The UK bankruptcy court ruled last month that Maud – who amassed a $7 billion global property portfolio before he went bust as a result of the financial crash – does not have to repay a loan he received from the LIA to help finance his acquisition of 50 percent of Banco Santander’s global headquarters in Madrid in 2008.

The loan was granted to Maud before the imposition of United Nations sanctions against Libya in March 2011.

The sanctions regime effectively prevents the turbulent North African country from seeking to recover unpaid debt, and freezes all assets held outside the state.

Although the judge did not dispute that Maud owed the money, she ruled that its repayment to Libya would amount to a breach of sanctions.

According to court documents seen by Arabian Business, Maud’s now defunct real estate company Propinvest received the first tranche of what was originally intended to be a bigger loan from Libya at a time when it was common for the country to seek inward investment from other nations.

This payment amounted to £17.6 million. Maud claimed he did not receive the rest of the agreed loan because of the collapse of the Libyan regime. The total size of that loan is not revealed in the court documents.

The documents state that Propinvest defaulted on the loan repayment from March 2010 (it went into administration in 2011). The unpaid debt stood at around £20 million including interest.

The LIA served a statutory demand on Maud but he challenged it on the grounds that to pay would amount to a breach of sanctions.

The court ruled in Maud’s favour, deciding that anyone making payment to the LIA in breach of the sanctions would be subject to criminal penalties and it would be unjust to require a debtor to make repayments in such circumstances.

The LIA had argued Maud should have applied for a licence from the UK Treasury that might have allowed him to make the repayment regardless of the sanctions.

But the court held that Maud, as a debtor, was not responsible for doing this – especially since there was no certainty that a licence would be granted.

The lawyers involved in the case declined to comment. The judgment is a coup for Maud, who retains his 50 percent stake in Banco Santander’s headquarters at a time when he is still recovering from the financial crash that caused Propinvest to collapse in 2011.

The Financial Times reported in 2012 that Maud was subject to a Channel Islands court order that prevented him from living on more than £500 ($782) a week. He also had his worldwide assets frozen.

However, the flipside of the decision is that the LIA stands to lose out on valuable sources of funding that could help it to rebuild the country.

A spokesperson for the LIA revealed that the LIA has been given leave to appeal the decision. The spokesperson said: “This was a highly technical and complex public law case concerning the interpretation of economic sanctions. The sanctions are there to protect the interest of the Libyan people.

“Rather oddly in this ruling, the existence of sanctions has been turned on its head for the benefit of a debtor who is liable to those very same people. This cannot be right. The [LIA’s] Board of Directors is intent on clarifying this point of law and pursuing a substantial and undisputed debt due to the people of Libya.

“The LIA is taking the case to the Court of Appeal and hopes this court will recognise that Maud is seeking to protect his own interests by using a sanctions regime designed to protect funds designated for investment in the building of a safe country with a vibrant, well-educated and healthy population.”

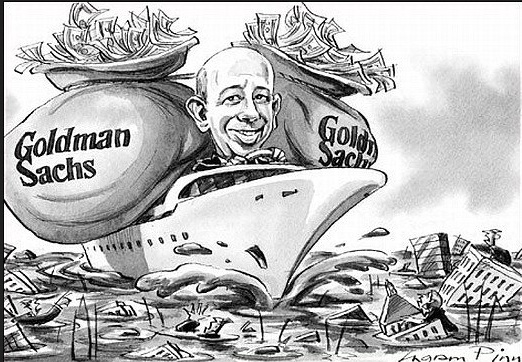

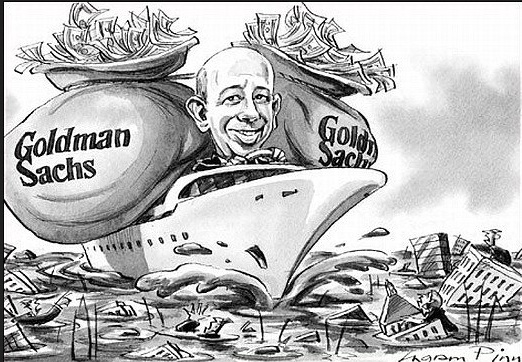

The outcome will have implications for Libya’s other creditors – among them the banks Goldman Sachs and Société Générale, both of whom are embroiled in similar, separate, court cases to quash the LIA’s demands to pay outstanding funds.

One well placed lawyer told Arabian Business that, should the LIA win or the sanctions be lifted, questions will arise over where to direct repayments given that it is unclear which of Libya’s two warring governments are in charge of the investment body.