1. Ohio Gov. John Kasich

In Office: Jan. 2011 – present

Kasich will have quite a story to tell if he enters the race for the White House.

When the former congressman entered the governor’s mansion in 2011, his state’s unemployment rate was 9.2 percent. In the most recent confirmed figures, for March 2015, it is 5.1 percent. The improvement is not just dramatic in itself, it also outpaces the nation as a whole. Importantly, Kasich’s record comes in an industrial — and electorally crucial — state in the Midwest which detractors had argued was in a near-inexorable decline.

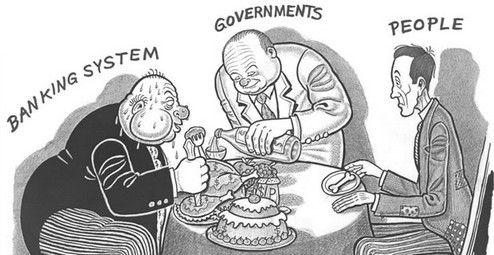

Kasich supporters point to a number of moves that they believed helped the economy along, including his replacement of a state board aimed at economic development with a private non-profit organization, JobsOhio. He has often noted that he erased a projected $8 billion budget shortfall without raising taxes.

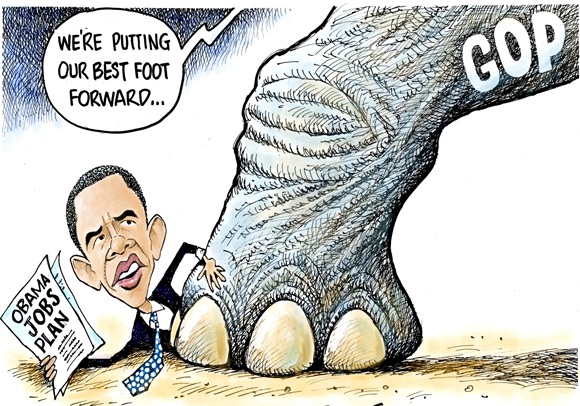

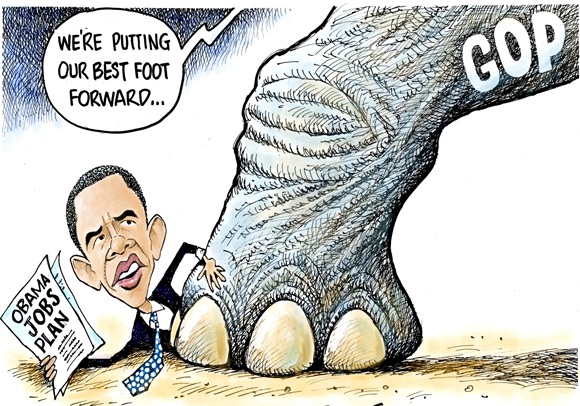

Skeptics, however, assert that President Obama’s bailout of the auto-industry had as significant an effect in reviving Ohio’s fortunes as anything Kasich has done.

2. Former Texas Gov. Rick Perry

In Office: Dec. 2000 – Jan. 2015

Note: Texas is a state committed to support business, and its jobs’ record is associated with this commitment.

Perry put his economic record in the Lone Star State front-and-center when he officially launched his campaign last week, claiming to have created 1.5 million new jobs in the last seven years of his tenure and to have “led the most successful state in America.”

When Perry took office a decade and a half ago, unemployment levels in the state were more than half a percentage point higher than the nation’s. By the time he left, joblessness in Texas was 4.4 percent, versus a nationwide 5.7 percent.

Perry backers note that Texas still has no state income tax and is light on regulation. Perry generally made sure that whatever tax hikes he did agree to were politically sellable to conservatives: a new tax on strip clubs was a notable example.

One contentious issue is the economic impact of Texas’ rapid population growth.

Perry boosters argue that his record on jobs is even more impressive given that the state’s population grew by around 26 percent during his time in office, versus a national population growth of around 11 percent.

Others, including left-leaning economist Paul Krugman, have suggested the influx actually helped speed economic growth by keeping labor costs low.

3. Former Florida Gov. Jeb Bush

In Office: Jan. 1999 – January 2007

Unlike Kasich and Perry, Bush was out of office before the Great Recession scythed down jobs everywhere.

His state’s performance on jobs was better than that of the nation during his tenure.

In the month he left office, joblessness in Florida was at 3.5 percent compared to a national rate of 4.6 percent. When he took office, eight years before, the Florida unemployment rate had also been below that of the U.S., but by a more modest amount.

Bush, who has difficulties with his party’s conservative base on some non-economic issues such as immigration, is on more solid ground when it comes to the economy. A Wall Street Journal assessment last year noted noted that he had vetoed $2 billion in government spending during his time in office.

Still, not everything he touched turned to gold. Reuters earlier this year noted how he spearheaded one of the biggest development projects in the state’s history — an effort to create a biomedical hub in a Palm Beach County town — but the outcome fell short of expectations.