J4WBs are a group from all employment sectors, severely punished for ‘speaking out’ by employers & UK judiciary…

HUMAN RIGHTS are being VIOLATED.

Category Archives: Finance

Chang Is Finally Convicted In Mozambique Hidden Debt Scandal!

A New York court found former Mozambican finance minister Manuel Chang guilty of fraud and money laundering in the $2-billion scandal.

dailymaverick.co.za reports. Former Mozambican finance minister Manuel Chang was convicted in a Brooklyn, New York court on Thursday, 8 August 2024, for his role in the $2-billion “hidden debts” fraud, bribery and money laundering scheme in his country in 2013 and 2014.

A federal jury found him guilty of one count of conspiracy to commit wire fraud and one count of conspiracy to commit money laundering. He faces a maximum penalty of 20 years in prison on each count. A federal district court judge will determine his sentence. It is not yet clear if he intends to appeal.

The jury reached its verdict after three weeks of trial and three days of deliberation.

“Today’s verdict is an inspiring victory for justice and for the people of Mozambique, who were betrayed by a corrupt high-level public official whose greed and self-interest sold out one of the poorest countries in the world,” said Breon Peace, US Attorney for the Eastern District of New York.

“Chang now stands convicted of pocketing millions in bribes to approve projects that ultimately failed, laundering the money and leaving investors and Mozambique stuck with the bill.”

Chang’s conviction has also been hailed as a victory for South African justice – but also an indictment of the executive – as it was the climax of a protracted legal process which began with his arrest at Johannesburg’s OR Tambo International Airport in December 2018 and wound through the South African courts for almost five years.

The Gauteng Division of the High Court in Johannesburg twice overturned orders by two different South African justice ministers that he should be extradited to Mozambique. But advocates representing the Mozambican NGO Fórum de Monitoria do Orçamento (FMO) – Forum for Monitoring the Budget – argued that he would very likely escape justice in Mozambique, and so in November 2021 the Johannesburg court ordered him to be extradited to the US. This decision was later confirmed by the Supreme Court of Appeal and the Constitutional Court, and Chang was finally extradited to the US in July 2023.

“While serving as finance minister of Mozambique, Manuel Chang obtained $7-million in bribe payments in exchange for signing guarantees to secure more than $2-billion in loans,” said principal deputy assistant attorney-general Nicole Argentieri, head of the US Justice Department’s criminal division. “

The loans were supposed to finance the purchase of tuna-fishing vessels and maritime patrol boats as well as maintenance facilities supplied by the Privinvest Group, a United Arab Emirates-based shipbuilding company, to three Mozambique state-owned companies, Proindicus, Ematum and MAM. But the New York court heard that Chang and his co-conspirators at Privinvest and in Credit Suisse and VTB banks, which loaned the US$2-billion, diverted more than US$200-million of the loans to pay bribes to Chang and others.

“Not only did Chang’s abuse of authority betray the trust of the Mozambican people, but his corrupt bargain also caused investors – including US investors – to suffer substantial losses on those loans,” Argentieri said. Prosecutors said investors lost money because the loans from Credit Suisse and VTB bank were sold onto investors including some Americans. It was this defrauding of US citizens which decided the US on prosecuting Chang and seeking his extradition from South Africa.

“Chang now stands convicted of pocketing millions in bribes to approve projects that ultimately failed, laundering the money and leaving investors and Mozambique stuck with the bill,” Argentieri said

The New York court heard that of the US$200-million in bribes, Privinvest paid Chang and other Mozambican government officials more than US$150-million to ensure that the Mozambican state-owned companies Proindicus, Ematum and MAM entered into the loan arrangements and that the government of Mozambique guaranteed those loans.

“The loans were subsequently sold in whole or in part to investors worldwide, including in the United States. In so doing, the participants defrauded these investors by misrepresenting how the loan proceeds would be used,” the US Justice Department said. “Ultimately, Proindicus, Ematum and MAM each defaulted on their loans and proceeded to miss more than $700-million in loan payments, causing substantial losses to investors.”

