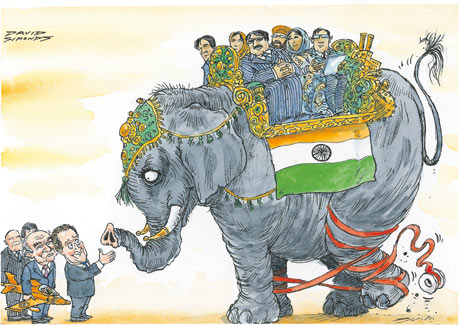

Adam Vaughan writes: Conservationists and politicians have called on the EU to ban the import of lion heads, paws and skins as hunters’ trophies from African countries that cannot prove their lion populations are sustainable, following the killing of Zimbabwe’s most famous lion by a European hunter with a bow and arrow.

The death of a radio-tagged lion called Cecil in Hwange national park was described as a tragedy by wildlife groups. But the lion, whose head and skin were removed, is only one of about 200 such lion ‘trophies’ that hunters legally import to the EU each year. Germany, France and Spain are the biggest importers.

In February, scientific advisers to the EU banned imports from Benin, Burkina Faso and Cameroon for the first time, on the grounds that their wild lion populations were not sustainable.

Lions were classed as vulnerable and critically endangered in western Africa due to over-hunting and a scarcity of prey.

MEPs said the Cecil incident showed that if hunters were desperate enough to lure lions out of national parks with bait rather than killing them in areas with a hunting quota, lion populations in Zimbabwe were clearly not sustainable.

They said the EU’s import ban should be extended to any African countries without independent, scientific data to show that lion hunting is sustainable.

Catherine Bearder, a Liberal Democrat MEP who on Monday submitted a written question to the European Commission on the issue, said: “The shooting of Cecil the lion was tragic and cruel, but it has at least shone a spotlight on the absurdity of the current situation. Despite the number of lions across Africa plummeting in recent years, hunters are still allowed to import lion hunting trophies into the EU from several African countries.”

“It’s outrageous that lions are being killed just so someone in Europe can decorate their home with the body parts. The European commission must immediately impose an EU ban on all imports of lion body parts,” he said.

When the SRG meets in September, it should ban imports from Zimbabwe.

Cecil was a 13-year-old lion with a distinctive black mane, and was reportedly lured out of the national park with bait earlier this month, before being killed with a bow and arrow and rifle, before being skinned and beheaded. Kat said that such baiting was legal in Zimbabwe, even on the edge of a national park, but it appeared the hunter had broken the law by killing the lion in an area without a hunting quota.