U.S. weekly regular gasoline retail prices reached a 2015 high of $2.69/gal on May 11, an increase of 28¢/gal from early April. Rising crude oil prices and a series of refinery outages in California have pushed gasoline prices higher in the past month. As a result of these outages, gasoline prices on the West Coast have increased by more than the U.S. average, with prices in Petroleum Administration for Defense District (PADD) 5 averaging $3.44/gal on May 11, an increase of 49¢/gal from the first week in April.

With crude oil prices projected to be relatively flat in the coming months, the U.S. monthly average gasoline price is projected to reach $2.68/gal in May, then decline as refineries in California resolve outages and refineries in the rest of the country increase production of gasoline following the spring maintenance season.

Total U.S. liquid fuels consumption rose by an estimated 70,000 b/d (0.4%) in 2014. In 2015, total liquid fuels consumption is forecast to grow by 340,000 b/d (1.8%).

Motor gasoline consumption, which rose by 80,000 b/d in 2014, increases by a projected 120,000 b/d (1.4%) in 2015 as lower prices and employment growth outweigh increases in vehicle fleet efficiency.

Consumption of distillate fuel, which includes diesel fuel and heating oil, is forecast to rise by 80,000 b/d (2.0%) in 2015 and by 60,000 b/d (1.5%) in 2016. This growth is driven by increasing manufacturing output and foreign trade.

Hydrocarbon gas liquids (HGL) consumption, which fell by 100,000 b/d (4.0%) in 2014, is projected to increase by 120,000 b/d in 2015 and by 60,000 b/d in 2016, as new petrochemical plant capacity increases the use of HGL as a feedstock.

U.S. crude oil production is projected to increase from an average of 8.7 million b/d in 2014 to 9.2 million b/d in 2015 and remain flat in 2016.

EIA expects onshore production to decline beginning in the second quarter of 2015 because of unattractive economic returns in some areas of both emerging and mature oil production regions.

EIA expects U.S. crude oil production to exceed 9.3 million b/d in the second quarter of 2015, then decline by 280,000 b/d through the first quarter of 2016. With forecast WTI crude oil prices rising to an average of $67/b in the second quarter of 2016, drilling activity is expected to increase again. plants, which reached a record high of 3.1 million b/d in October, is projected to average 3.2 million b/d in 2015 and 3.5 million b/d in 2016.

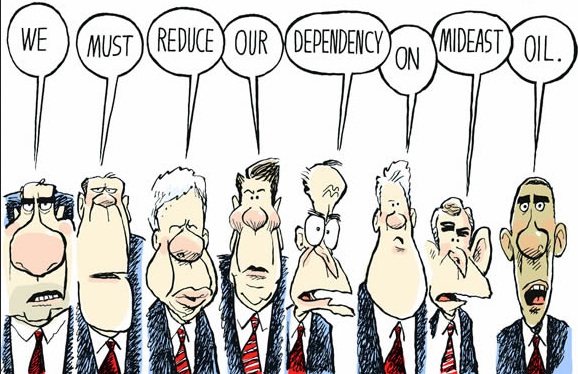

The growth in domestic crude oil and other liquids production has contributed to a significant decline in imports. The share of total U.S. liquid fuels consumption met by net imports fell from 60% in 2005 to an estimated 26% in 2014. EIA expects the net import share to decline to 21% in 2016, which would be the lowest level since 1969.