The jury convicted Chang on one count of conspiracy to commit wire fraud and one count of conspiracy to commit money laundering. He faces a maximum penalty of 20 years in prison on each count. “A federal district court judge will determine any sentence after considering the US Sentencing Guidelines and other statutory factors,” the US Justice Department said in a statement.

It also noted that in a separate case in October 2021, Credit Suisse AG and CSSEL (together, Credit Suisse) had admitted to defrauding US and international investors in the financing of an $850-million loan for the Ematum project.

“CSSEL pleaded guilty to conspiracy to commit wire fraud and Credit Suisse AG entered into a deferred prosecution agreement with the criminal division’s fraud section and money laundering and asset recovery section (MLARS), and the US Attorney’s Office for the Eastern District of New York.

“As a part of the resolution, Credit Suisse paid approximately $475-million in penalties, fines and disgorgement as part of coordinated resolutions with criminal and civil authorities in the United States and the United Kingdom.”

The case acquired the moniker of “hidden debts” because the Mozambique government concealed the US$2-billion in loans from parliament and international creditors, including the IMF, which withdrew its support when it found out.

Nicole Fritz, former head of the Southern Africa Litigation Centre and of the Helen Suzman Foundation – which joined the litigation to have Chang extradited to the US – hailed his conviction.

“The US verdict can’t stand as anything but an indictment of the SA justice system. It is true that SA ultimately extradited Mr Chang to the US, but this was only after much to-ing and fro-ing about whether to do so,” she told Daily Maverick.

“At different points, the SA government indicated that they would choose instead to extradite him to Mozambique where he would almost certainly have been guaranteed immunity. It was only the intervention of Mozambican civil society, and the solidarity of SA civil society, through the courts that ensured he was transferred to the US.

“It is worth noting that the period between his arrest in Johannesburg in 2018 and his extradition to the US in 2023 far, far exceeds the time in which it took the US to mount a jury trial and secure a conviction. “Whatever else that tells us, it should shame our criminal justice system for the endless delays we suffer in securing any relatively high-profile convictions.

“It should also be noted that while Chang’s conviction is an important outcome in the fight against impunity for political leaders in southern Africa, his conviction and corresponding actions — such as that against Credit Suisse — do much more to set to rights US investors than the primary victims of this scheme — the people of Mozambique who are made that much more impecunious by having to shoulder the repayments of this criminal, fraudulently obtained loan.

“Again, it is to SA’s discredit that we looked initially to stifle what little possibility of justice existed for the people of Mozambique by seeking to facilitate Chang’s return to Mozambique. But that is entirely in keeping with the ethos of the Zuma administration and Michael Masutha, his minister of justice.”

Mozambique NGO the Centre for Public Integrity also welcomed Chang’s conviction, noting: “ Chang becomes the first former member of the Mozambican government to be convicted abroad for corrupt practices while a member of the government.”

It noted that Chang was initially charged with three crimes, but one was dropped on the eve of the start of the trial – the charge of conspiracy to commit securities fraud.

In South Africa, the Chang extradition case became a great test of the power of justice to prevail over political interests. Two justice ministers, Michael Masutha, in then-president Jacob Zuma’s Cabinet, and then later Ronald Lamola, in President Ramaphosa’s Cabinet, ordered him to be extradited to Mozambique, largely, it seemed, because of the fraternal relations between the ANC and Mozambique’s Frelimo government.

But in 2019 Advocate Max du Plessis, appearing in the Gauteng Division of the High Court in Johannesburg case for the Helen Suzman Foundation – as a friend of the court – argued that the South African government was obliged to put law before politics, including foreign politics, by extraditing him instead to the US.

He insisted that even the most political decisions “are not immune from legal challenge. Nor does the field of international relations provide a cloak which shields such decisions from judicial scrutiny.”

He quoted Judge Kate O’Regan saying in a different case: “There is nothing in our Constitution that suggests that, in so far as it relates to the powers and obligations imposed by the Constitution upon the executive, the supremacy of the Constitution stops at the borders of South Africa.”

