson was once asked,“If you could wave a magic wand and do one thing to make the financial system better, what would it be?” Johnson had a quick answer: “Only women get to regulate finance.”

Adamti, Provocateur, Instigator