Kirsten Korosec writes: SolarCity, the largest installer of residential solar systems in the U.S., nearly doubled its workforce last year, hiring 4,000 people to do everything from system design and site surveys to installation and engineering.

The hiring spree at SolarCity isn’t slowing; it’s picking up speed as the company attempts to install twice as many rooftop solar systems than last year and readies its 1.2 million-square foot factory in New York, which is scheduled to reach full production in 2017.

Installers, panel makers, and even traditional fossil fuel energy companies helped U.S. solar employment grow nearly 22 percent in 2014.

The company’s expansion is indicative of what’s happening within the broader solar industry. More than 31,000 new solar jobs were created in the U.S. in 2014 bringing the total to 173,807—a 21.8 percent increase in employment since November 2013, according to a report released Thursday by The Solar Foundation. This is the second consecutive year that solar jobs have increased by at least 20 percent.

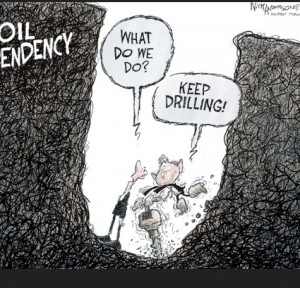

The solar industry is still dwarfed by the 9.8 million workers that the American Petroleum Industry says are employed the oil and gas industry.

Solar already employs more people than coal mining, which has 93,185 workers, and has added 50 percent more jobs in 2014 than the oil and gas pipeline construction industry (10,529) and the crude petroleum and natural gas extraction industry (8,688) did combined, according to the Solar Foundation.

One out of every 78 new jobs created in the U.S. over the past 12 months were created by the solar industry, representing nearly 1.3 percent of all jobs created in the country. Solar companies surveyed for the fifth annual census plan to add another 36,000 employees this year.

Third-party financing that allows homeowners to lease solar systems, a stabilizing manufacturing sector and utility-scale solar developers scrambling to finish projects before the federal investment tax credit drops from 30 percent to 10 percent on Jan. 1, 2017 has helped drive growth, says Andrea Luecke, president and executive director of The Solar Foundation.

The solar job-growth trend has spilled beyond the confines of companies solely dedicated to the renewable energy source.

NRG Energy, one of the largest U.S. independent power producers and owner of 88 fossil fuel and nuclear plants, is expanding its solar business rapidly. NRG’s Home Solar group, the residential solar division of NRG Home, hired 500 people in the past 12 months and now has 1,200 workers.

“We’re growing explosively in several markets,” NRG Home Solar president Kelcy Pegler Jr. said in an interview with Fortune on Thursday following the company’s investor day presentation.

As a result, Pegler’s residential home solar group plans to add “hundreds of jobs” this quarter and will double its current headcount in the next two years.

NRG Energy, which employs 10,000 people, reorganized last year into three business lines: NRG Business, NRG Home and NRG Renew. The company NRG -1.02% has a number of other solar-related jobs within NRG Renew and NRG Home, including its power on the go division which was expanded after the 2014 acquisition of portable solar power company Goal Zero.

These aren’t just part-time jobs either, these are careers.