(Elizabeth Williams via AP)

Global Military Spending Surges Amid War

SIPRI for the media

Global military spending surges amid war, rising tensions and insecurity

Total global military expenditure reached $2443 billion in 2023, an increase of 6.8 per cent in real terms from 2022. This was the steepest year-on-year increase since 2009. The 10 largest spenders in 2023—led by the United States, China and Russia—all increased their military spending, according to new data on global military spending published today by the Stockholm International Peace Research Institute (SIPRI), available at www.sipri.org

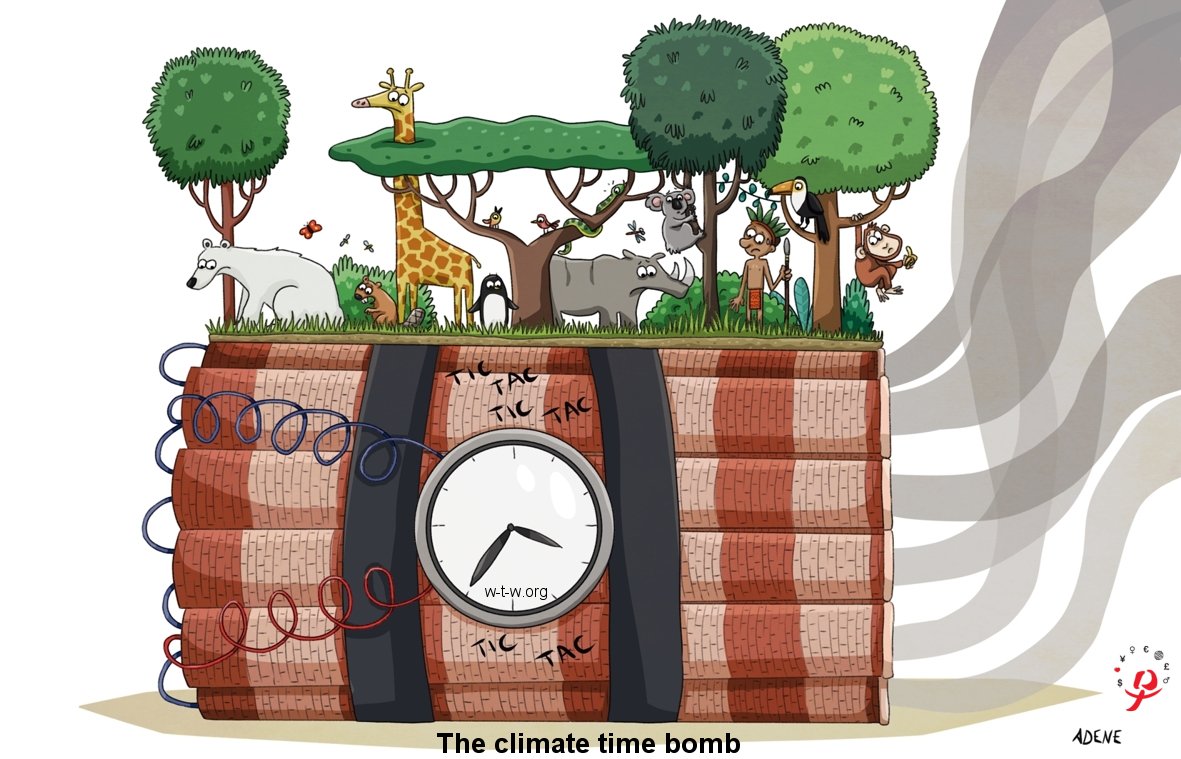

Money Laundering from Environmental Crime

Environmental crime – such as forestry crime, illegal mining and waste trafficking – is an extremely profitable criminal enterprise, generating billions in criminal gains each year. It fuels corruption, and converges with many other serious and organised crimes, such as tax fraud, drug trafficking and forced labour.

20.05.2022 G7 Germany Finance Ministers and Central Bank Governors´ Petersberg Communiqué

“We recognise that the fight against money laundering linked to environmental crimes can contribute to combatting climate change as well as the loss of biodiversity. We renew our commitment to address the risks of illicit finance from environmental crime and recognize them as a cross-cutting issue.”

