While President Obama and Vladimir Putin conduct little boys’ pissing contests in matters of great import, Angela Merkel gets things done without displaying a fist. She is the consummate politician, worth watching. The Machiavellian Genius of Angela Merkel

Category Archives: Entrepreneurs

Appointment of Sarah Khabirpour Problematic for Luxembourg’s Finance Minister

Khabirpour sits on the board of Banque International a Luxembourg, one of the country’s biggest banks, and is a director of the Luxembourg Stock Exchange – both institutions the CSSF regulates. Her appointment to the board of CSSF as a senior advisor to Luc Frieden, and her network of other positions give the appearance of impropriety.

Does this staffing decision violates the “principles of good corporate governance”. The head of ProtInvest, an investor-protection group, has sent a letter to Michel Barnier, an EU commissioner, in which he criticised Mr Frieden’s move as political.

Ms Khabirpour’s multiple jobs showcase the cosy relationships that tie Luxembourg’s business community, which centres largely on fund management, to its regulators and political leaders, suggests Fred Reinertz, ProtInvest’s president.

“It seems that the minister of finance does not care about the principles of good corporate governance,” Mr Reinertz wrote. “[Ms Khabirpour’s appointment] represents a conflict of interest and a flagrant violation of the basic principles of good governance.”

The CSSF refuted the “unfounded allegations” in a statement. Mr Frieden and Ms Khabirpour also deny the claims, arguing Mr Reinertz’s actions are politically motivated. The finance minister’s office is drafting a letter to Mr Barnier to defend itself against the allegations.

Meanwhile, Khabirpour spends her downtime in running guru Eric Orton’s Cool Impossible. PROFILE INFORMATION How many years have you been running? 12

What is your goal race for the year? In general better performance, right training and technique, run 10K under 50 minutes

What is your greatest running accomplishment?

Greatest…10K in 53 minutes and trails from 60 to 80km

What is your “ultimate dream” running goal?

To become the athlete runner Eric Orton describes in his book

She just may be too busy running to do much damage.

Predicting Where Value Will Reside in the future

Predicting where value will lie in the future is tricky, but this report on the consumer goods industry around the world is first-rate reading. Future Value Chain

China: A Country Where Entrepreneurs Flourish

“China’s females are having a bigger-than-ever say in business, investment and family wealth management,” said Wu, a research analyst in Shanghai. The average wealth of the female billionaires on the top 50 list is 9.6 billion yuan, a 9.1 percent year-on-year increase, according to the report. China is a Good Place for Entrepreneurs to do Business

Why Women May Have Trouble Leading

A new book suggests that we don’t perceive gender bias, but if we follow what we do perceive to be our purpose we can overcome this deficit.

Effective leaders develop a sense of purpose by pursuing goals that align with their personal values and advance the collective good. This allows them to look beyond the status quo to what is possible and gives them a compelling reason to take action despite personal fears and insecurities. Such leaders are seen as authentic and trustworthy because they are willing to take risks in the service of shared goals. By connecting others to a larger purpose, they inspire commitment, boost resolve, and help colleagues find deeper meaning in their work. Why Women May Have Trouble Leading

What Happens When Banks Comply With Capital Requirements

The Bank for Financial Settlements issued a quarterly report which shows us what happens.

- Banks are better capitalized.

- They are not cutting back on lending.**

- They are cutting back on “other income,” which includes (among other things) sorts of income that lots of people find naughty, prop trading and so forth.

- Shareholders, meanwhile, are getting less cash back than they used to.

- They’re also getting lower returns: Return on assets is down 27 percent, and leverage is also down (which is what higher capital ratios mean), so return on equity is down by over 60 percent.

Global Markets Will Be Impacted as US Heads Into a Perfect Storm

The witching hour arrives as Syria hurtles toward a solution or war, Bernanke does his will with quantitative easing next week and the debt ceiling debate roils Congress and the President again. US Heading Into A Perfect Storm

Women Are Leaving Wall Street. Why?

A fascinating article by Margo Epprecht analyzes why. Everyone now understands the game of institutionalized risk and individual rewards. New regulations mean to control risk. Even the smartest man in the room, Jamie Dimon, lost track of his profit and loss statement in the spring of 2012. The attributes that women (and many men who’ve been marginalized by the Wall Street culture) bring to the table; collaborative decision-making, a desire for more information, “common sense,” and high sensitivity to risk—are all traits allegedly in demand. Wall Street excess and its powerful protection of its own interests almost killed the financial system. Yet when it seems most imperative that the culture of Wall Street change, for the sake of the economy even, entrenched interests remain strong and resistant to change.

Reminded of her work habits from the early 1980s, Maryann Keller now laughs. “I thought I was going to die,” she says. “It was so crazy. If you think about it, we had barely any technology. You were literally locked on the phone the entire day.” Keller had to step back from her frenetic pace by the mid-1980s, briefly going into money management before joining Furman Selz for a satisfying dozen years building her expertise and network even further. Married for a second time, and adoptive mother to three grown children, Keller remains deeply involved in business, running her own consulting company, Maryann Keller and Associates, and serving on boards of companies and non-profits. But she thinks Wall Street is now less appealing to women. “The business has changed,” she muses, “It is not as intellectually challenging as it used to be. It’s more like cage fighting. Long-term investment today means a month; mathematicians convince themselves they can quantify risk in their arcane products that no one can understand; and fee structures are out of line with investor returns. No wonder people are cynical about Wall Street.” Why Women Are Leaving Wall Street

Women Owned Businesses in US Do Not Differ Much From Men’s

Whether this is a happy conclusion or not is in the eyes of the viewer, but it certainly is interesting that on almost every count, there is little difference. Except women’s businesses tend to be smaller. Here is a recent report covering many aspects of business. Women Owned Businesses Compared to Men Owned

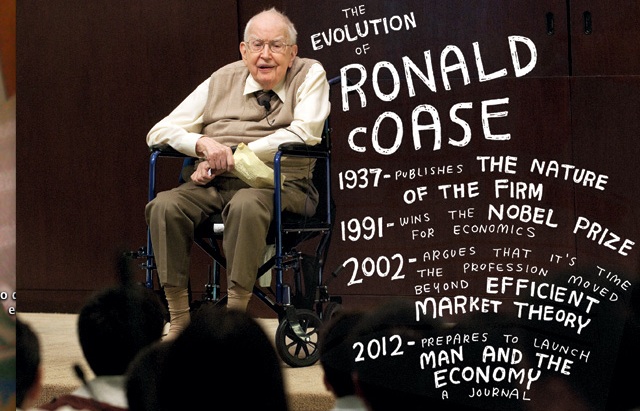

Nobel Economist Ronald Coase Dies at 102

For people interested in economics but not necessarily mathematics, Coase offered a new way of looking at the field. Last year (at 101!) he tried to start a new academic journal amplifying his belief that traditional economics had become too focused on statistical measures. Nobel Economist Ronald Coase Dies at 102

“Economics as currently presented in textbooks and taught in the classroom does not have much to do with business management, and still less with entrepreneurship,” he wrote in an essay for Harvard Business Review, which we have also provided. Coase on Economists

In this article he pointed out that “a modern market economy with its ever-finer division of labor depends on a constantly expanding network of trade. It requires an intricate web of social institutions to coordinate the working of markets and firms across various boundaries. At a time when the modern economy is becoming increasingly institutions-intensive, the reduction of economics to price theory is troubling enough. It is suicidal for the field to slide into a hard science of choice, ignoring the influences of society, history, culture, and politics on the working of the economy.”