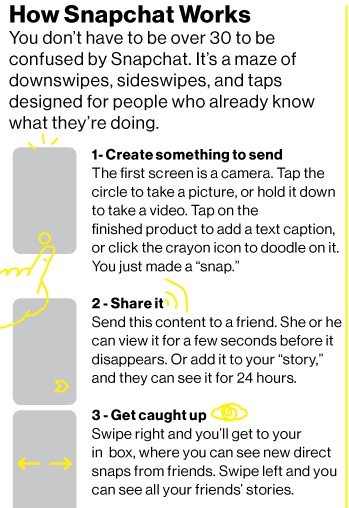

Brad Stone and Sarah Frier write: Evan Spiegel begins a conversation in the offices of his startup, Snapchat, by propping a sneakered foot onto an Eames chair, leaning back, and acknowledging how infrequently he speaks to the press. “I literally have not done this in so long,” he says, before taking a sip from something called a Happy Juice—pineapple, pear, ginger, mint. When asked why, he chooses his words carefully. “I’ve been working,” he says. “This s— is hard!”

Spiegel is the co-founder, chief executive officer, and profane enfant terrible behind one of the largest and fastest-growing social networks on the Internet. At 24, he runs a startup with 330 employees and a valuation north of $15 billion, which claims more than 100 million mostly young users. He’s also incredibly secretive about his business plans and an unknown (and arguably underestimated) figure in the intersecting gossip circles of Silicon Valley and Hollywood.

Now he’s ready to talk about a major turning point for his company. More than three years after Spiegel founded Snapchat at Stanford with his fraternity brother, Bobby Murphy, 26, he’s trying to turn it into a real business. After starting to run select video ads earlier this year, Snapchat is about to begin soliciting other big advertisers with some new numbers that assert its audience is bigger, younger, and more obsessive than anything on television. In a 23-page sales pitch it’s sending to ad agencies this month, the company says more than 60 percent of 13- to 34-year-old smartphone users in the U.S. are active on the service and together view more than 2 billion videos a day. That’s already about half the number of videos people watch on Facebook, which is seven years older and has 10 times as many members. Spiegel’s Snapchat