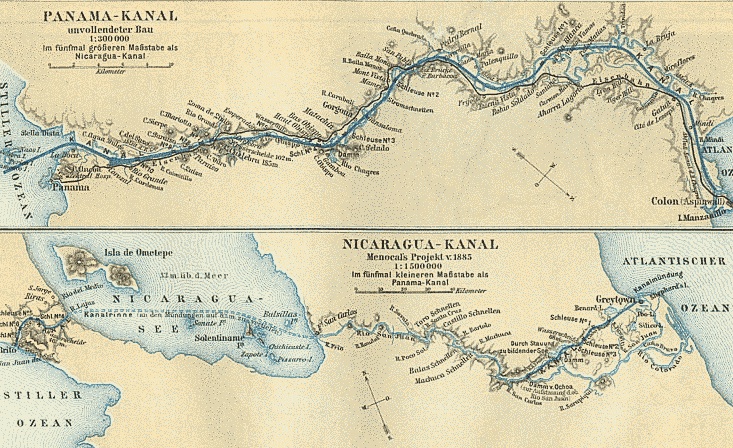

Chinelse company to build green canal in Nicaragua.

The Nicaragua Canal project now under construction is expected to link the Atlantic and Pacific oceans and be a green project as well, an offical with China’s HKND Group that holds the concession for the canal told local media on Monday.

The 279-km-long mega project, which began at the end of 2014, will take five years to build with a total cost of 50 billion U.S. dollars.

It will provide a more convenient interoceanic passage for large vessels that can not go through the Panama Canal, such as 25,000-TEU container ships, said Bill Wild, HKND Group’s chief project adviser.

Moreover, over the past two years, HKND has also made great efforts on the environmental and social impact assessment, which has been submitted to the local government and is waiting for approval.

Wild said the company will launch a re-forestation program for watersheds along the canal. Also, the canal will serve as a protective barrier once the program is completed. There will be a 10-km-wide “no-go area” in the Mesoamerican Biological Corridor so that no human activities will affect wildlife in this area.

Material excavated during construction will be used to create some 30,000 to 40,000 hectares of land for agriculture, Wild said.

He said two islands with rock walls will be built in Cocibolca or Nicaragua Lake, the country’s largest lake and part of the canal route, where the extracted material can be deposited.

The material will be extracted through a system that uses giant suction tubes, with a mechanism similar to a vacuum cleaner, ensuring the sediment is not simply disrupted and floating around, he said.

“The lake is one of the people’s biggest concerns. We will make sure to protect it,” Wild said.