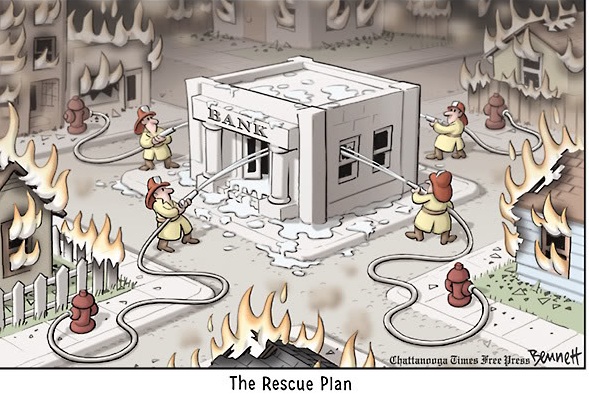

Ben Bernanke writes: Earlier this week Senators Elizabeth Warren (D-Massachusetts) and David Vitter (R-Louisiana) introduced a bill they call the “Bailout Prevention Act of 2015.” If enacted, the bill would further restrict the Federal Reserve’s emergency lending powers in a financial crisis. That would be a mistake, one that would imprudently limit the Fed’s ability to protect the economy in a financial panic.

During the 2007-2009 crisis, the Fed used its emergency lending authorities in two quite different ways. First, it made loans to help prevent the collapse of two systemically critical firms, Bear Stearns and AIG. The Fed took these actions, with the support of the Treasury, because it feared that the disorderly failure of a large, complex, and highly interconnected firm would greatly worsen the financial panic and damage the economy—a judgment confirmed by the aftermath of the bankruptcy of Lehman Brothers in September 2008. Second, the Fed created a variety of broad-based lending programs, to unfreeze dysfunctional markets and to help stem devastating runs that left whole sectors of the financial system without adequate funding. In providing this funding via short-term, fully collateralized loans, the Fed was fulfilling the traditional central bank role of serving as lender of last resort. This lending, all of which was repaid with interest, was essential for stabilizing the financial system and restoring the flow of credit. Should the US Fed be Lender of the Last Resort