Michael Spance writes: The world is facing the prospect of an extended period of weak economic growth. But risk is not fate: The best way to avoid such an outcome is to figure out how to channel large pools of savings into productivity-enhancing public-sector investment.

Productivity gains are vital to long-term growth, because they typically translate into higher incomes, in turn boosting demand. That process takes time, of course – especially if, say, the initial recipients of increased income already have a high savings rate. But, with ample investment in the right areas, productivity growth can be sustained.

The danger lies in debt-fueled investment that shifts future demand to the present, without stimulating productivity growth.

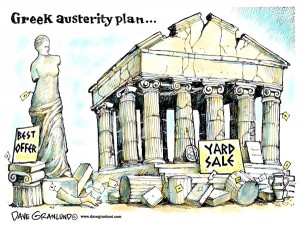

Crises like 2007-8 cause major negative demand shocks, as excess debt and falling asset prices damage balance sheets, which then require increased savings to heal – a combination that is lethal to growth.

Severe demand constraints are a key feature of today’s global economic environment. Another notable trend is that individual economies are recovering from the recent demand shocks at varying rates, with the more flexible and dynamic economies of the US and China performing better than their counterparts in the advanced and emerging worlds.

.Reforms aimed at increasing an economy’s flexibility are always hard – and even more so at a time of weak growth – because they require eliminating protections for vested interests in the short term for the sake of greater long-term prosperity. Given this, finding ways to boost demand is key to facilitating structural reform in the relevant economies.

That brings us to the third factor behind the global economy’s anemic performance: underinvestment, particularly by the public sector.

In the emerging world, India and Brazil are just two examples of economies where inadequate investment has kept growth below potential (though that may be changing in India). The notable exception is China, which has maintained high (and occasionally perhaps excessive) levels of public investment throughout the post-crisis period.

Properly targeted public investment can do much to boost economic performance, generating aggregate demand quickly, fueling productivity growth by improving human capital, encouraging technological innovation, and spurring private-sector investment by increasing returns. Though public investment cannot fix a large demand shortfall overnight, it can accelerate the recovery and establish more sustainable growth patterns.

The problem is that unconventional monetary policies in some major economies have created a low-yield environment, leaving investors somewhat desperate for high-yield options.

Though monetary stimulus is important to facilitate deleveraging, prevent financial-system dysfunction, and bolster investor confidence, it cannot place an economy on a sustainable growth path. Structural reforms, together with increased investment, are also needed.

Policymakers must find ways to ensure that public investments provide returns for private investors. Fortunately, there are existing models, such as those applied to ports, roads, and rail systems, as well as the royalties system for intellectual property.

Such efforts should not be constrained by national borders. Given that roughly one-third of output in advanced economies is tradable – a share that will only increase, as technological advances enable more services to be traded – the benefits of a program to channel savings into public investment would spill over to other economies.

That is why the G-20 should work to encourage public investment within member countries, while international financial institutions, development banks, and national governments should seek to channel private capital toward public investment, with appropriate returns. With such an approach, the global economy’s “new normal” could shift from its current mediocre trajectory to one of strong and sustainable growth.