G7 Finance Ministers and Central Bank Governors´ Petersberg Communiqué

28.06.2021 FATF: Money Laundering from Environmental Crime

Money Laundering from Environmental Crime

25.06.2020 FATF: Money Laundering and the Illegal Wildlife Trade

Money Laundering and the Illegal Wildlife Trade

10.09.2018 Interpol World Atlas of illicit flows / Environment

Combined, environmental crimes, including those that involve the sale or taxation of natural resources, account for 38% of the financing of conflicts and of non-state armed groups, including terrorist groups; followed by drugs (at 28%); other forms of illegal taxation, extortion, confiscation and looting (26%); external donations (3%); and money extorted through kidnapping (3%).1 This evidence-based report aims to quantify how these illicit flows finance the major non-state armed groups

See Environmental crime. The largest conflict finance sector page 15

03.01.2024 Global Fishing Watch Study reveals 75 percent of the world’s industrial fishing vessels are hidden from public view

05.01.2024 Heise: Dank Satellitenbildern und KI: Bislang unbekannte Fischereiflotten entdeckt

Thanks to satellite images and AI: previously unknown fishing fleets discovered

24.01.2024 Sentinel-1 and AI reveal 75% of fishing vessels not tracked

2024 OECD Global Anti-Corruption & Integrity Forum

26 – 27 March 2024

Democracies are under unprecedented internal and external pressures, and efforts to uphold integrity are more important than ever. Threats of foreign interference, the rise of artificial intelligence, and the speed and scale of climate change are giving rise to new corruption risks and increasing pressure on integrity frameworks. Strengthening these frameworks is essential to support government, the private sector and civil society in efficiently combating corruption and producing the best outcomes for the public.

The 2024 OECD Global Anti-Corruption & Integrity Forum will gather leaders from around the world to share new thinking, insights and evidence, and to explore how anti-corruption policies and integrity frameworks can enhance our ability to respond to the future challenges our democracies face. It will also mark the 25th Anniversary of the Anti-Bribery Convention, a cornerstone in the global fight against corruption, and a catalyst for policy change.

Fight Against Money Laundering And Terrorist Financing In The EU

The EU’s rules on anti money laundering and countering terrorist financing protect its financial system and contribute to security and growth.

EU fight against money laundering

Money laundering and the financing of terrorism are major concerns for the EU. They pose major risks to the EU’s economy and financial system and to the security of its citizens.

For over thirty years, the fight against money laundering and terrorist financing has been high on the EU’s political agenda, with the first anti-money-laundering directive (AMLD) being adopted in 1991. Since then, the directive has undergone several reforms.

