During the Second World War,70 countries met in 1944 to work out an agreement about monetary policy which would ensure some stability about the War. The agreement reached in Bretton Woods helped to achieve this goal, until the US stopped supporting the dollar with gold.

Roger Lowenstein writes: The world’s monetary system moves from tumult to tumult. Europe’s economy is stagnant and menaced with deflation. Greece has flirted both with leaving the euro and with default. America’s economy has fallen into a discouraging pattern of hopeful growth spurts followed by dispiriting slowdowns. Such turmoil has played havoc with world currencies. Late last year, the value of the euro crashed. Earlier this year, the cautious Swiss stunned traders by freeing their currency, permitting it to soar against the euro and raising—sharply—the price of its chocolates and ski chalets for people from Lisbon to Rome. Such volatility has lately been increasing. If, as the Harvard political scientist Jeffry Frieden has asserted, “the exchange rate is the single most important price in any economy, for it affects all other prices,” then global economies have rarely looked so unstable.

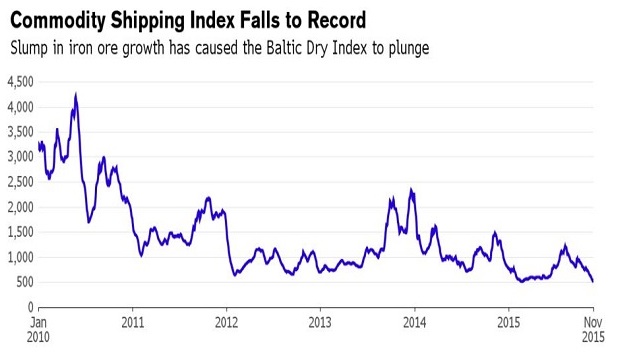

Lately, the instability has spread to Asia. Since 2012, the Japanese yen has lost nearly a third of its value. This has enhanced the competitiveness of Japanese products, putting pressure on its Asian neighbors. China’s economy—in recent years the biggest contributor to the world’s growth—is rapidly decelerating. In August, China stunned markets by devaluing its currency. As for the US, the dollar has risen sharply against the euro and other currencies, but this rise has put America’s fragile recovery in jeopardy, by rendering its manufactured products less affordable overseas. And it has spelled bankruptcy for some of the foreign firms that borrowed in dollars (now too expensive for them to repay). A certain amount of gyration among currencies is normal, of course; that is what currencies do. But the instability has been alarming to traders, businesses, and statesmen.

Since the financial crisis, individual banks have been subject to a welter of new laws and regulations, but not so the international monetary system in which they operate. This system serves as a conducting rod for transmitting local disturbances around the globe. Even this metaphor presumes too much, for the international monetary “system” is, in fact, not a system at all. Its various pieces are simply too disjointed. America and most countries in the West permit capital to freely cross their borders. But China, the most important emerging power, tightly controls the movement of capital.

If, say, Coca-Cola wants to build a factory in China, it must apply to the government to exchange dollars for local renminbi. Many other emerging countries maintain weaker, or periodic, capital controls. Some allow their currencies to float; others “peg” them to the euro or the dollar. Switzerland maintained such a peg—until, in January, it didn’t. The dollar is the linchpin—the usual standard for other currencies and for international trade. However, no agreement or formal convention assures the dollar. The New Financial Order