Carol E. Lee writes: President Barack Obama is set to visit his father’s native Kenya this weekend in a long-anticipated trip designed to highlight his personal ties to a continent that has largely been on the periphery of his foreign-policy agenda.

Mr. Obama plans to showcase initiatives he hopes will define his Africa legacy, such as steps to increase access to electricity.

He will move on to Ethiopia, meeting with the African Union on matters of trade, business and security, as U.S. officials have voiced growing concerns over the rise of extremism.

But his arrival in Nairobi on Friday is in itself a hallmark moment for his presidency. For Mr. Obama, it isn’t so much what he does, but who he is that ties him to the continent—and to Kenya in particular—and sets him apart from other U.S. presidents who have invested resources in Africa.

His two-day visit is widely seen as a homecoming of sorts, as the first African-American U.S. president returning to a country that considers him a native son.

Mr. Obama plans to spend time with members of his father’s family. He will meet with Kenyan President Uhuru Kenyatta, hold an event with young African leaders and reflect on his familial roots in a speech at an indoor sports arena.

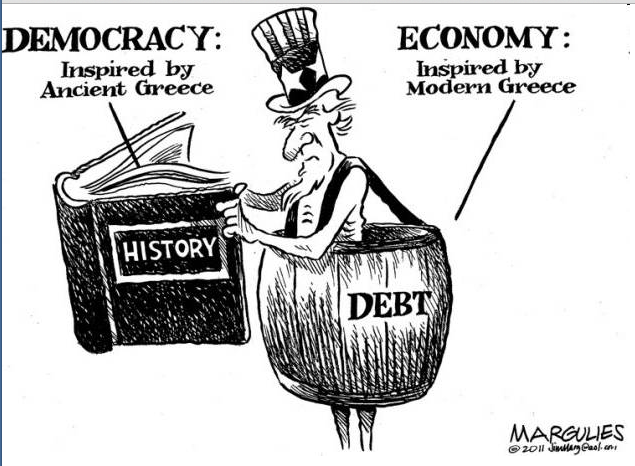

Mr. Obama’s election in 2008 raised expectations across Africa for deeper American engagement. But his foreign-policy agenda has largely been consumed by unrest in the Middle East and efforts to strengthen U.S. ties in Asia.

During his first term, Mr. Obama spent about a day in sub-Saharan Africa, with a brief visit to Ghana.

His trip this week is part of a renewed focus on the continent in the homestretch of his presidency. It follows his gathering of African leaders in Washington last year, and his 2013 trip to Senegal, South Africa and Tanzania.

Mr. Obama is expected to use the platforms in Kenya and Ethiopia to highlight programs to combat hunger and his 2013 electricity initiative, Power Africa, which has been slow to expand. White House officials said he also plans to raise human rights, corruption and democracy concerns.

In Ethiopia, Prime Minister Hailemariam Desalegn’s ruling party won all seats in Parliament this year, a result the White House has said raises concerns about the integrity of that election.

Africa is also increasingly a security concern for the U.S., with the rise of al Qaeda-affiliated terrorist groups in the east and Islamic State’s expansion in the west and north.

Kenyan officials have said they hope Mr. Obama will focus on how Kenya and the U.S. can collaborate on business—both bringing in large U.S. companies and helping nurture Kenya as a location for film production.

But much of the two countries’ collaboration currently is in the realm of security—the U.S. trains Kenyan soldiers and shares intelligence in the effort to keep extremist militants from al Qaeda-linked al-Shabaab at bay.

Mr. Obama’s 49-year-old half-uncle, Said Obama, said his nephew’s visit to Kenya has been eagerly awaited.

“It would have looked very bad if he had left office without visiting Kenya,” he said, adding, “The people of Kenya are proud of him because of his achievements, though I can also say that there were very unrealistic expectations. People thought that being the president of America he was going to develop this place, do very many things.”

In Nairobi, a massive city-beautification effort has been under way for weeks in preparation for Mr. Obama’s arrival. New roads have opened, and highway medians have been adorned with flowers. Residents are jokingly calling the efforts “Obamacare.” Street hawkers, meanwhile, are selling American flags and T-shirts welcoming Mr. Obama “home.”

“There’s huge excitement in Kenya and perhaps excessive expectations of what this trip might deliver,” said Jennifer Cooke,director of the Africa program at the Center for Strategic and International Studies.

“I’ll be honest with you, visiting Kenya as a private citizen is probably more meaningful to me than visiting as president because I can actually get outside of a hotel room or a conference center,” Mr. Obama said last week. “But it’s obviously symbolically important.”