Fight Against Terrorism

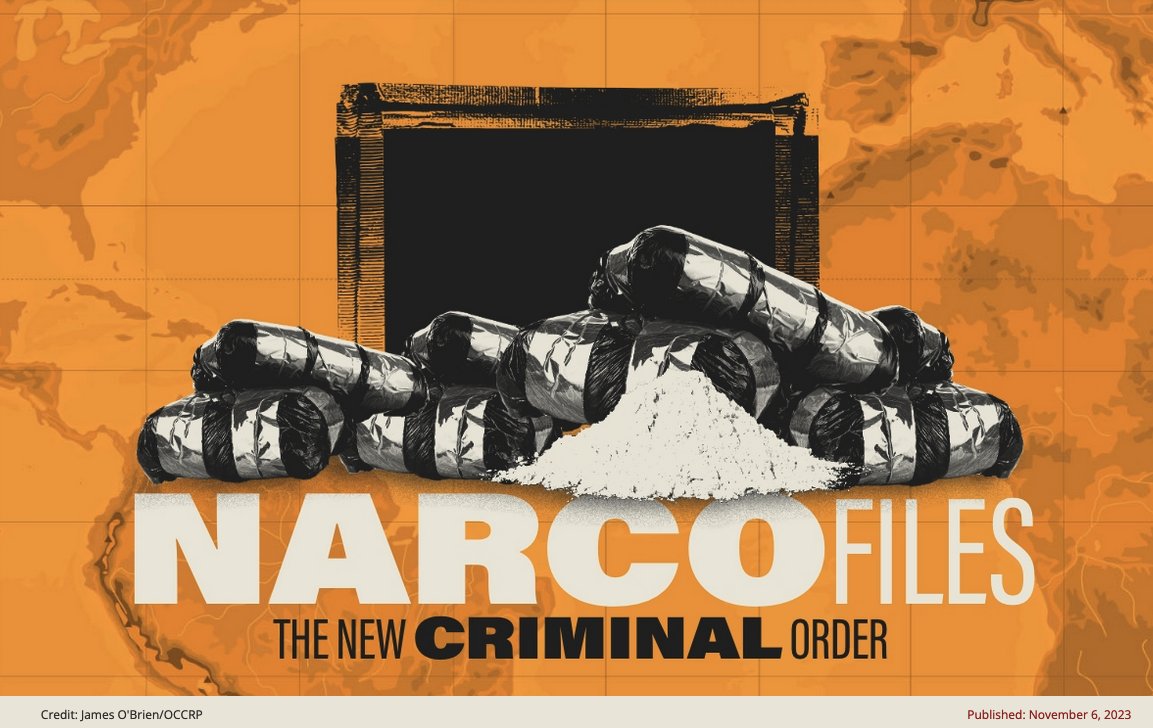

NarcoFiles: The New Criminal Order

Drug trafficking is a globe-spanning business. Cocaine might start life at a plantation in Colombia before being repackaged in Mexico, processed in the Netherlands, and sold on to users as far away as Bulgaria. Markets are booming in Asia, Africa, and Australia, generating billions in illicit revenues that flow back across the world through bank wires, cash transfers, and other transactions.

But the harms are not felt equally. It is developing nations that are most often strangled by the drug trade’s tentacles of violence, corruption, environmental destruction, and economic instability. The borderless nature of these crimes — and the gangs and cartels behind them — requires cross-border cooperation by journalists trying to expose them.

NarcoFiles: The New Criminal Order, the largest investigative project of its kind to originate in Latin America, was launched with this in mind.

OCCRP, the Centro Latinoamericano de Investigación Periodística (CLIP), Vorágine, and Cerosetenta / 070 gained early access to the data from two organizations, Distributed Denial of Secrets and Enlace Hacktivista. They then shared the leak with more than 40 other media outlets. Journalists from over 23 countries worked on the investigation, chiefly in Latin America but also in Europe and the United States.

Using leads found in the leaked data, reporters produced dozens of stories revealing the myriad ways in which organized crime groups are evolving, expanding, and experimenting in the modern world — while leaving new victims along the way….

occrp.org/narcofiles

Julias Baer Bank Financial Crimes

On this episode of the Whistleblowers, John Kiriakou speaks with Swiss whistleblower Rudolf Elmer. While working in the Cayman Islands as an employee of Julius Baer he exposed financial crimes. In blowing the whistle, Elmer believes he was acting in the public interest. Since then he has been pursued for breaking draconian Swiss banking secrecy laws. His family has been severely harassed. Under investigation since 2005, he has already served 220 days in prison, and is still being pursued by judges of the high court in Zurich.

Julias Baer Bank financial crimes.

New Europol Report Shines Light On Multi-Billion Euro Underground Criminal Economy

Europol’s inaugural threat assessment on financial and economic crimes leverages operational insights and strategic intelligence contributed by EU Member States and Europol’s partners.

The Other Side of the Coin – Analysis of Financial and Economic Crime

The world is getting smaller, as trade, communication and infrastructure on a global scale brings us closer together. However, there is another, darker, side to the coin: our interconnected world is being abused by criminals who have created an underground economy to sustain their illegal operations.

Europol’s first ever threat assessment on the topic, ‘The other side of the coin: an analysis of financial and economic crime in the EU’, sheds a light on this system which, from the shadows, sustains the finances of criminals worldwide.

The report is based on a combination of operational insights and strategic intelligence contributed to Europol by EU Member States and Europol’s partners. It analyses all financial and economic crimes affecting the EU, such as money laundering, corruption, fraud, intellectual property crime, and commodity and currency counterfeiting.

