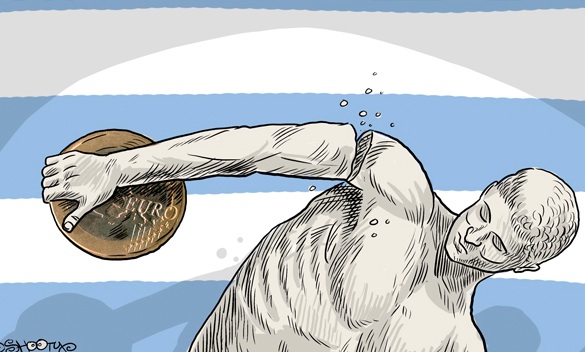

Ian Talley writes:-International Monetary Fund chief Christine Lagarde signaled that debt relief would still be a necessary component of any bailout package for Greece to ensure the program would rescue its beleaguered economy.

Led by fiscal hawk Germany, some European creditors have opposed debt relief as part of a bailout package for Greece, instead urging tougher economic overhauls from Athens. That position has been at odds with the new government in Athens that has an antiausterity stance and a requirement for European creditors to restructure their Greek debt holdings, which have stalled bailout talks for months.

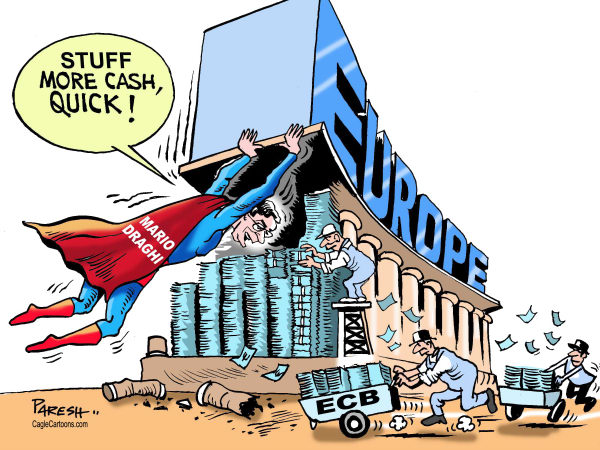

A new proposal by Greece’s creditors–the IMF, the European Commission and the European Central Bank–offered Athens a slower pace of budget belt-tightening and, according to some reports, a softening of the IMF’s requirement for debt relief

But Ms. Lagarde said any slippages from the last bailout program would mean “financing has to be considered.” Greece has failed to meet many of its bailout targets.

“And financing is a factor of the level of the debt, which itself is a factor of the maturity and interest rates at which debt has been accumulated. Everything has to add up at the end of the day,” she said.

Under the bailout program Athens is currently trying to renegotiate, the IMF said debt relief was required by Greece’s European creditors for the deal to be credible. In particular, the IMF assumed Europe would help Athens cut the ratio of its debt-to-gross domestic product to 124% by 2020, and in 2022 a debt-to-GDP ratio substantially lower than 110%. That, officials indicated, would likely mean some combination of debt maturity extensions, lowering of interest rates or even a cut in the underlying value of the bonds.

To be sure, that debt relief was contingent upon Athens living up to its bailout conditions, which it failed to do.

Such debt relief is a political anathema in Germany, and Berlin has fought against inclusion of any mention of debt relief in a new bailout package.

Given that Greece’s economic situation has deteriorated with the deadlock in bailout talks and officials are considering weakening the budget-tightening requirements, it would naturally entail more financing–including debt relief–to meet the debt levels the IMF said were necessary to be credible and sustainable.