Europol’s Executive Director Catherine De Bolle said:

Organised crime has built a parallel global criminal economy around money laundering, illicit financial transfers and corruption. With modern technology, they have diversified their modi operandi to evade detection. The report presents Europol’s expertise in financial and economic crimes, detailing how the current threats are manifesting themselves and how these crimes impact the wider society. It serves as a roadmap to foster cooperation that will derail the world of criminal finances, intercept illicit profits, and – above all else – Make Europe Safer.

The European Commissioner for Home Affairs Ylva Johansson said:

Financial and economic crime, and its scale, is a corrosive force in society. Europol and the European Financial and Economic Crime Centre are part of the solution. This report sets out the increasingly sophisticated methods of organised crime and the European law enforcement successes in fighting back. If EU Member States work together even closer on this fight, we can achieve great results.

Key findings of the reportAlmost 70% of criminal networks operating in the EU make use of one form of money laundering or the other to fund their activities and conceal their assets.

More than 60% of the criminal networks operating in the EU use corruptive methods to achieve their illicit objectives.

80% of the criminal networks active in the EU misuse legal business structures for criminal activities.

The criminal landscape in this area is fragmented, with key players often located outside of the EU.

The techniques and tools used by the criminals advance quickly, as they take advantage of technological and geopolitical developments.

Asset recovery as a powerful deterrent

Asset recovery remains one of the most powerful tools to fight back. It deprives criminals of their ill-gotten assets and prevents them from reinvesting them in further crime or integrating them into the mainstream economy.

Increasing efforts are being made by EU legislators, Member States and law enforcement to corrode the economic power of serious and organised crime through the recovery of confiscated assets. Yet the amount of captured proceeds still remains too low – below 2% of the yearly estimated proceeds of organised crime, according to a data collection carried out on seized assets for the purpose of the report.

Commissioner Johansson’s speech at a press point with Ms Catherine De

Bolle, Executive Director of Europol on the first flagship report of the

Economic and Financial Crime Centre:

Commissioner Johansson Speech

Corruption and moneylaundering are destroying the planet. Environmental crimes like illegal wildlife trade, forestry crimes, illegal fishing, illegal mining, and waste trafficking are destroying our natural resources and threatening sustainable livelihoods.

Corruption and moneylaundering are destroying the planet. Environmental crimes like illegal wildlife trade, forestry crimes, illegal fishing, illegal mining, and waste trafficking are destroying our natural resources and threatening sustainable livelihoods.

Thank you Anne wonderful cartoon !!

Integrated Security for Germany – Anti Mony Laundering

Unfortunately, it is not enough to keep claiming that money laundering should be combated – it has to be done.

Money laundering has not been combated for decades. Money laundering finances organised crime and terrorism. It causes considerable economic damage and endangers fair economic competition.

Money laundering endangers democracy and the rule of law

- Integrated Security for Germany – Anti Mony Laundering

“Providing security for its citizens is the most important job of every state, of every society.

Without security there can be no freedom, nostability, no prosperity.”

We will improve the transparency of asset relationships in order to combat money laundering more effectively, to better implement sanctions regimes and to be able to identify land acquisitions for security-endangering purposes in good time. This will also contribute to a better security policy understanding of financial and economic influence. In addition, efforts are being made to optimise anti-money laundering structures and their resources (page 55).

The Federal Government continues to work at national, international and EU level to sharpen existing measures to combat financial crime and money laundering and, if necessary, to create supplementary ones in order to identify financial flows in the area of organised crime even better and to further close gaps in the traceability of criminally obtained funds and assets. We do this in particular within the framework of the Financial Action Task Force (FATF). In this way, we are helping to ensure that criminals cannot use their illegally acquired assets and that they are deprived of them (pages 56-57).

At the national level, the Federal Government will strengthen the strategic approach against financial crime and money laundering in terms of organisation and personnel. In order to effectively combat money laundering, responsibilities will also be reviewed and the recommendations from the FATF German audit will be swiftly implemented into German law where necessary (page 57).

National Security Strategy – EU-14.6.2023.1

The War on Money Laundering has Failed